Using ETFs to Build a Diversified Portfolio

Post on: 30 Декабрь, 2016 No Comment

Asset Class ETFs News:

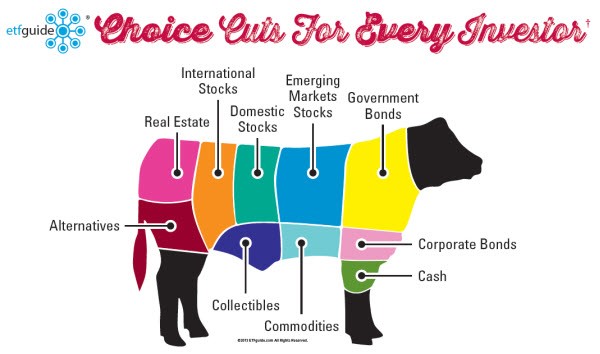

With the advent of exchange traded funds, investors are now capable of including a wide range of investment styles and strategies to form their very own diversified ETF portfolio.

Depending on the investment objective and time horizon, investors may weight play around with the traditional 60/40 stock-to-bonds split. But with ETFs, investors have the chance to delve deeper and diversify within the two categories.

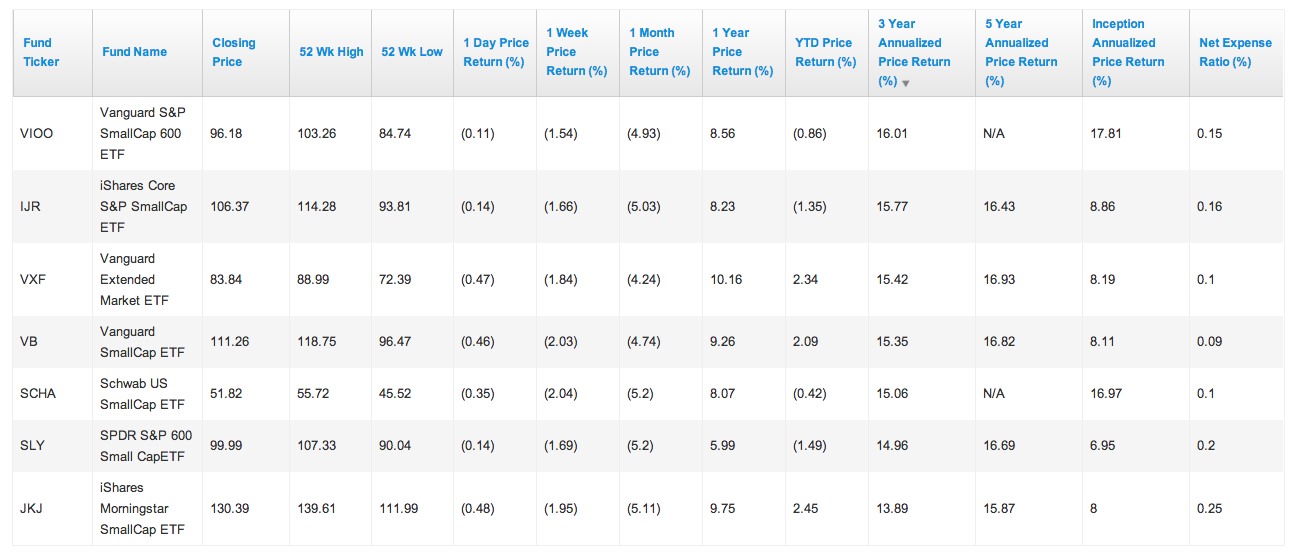

For example, ETF investors seeking to take on equities exposure may break it down into different capitalization. Using the Vanguard ETFs, they include Vanguard Mega Cap 300 Index (NYSEArca: MGC ). Vanguard Mid-Cap ETF (NYSEArca: VO ) and Vanguard Small-Cap ETF (NYSEArca: VB ) .

Additionally, investors may want some international diversification. The iShares MSCI EAFE Index (NYSEArca: EFA ) invests in developed markets, while Vanguard Emerging Markets ETF (NYSEArca: VWO ) tracks developing economies. There are many ETFs to choose from these are just examples.

For bond allocations, investors will want high-quality investment-grade government bonds as a core holding, such as the Vanguard Short-Term Bond ETF (NYSEArca: BSV ). If you believe inflation will eat away at the performance on long-term bonds, you might want to consider Treasury Inflation-Protected Securities (TIPS) ETFs like iShares Barclays TIPS Bond ( NYSEArca: TIP ) or the international TIPS ETF, SPDR DB International Government Inflation-Protected Bond ( NYSEArca: WIP ) .

Furthermore, investors may want to take a look at high-quality bonds outside of Treasuries, such as the iShares iBoxx $ Investment Grade Corporate Bond (NYSEArca: LQD ) or the mortgage-backed iShares Barclays MBS Bond (NYSEArca: MBB ). [What are ETFs? — The Benefits of Transparency ]

If you dont want to make decisions on ETF weightings or creating your own diversified portfolio, you might like an ETF that substitutes as a diversified portfolio.

The iShares S&P Moderate Allocation Fund (NYSEArca: AOM ) holds about 69% in domestic fixed-income, 28% in domestic equities and 13% in international equities. The actively managed Cambria Global Tactical ETF (NYSEArca: GTAA ) weights U.S. fixed-income at 59%, international fixed-income 5%, international emerging markets 2%, U.S. stock 13%, commodities 1%, U.S. Real Estate 11%, cash 8% and currencies 7%. [Diversified ETFs vs. Sector Funds ]

For more information on ETFs, visit our ETF 101 category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.