Understanding the Difference Between NPV vs IRR

Post on: 22 Октябрь, 2015 No Comment

Understanding the difference between the net present value (NPV) versus the internal rate of return (IRR) is critical for anyone making investment decisions using a discounted cash flow analysis. Yet, this is one of the most commonly misunderstood concepts in finance and real estate. This post will help you understand the difference between NPV vs IRR, and clear up some common misconceptions.

First, lets go over some definitions of NPV and IRR, then well walk through an example and some common pitfalls.

Net Present Value (NPV) Definition

Net present value (NPV) is an investment measure that tells an investor whether the investment is achieving a target yield at a given initial investment. NPV also quantifies the adjustment to the initial investment needed to achieve the target yield assuming everything else remains the same. Formally, the net present value is simply the summation of cash flows (C) for each period (n) in the holding period (N), discounted at the investor’s required rate of return (r):

Internal Rate of Return (IRR) Definition

Internal rate of return (IRR) for an investment is the percentage rate earned on each dollar invested for each period it is invested. IRR is also another term people use for interest. Ultimately, IRR gives an investor the means to compare alternative investments based on their yield. Mathematically, the IRR can be found by setting the above NPV equation equal to zero (0) and solving for the rate of return (IRR).

Distinction Between NPV vs IRR

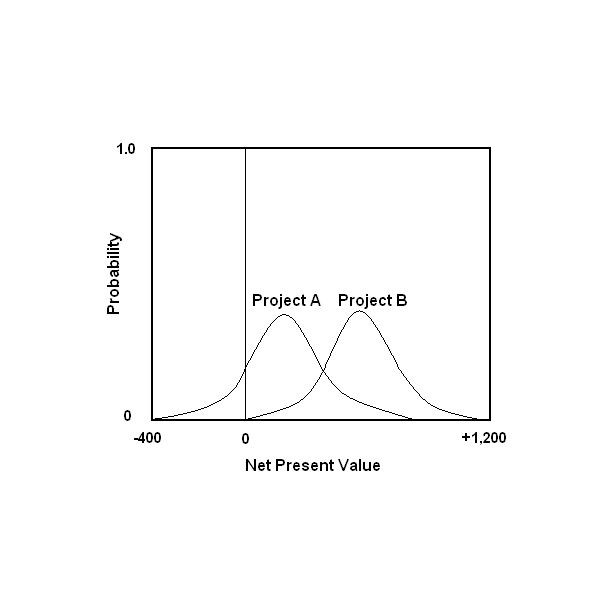

So, whats the difference between NPV and IRR? As shown in the formulas above, the NPV formula solves for the present value of a stream of cash flows, given a discount rate. The IRR on the other hand, solves for a rate of return when setting the NPV equal to zero (0).

In other words, the IRR answers the question what rate of return will I achieve, given the following stream of cash flows?, while the NPV answers the question what is the following stream of cash flows worth at a particular discount rate, in todays dollars? To dive deeper into a more intuitive explanation of IRR and NPV, check out the Intuition Behind the NPV and IRR .

Quantitative Example of NPV vs IRR

Consider a property with expected future net cash flows of $30,000 per year for the next five years (starting one year from now). If you expect to sell the property 5 years from now for a price 10 times the net cash flow at that time, what is the value of the property if the required return is 12%?

Plugging in the $30,000 net cash flows for five years into the NPV equation above along with the 12% discount rate, youll find that the net present value is $278,371. You can also find all of the formulas and answers to these questions in this spreadsheet we put together: