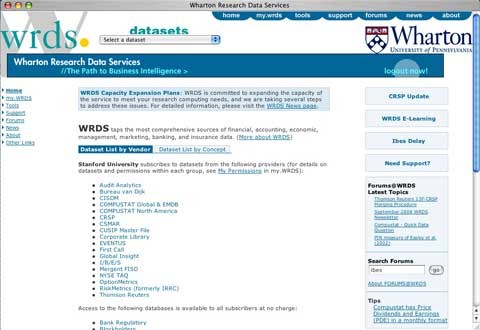

Wharton Research Data Services

Post on: 22 Январь, 2017 No Comment

Additional Subscription Databases

Bureau van Dijk

Bureau van Dijk Electronic Publishing provides an extensive suite of financial databases, including over 20+ million European private and public companies contained in the AMADEUS database.

BANKSCOPE is a database containing financial information on over 30,000 banks worldwide. Up to 16 years of detailed information are available for European banks, North American banks, all Japanese commercial and sogo banks, and over 4,100 other major banks.

ISIS is a comprehensive database of detailed reports on public and private insurance companies around the world. ISIS contains information on 11,700 companies on 150 different countries. Each company report typically contains the following: income statements and balance sheets, ratios, shareholder, and subsidiaries.

OSIRIS is a database containing financial information on globally listed public companies, including banks and insurance firms on 80,000 companies from over 190 countries.

The comScore panelist-level database captures detailed browsing and buying behavior by one hundred thousand Internet users across the United States.

The Center for Research in Security Prices maintains the most comprehensive collection of security price. return. and volume data for the NYSE, AMEX and NADSAQ stock markets. Additional CRSP files provide stock indices, beta- and cap-based portfolio, treasury bond and risk-free rates, and mutual funds. and real estate data.

US Stock Database provides a unique research source characterized by its unmatched breadth, depth, and completeness. It includes CRSPs unique permanent identifiers allowing for clean and accurate backtesting, time-series and event studies, measurement of performance, accurate benchmarking, and securities analysis.The CRSP US Stock Database contains end-of-day and month-end prices on all listed NYSE, Amex, and NASDAQ common stocks along with basic market indices, and includes the most comprehensive distribution information available, with the most accurate total return calculations.

Unique Historical Indices Databases serve as benchmarks for the investment community, and as a foundation for academic research. Created according to clear, unbiased and systematic processes, these indexes undergo rigorous procedures to promote data accuracy, timeliness and consistency. Each CRSP index is offered as a series that contains decile subsets for market analysis.

CRSP Indices database contains five groups of CRSP indices: the CRSP Stock File Indices, the CRSP Cap-Based Portfolios, the CRSP Indices for the S&P 500 Universe, the CRSP Treasury and Inflation (CTI) Indices, and the CRSP Select Treasury Indices.

www.whartonwrds.com/archive-pages/our-datasets/crsp/#sthash.7HkKAhGW.dpuf

CRSP U.S. Intraday Index History, generated by the investable CRSP Indexes, provides additional market data for scholarly research. The introductory time series provides the base for future product expansion, including additional index data as well as index holdings, Intraday, and end-of-day security data.

www.whartonwrds.com/archive-pages/our-datasets/crsp/#sthash.7HkKAhGW.dpuf

CRSP US Treasury and Inflation Series contain returns and index levels on the US Government Bond Fixed Term Index Series, and the Risk Free Rates File. The US Treasury database begins in 1925 for month-end data and in 1961 for daily data. Over 1.6 million end-of-day price observations for 3,350 US Treasury bills, notes, and bonds and over 101,500 prices for 5,300 month-end issues are included in the databases.

Mutual Funds. As the provider of the only complete database of both active and inactive mutual funds, CRSP leads the way in mutual fund research. The CRSP Survivor-Bias-Free US Mutual Fund Database serves as a foundation for research in and benchmarking for this asset class. Central to this work is the use of survivor-bias-free data to insure the accuracy of performance benchmarks, and the validity of analyses. Created according to clear, unbiased and systematic processes, this database undergoes rigorous procedures employed to promote data accuracy, timeliness and consistency.

The CRSP Survivor-Bias-Free US Mutual Fund Database was initially developed by Mark M. Carhart of Goldman Sachs Asset Management for his 1995 dissertation (Chicago GSB) entitled, Survivor Bias and Persistence in Mutual Fund Performance, to fill a need for lacking survivor-bias-free data coverage.

CRSP/COMPUSTAT Merged Database allows for concurrent database access to CRSPs stock data and Compustats fundamental data. The CRSP Link accurately maps complex, many-to-many relationships over time between CRSPs unique permanent identifiers (PERMNO and PERMCO), and Compustats unique permanent identifier (GVKEY). This link permits the seamless time series examination of CRSP and of Compustat companies and securities side by side, regardless of CUSIP or ticker changes. CRSPLink is a product and is trademarked by CRSP.

CRSP/Ziman Real Estate Data Series represents a collaborative effort between the Richard S. Ziman Center for Real Estate at the UCLA Anderson School of Management and The Center for Research in Security Prices at the University of Chicago. The REIT data series is a unique research resource whose development merges CRSP experience in academic-quality financial database and indices creation with the Ziman Centers expertise in markets and the collection of real estate data.

The CSMAR Database System encompasses data on the China stock market and the financial statements of China’s listed companies. There are several databases: Trading, Financial Statement, Trade and Quote, Mutual Fund, IPO, Event Dates.

- CSMAR China Stock Market Trading Database. The database provides users with data on returns of individual stocks, market return, and aggregated market returns.

- CSMAR China Stock Market Financial Database. It contains the financial data (including the balance sheet, statement of profit and profit distribution, statement of changes in financial position, cash flow statement and asset impairment provision statement (since 2001)) of all companies listed on the Shanghai and Shenzhen stock exchanges since 1990.

- Merger and Acquisition (SAS datasets)