Backspreads (Reverse Ratio Spreads)

Post on: 2 Сентябрь, 2015 No Comment

Backspreads. also known as reverse ratio spreads, are an option strategy utilized when you believe there will be much volatility in the stock but are not 100% sure whether it will go up or down. If the stock moves a lot in the predicted direction, you will earn a tidy profit. If the stock moves a lot, but in the opposite direction, you will earn a small profit. However, if the stock doesn’t move much and is stuck in a trading range, you will experience a loss.

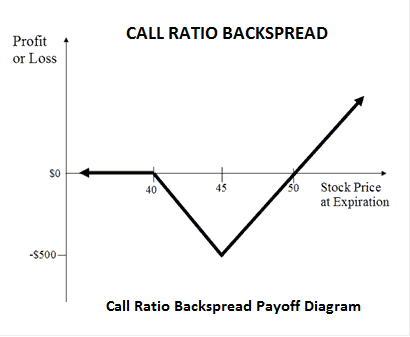

The backspread position used when you are bullish on the stock is known as a Call Backspread. since call options are used to create this position. The call backspread is created by buying a certain number of Out-of-The-Money (OTM) call options (i.e. call options whose strike price is higher than the current stock price), and selling a lesser number of In-The-Money (ITM) call options (i.e. call options whose strike price is lower than the current stock price). You can create a call backspread by buying and selling any number of call options, but for the purposes of this article, we will talk about buying 2 OTM call options and selling 1 ITM call option .

Because you are selling a call option that is ITM and buying 2 call options that are OTM, this position should be a credit position. that is you will earn a premium by opening a call backspread. However, because you are selling an option, you are not able to allow this position to expire. You will need to buy back the option before expiration date, which brings us to the risks involved with this position.

A call backspread is created by buying 2 out-of-the-money calls and selling 1 in-the-money call. earning you a net credit premium. It is meant for stocks that are high volatility and bullish. You earn unlimited profit if the stock climbs. If the stock falls, you get to keep your original net credit premium. If the stock price doesn’t move, you will incur a loss.

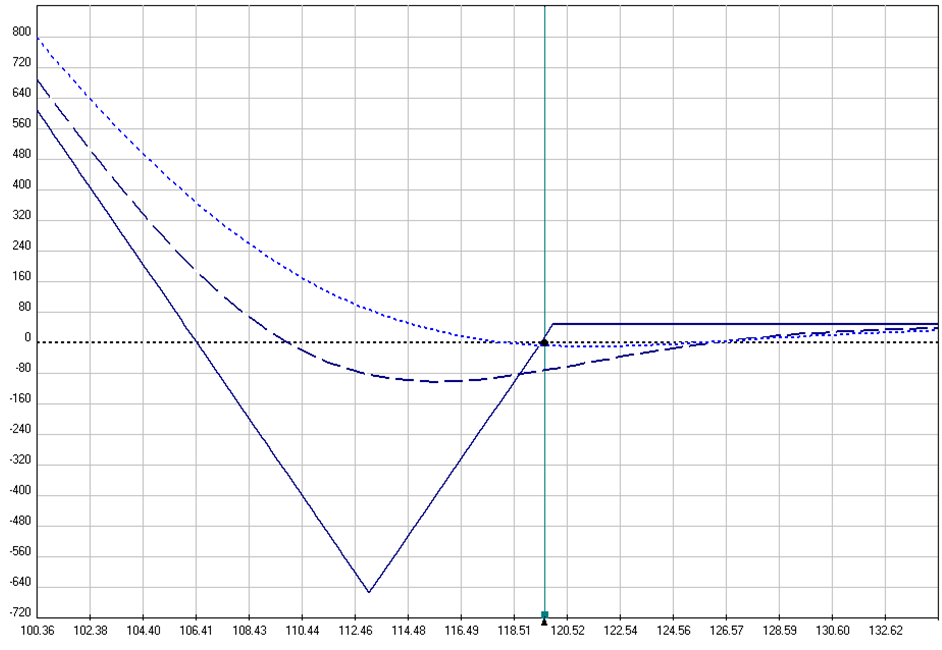

A Put Backspread functions in the same way but in the opposite direction, and is a bearish position. You would use this position on a stock that you expect to move a lot, with a high likelihood that it will go down in price. The reason it is known as a put backspread is because it is created by buying and selling put options.

The put backspread is opened by buying any number of out-of-the-money (OTM) put options (i.e. put options whose strike price is below the current stock price, and selling a smaller number of in-the-money (ITM) put options (i.e. put options whose strike price is above the current stock price). Doing this should give you a net credit premium. Similar to the call backspread, a put backspread can be created by buying and selling any number of put options, but for this article we will talk about the simplest case, which is selling 1 ITM put option and buying 2 OTM put options .