A Brief Primer on REITs (Real Estate Investment Trusts) Part 2 The basics of evaluating a REIT

Post on: 1 Июнь, 2015 No Comment

May 22nd, 2013 | 4 Comments

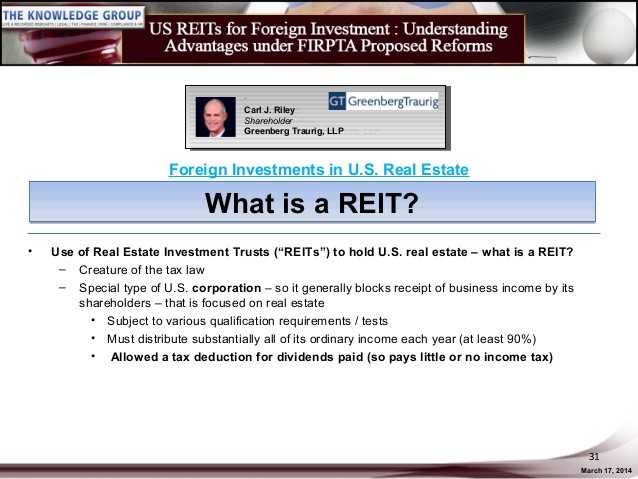

In part 1 of the REIT series, we discussed what REITs are, why we should be interested in investing in them, and compared them to being a more traditional landlord. Here, were going to review some of the basics of evaluating REITs. While REITs can be great dividend producing investments, they cant be evaluated in exactly the same way as traditional stocks.

Dividend Growth or High Yield

The first choice that youll need to make when evaluating REITs is whether to focus on only those REITs that have demonstrated consistent dividend growth (10+ years), or to consider REITs with higher, but more labile dividend yields. The right answer is the one that aligns with your investment philosophy, risk tolerance, and desired asset allocation.

At present, I am employing both strategies. Those REITs with consistent dividend growth are strong candidates for inclusion into my dividend growth portfolio. Those with higher, but less predictable, yields are candidates for my high yield stock portfolio. For those with less predictable yields, I look at the lowest dividend paid over the last several years as well as the average dividend payments over that time. I try to limit my yield chasing to a maximum of 10% of my portfolio (see my previous post on my portfolios asset allocation).

Take note of how a REIT makes its money

If you recall there are two main flavors of REITs. Equity REITs which make their money from rents. And mortgage REITs that make their money from mortgage interest. Different local real estate markets and different macroeconomic situations affect a REITs income and thus its ability to pay out dividends.

In markets where rents have room to grow, equity REITs will be more likely to maintain and even increase their dividends as their rental income grows. Mortgage REIT income depends on the spread between short and long-term interest rates. As these two rates move farther apart, mortgage REITs will do well.

Earnings Per Share - not particularly useful for REITs

Earnings Per Share (EPS) and metrics derived from it, including price/earnings (P/E) ratio and payout ratio (Dividends per share / EPS) are usually skewed and not particularly useful when evaluating a REIT. For example, its not uncommon to see P/E ratios 30s, 40s, or 50s.

Instead, FFO is used in place of EPS.

Funds from operations (FFO)

The REIT world prefers FFO, rather than EPS, as a measure of cash flow. FFO begins with net income, adds depreciation and amortization expenses back in, and subtracts gains and losses from property sales. Depreciation is added back in because real estate rarely depreciates in value and often appreciates.

If youre lucky, you can find FFO quoted on a per share basis. Otherwise, youll have to calculate it. No, you dont get to be lazy and not calculate FFO/share. REITs regularly fund their expansion by issuing new shares. The more shares issued, the lower that FFO/share ratio goes. Low is bad.

FFO per Share Growth Rate

Similar to how EPS should grow over time for a dividend stock, FFO per share should grow over time for a REIT. A falling FFO per share may indicate either a decline in income over time, or that the number of outstanding shares is increasing. One of the main ways in which REITs raise capital for expansion is by issuing new shares. Either way, it suggests that the value of of the stock may stay flat or decline over time.

Calculating a Payout Ratio and P/E for a REIT

Now that we have the FFO/share value we can calculate the payout ratio of a REIT. If you are seeing payout ratios consistently above 90%, thats an indication that the dividend may not be sustainable.

REIT Payout Ratio = Dividend per share / FFO per share

You can also calculate something similar to a P/E ratio for a REIT by using price per share/ FFO per share .

Adjusted Funds from operations (AFFO)

AFFO is often used in place of FFO when evaluating REITs. The problem with FFO is that it does not subtract capital expenses undertaken to maintain property. AFFO corrects for that. However, AFFO is not a standardized measure and may or may not be reported.