Benefits and pitfalls to investing in ETFs

Post on: 8 Сентябрь, 2015 No Comment

Benefits and pitfalls to investing in ETFs

Page 1 of 1

Christine St Anne is Morningstar’s funds editor.

Exchange-traded funds (ETFs) provide a number of benefits to an investment portfolio, but investors should be mindful of a number of potential risks.

Speaking at the Trading & Investing Seminars & Expo event in Sydney last week, Morningstar co-head of research Tim Murphy said ETFs offered investors many benefits to their portfolio.

The big benefit to investing in ETFs is that they provide investors with diversification to overseas stocks, Murphy said.

Australians do have a home bias and like to invest in Australian stocks. However, the Australian equities market is narrow. Quality companies in the health and IT [information technology] sector are not available in the Australia equities market, he said.

Investing in international ETFs gives investors exposure to these companies, Murphy said.

However, there are some risks that investors need to consider when investing in ETFs, including taxation and currency issues.

Taxation issues are more prevalent when investing in international ETFs, Murphy said.

Estate tax could apply to investors who have invested in US ETFs, he said.

Currency is another key consideration when investing in ETFs.

ETFs in Australia are unhedged, which means currency fluctuations will impact on the return of your ETF, Murphy said.

Investors also need to be mindful of the concept of double-dipping, which means taking on extra risk by investing in one region.

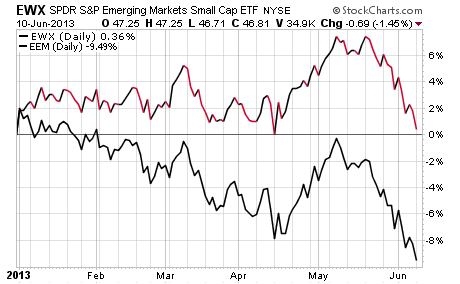

Many Australian investors have a significant exposure to the growth in emerging markets through resource stocks such as BHP Billiton (BHP) and Rio Tinto (RIO) , Murphy said.

By buying ETFs focused in emerging markets, investors are taking even bigger bets, he said.

For example, investors with a portfolio of Australian resource stocks will have access to the growth story in China. Investing in an ETF such as the iShares FTSE/Xinhua China 25 IZZ will also give these investors access to the Chinese economy as the ETF invests in large-cap Chinese companies.

If the Chinese economy stalls, however, all resource stocks will be affected, including Australian resource companies as well as the Chinese large-cap stocks, Murphy said.

Investors need to be aware about taking on this same risk factor.

Investors also need to be aware that making regular but small contributions to their ETF portfolio could mean higher costs that eventually erode the benefits of low fees, Murphy said.