Basic Rules for Regular Contributions

Post on: 16 Март, 2015 No Comment

By Kaye A. Thomas

Current as of November 14, 2013

Main rules for annual contributions to a Roth IRA.

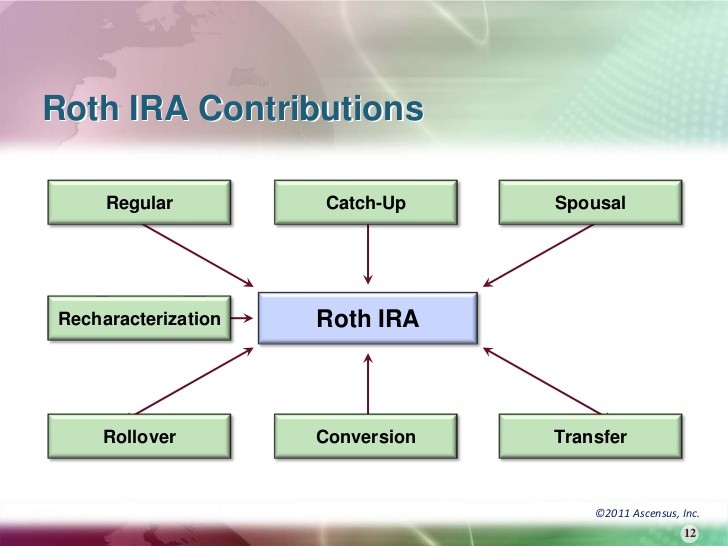

Most people who work for a living (or have a spouse who works for a living) can contribute to a Roth IRA. Theres still an income limit on regular contributions, though, even though the income limit on conversions has been repealed. Heres an overview of the rules for regular contributions.

First, the Good News

Before we turn to the restrictions, here are some items that dont affect your contributions.

- No age limit. Theres no age limit for contributions to Roth IRAs. For regular IRAs, you lose the ability to make contributions in the year you turn age 70½. Not so for Roth IRAs. If you meet the other requirements, you can set up a brand new Roth IRA at age 85 and begin saving for your retirement. Theres also no lower age limit. A minor can set up a Roth IRA and contribute to it. (We have a separate article on Roth IRAs for Minors .) But remember, young or old, you need to have compensation income, as explained later.

- No employer plan limit. Coverage under a retirement plan maintained by your employer does not affect your ability to contribute to a Roth IRA. If you meet the requirements described below, you can contribute to a Roth IRA even if you participate in an employer plan such as a 401k. Even if you contribute to a designated Roth account (a Roth account in a 401k or similar plan), your contributions to a Roth IRA are unaffected.

- Conversion doesnt affect regular contribution. Regular contributions are not affected by Roth IRA conversions. You can make a regular contribution even if you made a conversion in the same year.

- Contribution to conversion Roth IRA. Although there was initially some confusion on this point, its been clear for a long time that you can make regular contributions to a conversion Roth IRA .

The Contribution Limit

For 2013 and 2014. the basic limit for regular contributions to a Roth IRA is $5,500 for people under 50 years of age, and $6,500 for those who are 50 or older. (Numbers like this can be found in our Reference Room .) This limit may be reduced for any of the following reasons:

- You or your spouse may not have enough compensation or alimony income to contribute the full amount.

- Your contribution may be reduced or eliminated because your modified adjusted gross income is too large.

- Your limitation is reduced if youve made certain other contributions .

Compensation or Alimony Income

For each year you contribute to a Roth IRA, you (or your spouse, if you file jointly) must have compensation or alimony income. If you dont have compensation or alimony income you cant contribute, even if you have other types of income. And if your compensation or alimony income is less than the maximum contribution, the amount you can contribute is reduced.

- Compensation income. Compensation income includes amounts you receive from your employer of course, but also includes self-employment income from your own business or from a partnership that generates this type of income. Theres a special rule that treats alimony income as compensation income, just for purposes of determining how much you can contribute to an IRA. That means you can contribute to an IRA if you receive taxable alimony payments, even if you dont work for a living. Compensation income does not include investment income, pension income or non-taxable income.

- Spousal Roth IRA. If you file jointly with a spouse who has compensation income, you dont need compensation income of your own. You can contribute to a Roth IRA based on your spouses compensation income.

Modified Adjusted Gross Income

For some people the most important limit on contributions to a Roth IRA is based on modified adjusted gross income (modified AGI, defined below). If this number is too large, your contribution limit may be reduced — possibly all the way to zero.

- General rule. The income level where the reduction occurs depends on your filing status. You dont have to worry about these rules unless your modified AGI is above the following levels for 2014. Inflation-adjusted amounts for other years appear in our Reference Room .