Using Mutual Funds To Profit From Market Dips

Post on: 16 Январь, 2017 No Comment

Sometimes it can be a very difficult task to determine the optimal way to profit from a decline in the overall market. So, what should an investor do to make money when the indexes drop? Or what should one do to protect the gains they’ve already made without selling their investments and possibly getting a tax bill?

Options. such as puts. are one way. But if you guess wrong, you could lose your money in a relatively short period of time. Shorting stocks is another method. However, that can be riskier than buying options, as the losses can exceed your initial investment.

Reverse market mutual funds or reverse exchange-traded funds (ETFs) might be a solution. They offer professional management and may be safer than investing in options or shorting the market. However, these funds are not for the faint of heart. Long-term investors can get caught off guard and burned by a bullish rally. And expenses can be high.

Two Types

Reverse market funds, also known as bear-market funds or short-funds, come in two different investment styles — reverse index and actively managed. Both are meant to make money only when the market goes down. (To keep reading on this subject, see Active Vs Passive Investing In ETFs and Why Fund Managers Risk Too Much .)

Reverse index

A reverse index fund is designed to go up when the index it follows drops. So, for example, if the index loses 2%, the fund’s net asset value (NAV) should rise 2% before fees and expenses. Some funds use leverage to magnify the impact of your investment by paying a multiple of the index’s decline. For instance, if the fund will pay double the index’s drop, and the index it follows loses 10%, the fund could earn 20%.

By taking an inverse position that corresponds to twice the daily drop in the index, you can hedge your long positions for half the amount of money. Then you might take the other half of your cash and put it in a money market fund. giving you the ability to increase your hedge down the road. (To find out more about money market funds, see Money Market Mutual Funds . Money Market Vs. Savings Accounts and The Money Market .)

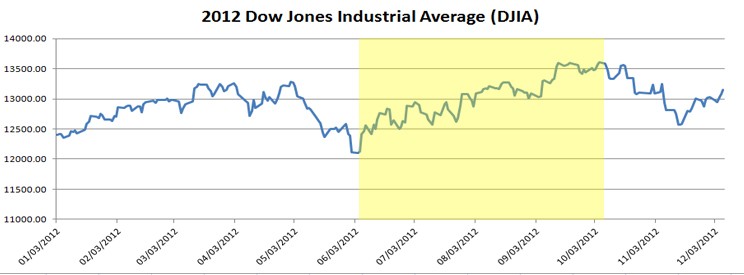

Reverse index funds follow just about every index out there, including the S&P 500. Nasdaq 100, Russell 2000. S&P MidCap 400, DJIA. Dow Jones U.S. Financial Index, Dow Jones Precious Metals Index, Dow U.S. Real Estate Index and Nikkei 225 Stock Average. (Keep reading about the markets in The Tale Of Two Exchanges: NYSE And Nasdaq and The ABCs Of Stock Indexes .)

And there are even funds that inversely track oil, natural gas and currency indexes. So you can focus as broadly or narrowly as you wish.

Actively Managed

An actively managed reverse market fund generally looks for quick returns against daily market movements and hopes to do better than the strictly passive reverse index funds. Its managers might buy derivatives (i.e. futures. swaps or options on futures) or index put options, or sell short index futures instead of inversely mirroring an index. Some even short individual stocks, too.

Management styles can vary. Some managers stay 100% short regardless of the market’s trend, while others will include long positions in assets, such as gold stocks, that could act contrary to other markets. (To find out more about the manager’s role, see Preparing For A Career As A Portfolio Manager . Will A New Fund Manager Cost You? and Should You Follow Your Fund Manager? )

Hedge for Overweighted Portfolio

Suppose, for example, that you work for one of the companies that make up the DJIA and that your employer’s stock represents a huge percentage of your portfolio. You know that that’s a risky position to maintain, but you don’t want to sell any shares because you’re confident the company will continue to prosper. Plus, you’d face a big tax bill because of your low cost basis in the stock. (For related reading, see How do I figure out my cost basis on a stock investment? )

You could use a reverse market fund that inversely tracks the DJIA to protect against a long-term drop in your employer’s stock. If the market surges, the increased value of your stocks could offset the loss in your reverse market fund’s NAV.

High Expenses

Because reverse market funds might frequently trade holdings to take advantage of quick market declines, fees and expenses can be higher than with traditional funds. You could, of course, take the short position yourself and not use a fund with its associated expenses. But keep in mind that a reverse market fund:

- Does not require that you open a margin account to hold short positions

- Will never cost you more than your initial investment

- Can be owned by your retirement account

Conclusion

Reverse market funds can reduce your exposure to the market without selling the securities you own and taking taxable gains. You may even win big when the markets tumble, or you could earn back prior market losses. However, these funds — especially those that use leverage to magnify potential returns — can lose money quickly in market rallies, and are best used to regulate portfolio risk.

Furthermore, the concept of betting against the market is tricky and mainly for market timers. After all, unless you believe the economy is in for a long-term decline and want to prepare for the worst, it might not make sense to own such a fund for the long term. Nevertheless, if you want to use a reverse market fund as insurance against losses, be sure to limit it to a fraction of your portfolio.