What is a Hedge Fund and How Does it Work

Post on: 31 Июль, 2015 No Comment

A hedge fund refers to an investment partnership that is set up by a money manager. Most of the time, it is registered as a limited liability company, which means that, if for some reason, there is bankruptcy, the creditors cannot ask the investors to put in more money to counter that. The main purpose of any hedge fund is to make money by way of investments, irrespective of whether there is a downward or upward trend in the market

How Hedge Funds Work

Every hedge fund company has a legal document known as the operating agreement, which lists the terms and conditions with regards to managing and operating the hedge fund. The operating agreement very clearly mentions the kind of investments that it will be making, and the profit sharing arrangement between the investors and the company. Now, let us see how it works. Take the workings of ‘XYZ Ltd’, as an example.

According to the operating agreement of XYZ Ltd, the company will receive 30% of all profits, which are over and above 3%. Another thing that is mentioned in this legal document is that the company is free to invest in anything, i.e. mutual funds, stocks, real estate investment, art, bonds, gold, artifacts, etc.

Now let’s suppose that an investor invests $200 million in this hedge fund. The operators can invest this money in all things of value as stated in the operating agreement. The role of hedge fund managers is to invest this capital in the best possible way, so that it reaps maximum returns. This capital can be invested in the stock market, in a new company, or perhaps it can even be invested in buying gold. The investments have to be in accordance with what is stated in the operating agreement.

To make money, let’s say that the initial investment of $200 million, made $300 million in a year, i.e. a profit of $100 million. According to the agreement, the investor has a right to the first 3% of this profit. In this case, it works out to be $3 million, which will straightaway go to the investor. This $3 million is referred to as ‘hurdle’ money in financial circles. The remaining $97 million is then shared in the ratio of 30:70 between the hedge fund and the investor, as stated in the initial operating agreement.

Investing in Hedge Funds

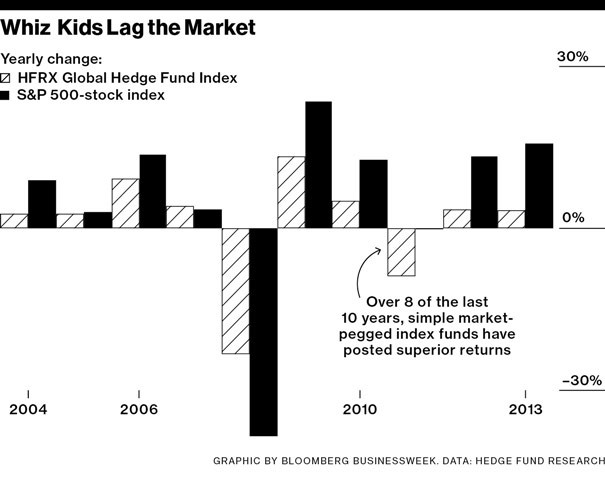

Hedge funds are no doubt a high-risk investment. They require huge initial investments on the part of investors. On an average, the initial investments are well over $250,000. On top of that, the profit sharing arrangement that most hedge fund companies follow these days, i.e. 2% of asset value and 20% share in profits, is not investor friendly too, as even if the fund makes losses, the company is still entitled to this 2% of the asset value, without any ‘hurdle’ money whatsoever. Also, hedge funds do not come under the radar of the securities and exchange commission, which means that there is no regulation with regards to the kind of investments that managers will make. On the positive side, the investments on hedge funds, especially the ones handled by experienced money managers, can give you some really good returns in terms of profits, sometimes even double the money that you initially invested.

If you are planning to invest in a hedge fund, then just the knowledge about its working is not enough. Other things such as the reputation of the hedge fund managers, initial investment money, and past record, should be thoroughly considered before making any investment. So, if you are a novice in finance, and do not understand the workings of the market well, take help from a professional financial adviser before making any investment.