What are Alibaba s

Post on: 16 Март, 2015 No Comment

Share:

When Alibaba executive chairman Jack Ma rings the opening bell at the New York Stock Exchange on Friday, itll mark one of the worlds largest initial public offerings. But if you’re expecting Alibaba’s arrival here to be followed by a play for the wallets of American consumers, you’re probably going to be waiting a while.

Alibaba could raise as much as $21.8 billion (at about $68 a share) and would come close to matching the largest IPO ever — the $22.1 billion public offering of Agricultural Bank of China in 2010.

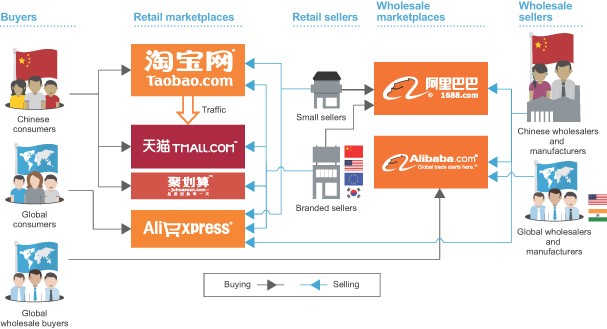

What it does with this huge war chest has become the subject of much debate not only among investors, but U.S. e-commerce executives. And for good reason: Alibaba operates the largest e-commerce ecosystem in China, with its retail marketplaces Taobao, Tmall and group-buying site Juhuasuan selling a combined $248 billion in total merchandise a metric known as gross merchandise volume, or GMV in 2013.

How does that stack up against Amazon and eBay? Amazon and the sellers on its marketplace sold about $113 billion in goods in 2013, according to an estimate by research firm IDC. Sellers on eBay’s marketplaces sold about $83 billion in goods, including cars, that same year, according to its regulatory filings. That makes Alibabas GMV more than a quarter bigger than Amazon and eBays combined.

While the companys yearly revenue is actually much smaller at $8.46 billion compared with Amazons $74.45 billion and eBays $16.04 billion its growing much faster and is far more profitable. The Chinese company generates revenue by selling ad placements to merchants on its system, and in some cases takes a cut of each sale.

For now, all signs point toward Alibaba continuing to focus on selling goods mainly to Chinese, not American, consumers. In a video presentation for investors. Alibaba executives made no mention of a plan to enter the American e-commerce market. Alibaba highlighted stats showing how much room for growth still remains in China. In one slide, the company said less than half of China’s population is currently online compared with more than 80 percent in the U.S. And of those Chinese online, less than half have ever purchased goods from an e-commerce site.

Likewise, there was little mention of U.S. expansion at the company’s IPO roadshow investor meetings in the U.S. according to a person familiar with those discussions.

Part of the company’s near-term plan for growth does, however, involve cutting deals with U.S. e-commerce and payments companies such as ShopRunner, Fanatics and Stripe, in an attempt to make it easier for American brands to sell to Chinese shoppers.

Alibaba already led a $200 million-plus investment in ShopRunner. which gives the Chinese e-commerce giant ownership of more than a third of the company. ShopRunner runs a membership program that allows American shoppers to get free, two-day shipping from a variety of online brands and retailers such as Neiman Marcus, Lord & Taylor and Calvin Klein. The two companies are now working together to get goods from these brands into the hands of Chinese shoppers within a week of placing an order.

Most analysts and industry executives who spoke to Re/code believe this partnership approach will last several years, and any serious foray by Alibaba into U.S. e-commerce is at least a few years off. Two of the company’s subsidiaries did recently launch an online shopping marketplace in the U.S. called 11 Main, but as we previously reported. the effort comes across more as an experiment than a big flag being planted on America’s digital soil.

Assuming Alibaba thinks it can eventually make a dent in the U.S. market in the long term, the question becomes whether it should build or buy. In 2010, Alibaba launched a shopping site called AliExpress that is geared toward non-Chinese shoppers, but theres little evidence that it has become popular in the U.S.

“I think it’ll be very hard to do without some major acquisition,” Kelland Willis, an analyst with Forrester Research covering China’s retail industry, said.

One scenario that e-commerce insiders like to speculate about is Alibaba eventually pursuing a purchase of eBay. That possibility would likely increase if eBay spins off PayPal, which many people, including Carl Icahn. believe is a matter of when, not if. Another acquisition possibility is Overstock.com, which would help Chinese sellers sell more goods to American shoppers.

The idea that Alibaba could become a more direct supplier of Chinese-manufactured goods to American consumers should make all U.S. retailers and online marketplaces take notice. It may also be Alibabas retail endgame to sit between the U.S. and China and collect a portion of every transaction that passes both ways.

When you consider that possibility, $21 billion may not be so big after all.