5 Differences Between A Roth IRA And A Roth 401k

Post on: 31 Март, 2015 No Comment

Should you be in a Roth 401(k)?

By Jean Chatzky

A Roth 401(k) and a Roth IRA sound similar — and they are. Contributions are made after taxes and earnings can be taken out tax-free after either five years or at age 59½. But the 401(k) version of the Roth has a couple of key differences from its IRA cousin.

Contribution amounts

The most distinguishing characteristic of 401(k)s, whether Roth or traditional, is the high contribution limit, allowing employees to squirrel away up to $16,500 per year. For workers over 50, the ceiling is $22,000.

The contribution limits for a 401(k) are roughly three times higher than that of an IRA.

Limits for individual retirement accounts are $5,000, and workers over 50 may contribute up to $6,000 per year.

The contribution limits are the same as the traditional 401(k) limits, so with the Roth 401(k) you can get much more money into the plan than into an IRA, says Dean Barber, founder and president of Barber Financial Group.

Distributions

A benefit of the Roth IRA is that the account can exist, essentially, forever without any minimum required distributions.

The Roth IRA can be passed down to the next generation and provide tax-free earnings for that generation and the next, says Barber.

A Roth 401(k), on the other hand, will require distributions starting at age 70½. If you need the money, you may not mind taking the distributions. But there is a way around it if you prefer to keep your savings working for you tax-free.

In that case, account holders can roll the account over from a 401(k) directly to a Roth IRA, says Paul Hynes, a principal at Burns Advisory Group.

The match in a 401(k)

Besides their high contribution limits, 401(k)s have another advantage: The worker’s contributions can be matched by the employer up to a certain percentage. It’s essentially free money from the employer, on top of the employee’s elective deferrals.

However, if you are contributing to a Roth 401(k), the match portion of the contribution will be treated as a traditional 401(k) contribution because it goes in pretax.

The employer part never reaches you, so it can’t be done on an after-tax basis, says Barber. The match from the employer can’t be taxed so it can’t be a Roth.

That means that every Roth 401(k) account essentially has a traditional component if the employer provides matching contributions.

For workers who divide contributions between a regular 401(k) and a Roth 401(k), the company match will be applied to the traditional 401(k).

Investment options

A Roth IRA allows investors a great deal more control over their accounts than a Roth 401(k). Investors can choose from the universe of investments for their own accounts, including individual stocks and bonds, but are limited to the funds their employers offer in a 401(k) plan.

Depending on their plan’s investment menu, some employees might be better off maximizing the match from their employer and then funneling extra retirement dollars into a Roth IRA. That way they can take advantage of better investment options if the fund lineup is too limited in the employer’s plan.

Income limits

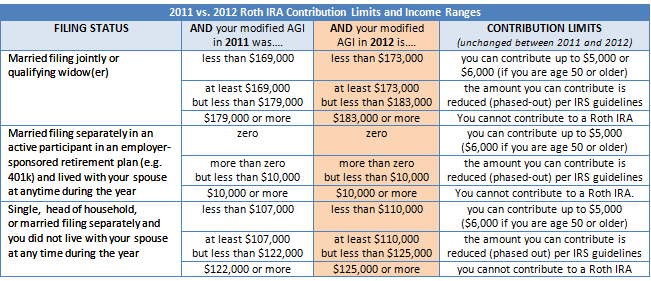

With the new rules for Roth conversions. high earners can convert to a Roth IRA from a traditional IRA, but they won’t be able to make contributions.

Not so for a Roth 401(k), in which there are no such restrictions.

Roth IRA contributions are off-limits if your modified adjusted gross income in 2010 is higher than $176,000 for married couples filing jointly or $120,000 for single filers.

For some people, the only access they would have to Roth contributions is through the 401(k), says Hynes.