Basic Long Option Strategies

Post on: 30 Август, 2015 No Comment

Related Options to Leverage and Manage Your Portfolio articles

Basic Long Option Strategies

The rudiments of options are not easy to grasp, and for that reason trying some paper trading makes sense. This helps you to try out basic strategies, master terminology, and learn how the system works. However, paper trading is safe because no money is actually at risk, so its value is limited to the concept of options trading and not to its real-world application.

Key Point

Paper trading is a good way to learn the rules of options trading, but that value is limited because no real money is at risk.

In addition, your brokerage firm will not allow you to just jump in and trade advanced options. You have to complete an options trading application in which you tell your brokerage firm how much experience and knowledge you possess. Based on what you say and on the value of your portfolio, you will then be assigned a trading level you will be allowed to pursue.

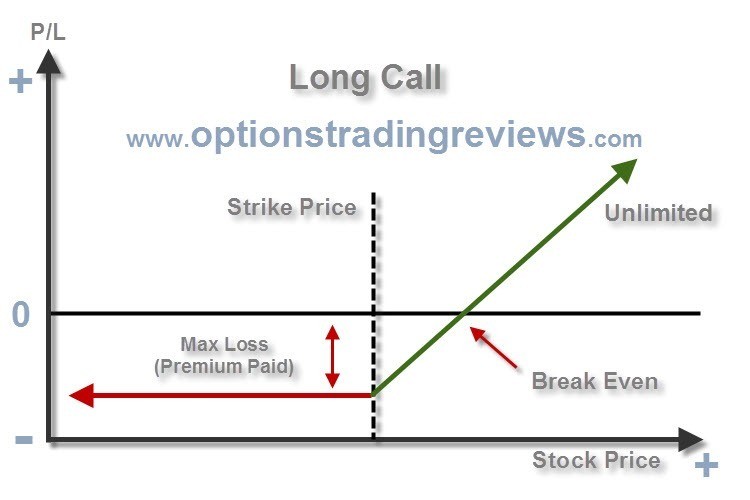

At first you will be allowed only to execute the most basic options strategies. The first step for options trading is the long position. Buying calls or puts gives you experience and exposure to the benefits and risks of options. A single option contract allows you to control 100 shares of the underlying stock, but you are not obligated to exercise the option. You can sell at any time you want, either to take a profit or to cut losses.

When you buy a call, you expect to make a profit if the stocks market value rises. However, it has to rise far enough and fast enough to move higher than the premium you pay to buy the call. Because time value is decaying as expiration approaches, you will need to have a substantial point gain in the underlying stock if the call will rise far enough and fast enough.

When you buy a put, you will earn a profit if the underlying stocks value declines. The lower the value falls, the more valuable the put will become. As with calls, the time value of puts has to be offset.

Key Point

Option buyers have to struggle with the balance between time and premium; the longer the time, the higher the premium and the more difficult it becomes to overcome that cost to create a profit.

For both types of options, time is the enemy. For example, if you buy an option that is at the money (meaning the strike is identical to the current market value per share of the underlying stock) and you pay 4 ($400), a price rise of four points in the money only leads to a breakeven (before deducting trading expenses). Four points of intrinsic value only covers your initial cost of the option. So you need more than the cost of the option in order to make a profit. For this reason, about three out of every four options expires worthless or is closed at a loss. In other words, trading long options is risky.

The dilemma for every trader is picking the best option. To get price movement, you need to pick options close to current value of the stock, but ideally right at or just removed from the money. So the ideal call is going to have a strike one to two points higher than current market value, and the ideal put is going to have a strike at the money or one to two points lower than the underlying stocks current value.

With the proximity between strike and stock value as close as possible, you have the best chance of experiencing price growth adequate to cover and exceed your cost. However, there are two problems you have to deal with, and picking the best option is a balancing act.

The first problem involves cost. The proximity of strike to value of the stock affects the premium level. You can buy deep out of the money options very cheaply, but the chances of making a profit are more remote because the stocks price must move substantially before expiration. So the closer your option is to current value, the more it is going to cost, even when out-of-the-money. The changes in price between one point and six points between strike and current value are caused by extrinsic value.

The second problem is time. The closer the option to expiration, the cheaper it is because time value and extrinsic value will be minimal. However, time value is also going to be declining at the fastest rate in the last two months of the options life span. So a cheap option that is cheap because it will soon expire is also a long shot. So you probably need to buy an option with some time remaining before expiration. However, the further away expiration is, the more expensive the option. This is due to time value; in addition, a long time to expiration also means that extrinsic value may work as an offset; so if the option moves in the money, the overall value may not move point for point with intrinsic value. Extrinsic value may make overall premium less responsive, adding to the problem. Not only did you pay more for the option, but even in the money its value is not growing as fast as you would like.

Key Point

Options close to expiration are cheap. However, they have only limited time for profits to develop, and time value declines rapidly as expiration nears.

The basic long strategies are a challenge because it is so difficult to profit with them. You fight time and cost and need to look for bargain prices for the time period you want to have available for your option.

The uses of long strategies are varied. These include:

- Pure speculation. You can buy calls or puts simply to speculate in the market. The leverage is significant, because for relatively small amounts of capital you control 100 shares of stock. This makes speculating in options very appealing, but remember, most long options do not end up profitably.

- Swing trading and timing. Options are used effectively for swing trading in place of stock. You can use long calls at the bottom and long puts at the top of identified short-term swings, reducing the swing-trading risks, enabling you to leverage capital, and avoiding the problems of needing to short shares of stock at topside reversals.

- Insurance for paper profits. You can buy puts when your stock value has risen substantially to insure profits. In this situation, you face a dilemma: You expect the stock price to reverse and decline to a degree because it has risen too quickly, but you do not want to sell shares. In this situation, buying puts insures your profits. If the stock continues to rise, you are out the put premium; if the stock price falls, the put increases in value and offsets the stock loss. The put can then be closed at a profit or exercised so you can sell shares at a strike above current market value.

- Parts of more complex strategies. The long option also plays a key role in strategies involving offsetting positions (long versus short or call versus put, for example), of which there are dozens of possible combinations. In other words, long options are not always separate and distinct as strategies, but also act as parts of more complex strategies.

The long option is high-risk in the sense that three out of four instances will lose, on average; but in terms of capital risk, it is a low-risk approach, because you can never lose more than the premium you pay to open the long option. This is a 100 percent loss, of course; but it is a relatively small dollar amount when compared to the market risk of buying 100 shares.

Adapted from Getting Started in Stock Investing and Trading.

Content provided here under exclusive license