Understanding FIRPTA Buying and Selling Real Property in the a Foreign Entity

Post on: 20 Ноябрь, 2015 No Comment

Buying and Selling Real Property

in the U.S. as a Foreign Entity

Buying Real Property

There are no general restrictions on foreign investment in the United States, unless that investment is in one of a few specific industries such as Radio and Broadcast Television, COMSAT, the Aviation sector, or Energy. The influx of capital is considered a welcome addition, and therefore there is very little legislation to navigate when purchasing U.S. real property as a foreign entity. Under U.S. federal law the only major restrictions to real property purchases by foreign entities impact buyers from countries with which the U.S. is at war, or who are subject to U.S. travel and trade restriction.

1 State law regarding such purchases varies considerably and also changes frequently, thus it is important to check state and local laws to ensure that a desired acquisition in a particular state is feasible. Some states limit foreign ownership of real property and have restrictions and reporting requirements which affect such purchases by foreigners. Some states limit the acreage a foreign entity can buy, or limit the purchase and control of a type of land such as agricultural or grazing lands. Generally, buying U.S. real property is a simple process for a foreign entity. The sale of this property at some future time is when problems can arise if the seller is not aware of the applicable law.

Selling Real Property

FIRPTA Basics

The Foreign Investment in Real Property Tax Act (FIRPTA) is a speed-bump in the otherwise smooth ride of buying and selling U.S. real property. FIRPTA was enacted in an effort to curtail lost capital gain tax revenue from the sale of real property by foreign individuals, and entities. Unfortunately, in operation it can delay property sales as well as withhold tax that is not owed. Simply knowing about FIRPTA in anticipation of any sale can help alleviate what can otherwise be a massive problem. This article is for the purpose of raising awareness of FIRPTA, as well as identifying what problems may arise during your real property sales.

The sale of U.S. real property by a foreign owner is subject to tax on the capital gain (profit made on the overall buy/sell transaction). To ensure that this tax is paid by a foreign owner who may have severed his only connection to the U.S. by way of this sale, FIRPTA requires a withholding tax apply at the time of sale. This tax withholds 10% of the GROSS sale price, which means that 10% is withheld even if you sell the property at a LOSS! 2 In order to recover any portion of the 10% that exceeds the amount actually owed under capital gains tax, you must wait until the end of the year and file for a refund. 3 It is important to note that in addition to the 10% federal withholding tax, some states require a similar withholding tax at a lower rate. FIRPTA applies to both individuals and entities, who hold direct or indirect interests in real property. 4

Avoiding or Mitigating FIRPTA

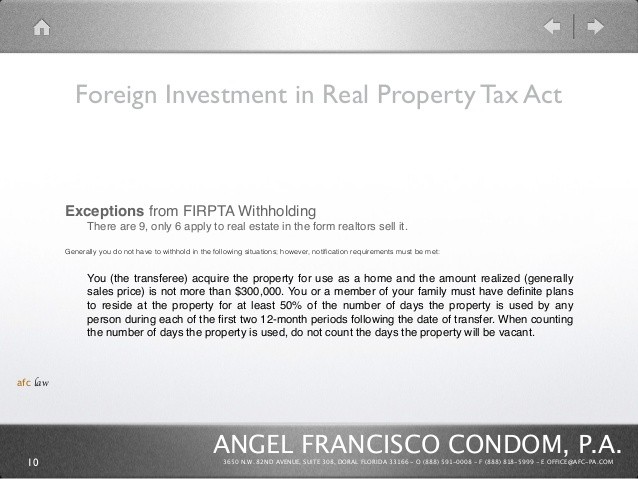

Can you avoid FIRPTA altogether? Generally the answer is no, however there are some exemptions, of which the most commonly used are: the transaction is for the purchase of a personal residence for $300,000, or less; the transaction is a non-recognition transfer; 5 or the amount realized on the transaction is zero. For the most part, these limited exemptions will not be of any help, which leads to the final recourse available, applying for a federal withholding reduction in the form of a withholding certificate. The grounds for requesting this reduction are that the amount withheld exceeds the actual capital gain tax liability. 6 If the application is submitted prior to the closing date on the transaction, the 10% that is withheld is paid into escrow. The escrow company then retains the funds until they receive a letter from the IRS confirming the reduced amount. The IRS then receives the appropriate portion of the funds in full satisfaction of the capital gain tax, and the remainder is remitted to the seller, including interest accrued on such funds. 7

Unfortunately, the process of applying for the withholding certificate is very time consuming. For all closings after November 3, 2003 in which the seller/transferor is a foreign entity or person, the regulations now require an international taxpayer identification number (ITIN) be supplied by the foreign seller/transferor as well as by the foreign or domestic buyer/transferee, (taxpayer identification number (TIN), if domestic) on the application for a withholding certificate. Before November 3, 2003 it was sufficient that the application for an ITIN was filed, however both parties now must supply the actual ITIN/TIN. If an ITIN/TIN is missing from either document 8 required for a withholding certificate, then the buyer/transferee must withhold the 10% and remit the funds to the IRS within 20 days of closing. Adding to the difficulty of this process is the fact that after submitting an application for an ITIN, it can take anywhere from 5 weeks to 3 months for an ITIN to be assigned. 9

Once both parties have their ITIN/TIN and the application for a withholding certificate is submitted, the IRS states that they will act within 90 days. Generally they are not that quick, and the funds will sit in escrow for up to 4-5 months before a decision is reached.

When a foreign owner is preparing to sell U.S real property these requirements, and time table, must be considered. The process involved is very time consuming, but by anticipating a future transaction that falls under FIRPTA you can prepare ahead and shield yourself from much of the aggravation associated with it.

Any foreign owner of U.S. real property should obtain an ITIN upon purchasing that property. Whether or not it is currently needed is immaterial, as it will be necessary sooner or later, and when that time comes it may not be possible to obtain it in a timely matter. 10 Planning ahead is truly the name of the game when dealing with FIRPTA.

Alternative Solution

One way to avoid the FIRPTA withholding problem altogether is to form a U.S. corporation, owned by the foreign entity, to hold the real property. Since the entity that holds the property being sold is now a U.S. corporation, FIRPTA does not apply. This approach avoids the withholding tax, and allows the foreign entity to escape the lengthy process of applying for an ITIN.

One drawback to the use of a U.S. corporation is the required filing of Form 5472: Information Return of a 25% Foreign-Owned U.S. Corporation, with the IRS. Not only does this form require the reporting of any foreign individual or entity that owns 25% or more of the U.S. corporation, but it also requires reporting all individuals or entities that are related to 25% foreign owners. This related requirement includes a foreign asset protection trust that owns the foreign entity that in turn owns the U.S. corporation. Further discussion of what relationships are implicated by this reporting requirement go beyond the scope of this article, however it is important to note that the requirements are broad.

Obviously, using a U.S. corporation is not a perfect solution, but does offer a viable alternative. In a situation where time is not an issue, and there is some concern over the scope of Form 5472’s reporting requirements, dealing with FIRPTA may be the proper option. However when the withholding tax and ITIN requirements are the greater concern, use of a U.S. holding corporation is a possible solution.

1 See Trading with the Enemy Act, Cuban Assets Control Regulations, and the Iranian Assets Control Regulations.

2 The transferee, or buyer, is the one required to withhold the 10%, and must report and remit that amount to the IRS within 20 days of the date of transfer.

3 The foreign seller must file a U.S. tax return even if a refund is not claimed; withholding does not excuse this requirement.

4 This includes co-ownerships, leasehold ownerships, life estates, reversionary interests in real estate, and ownership of stock in a U.S. corporation.

5 This exemption includes reporting requirements, and standards which exceed the scope of this article.

6 Proof that the gain is exempt from U.S. taxation or that a surety provides a guarantee to the IRS on that tax owed are other grounds for applying for the reduction.

7 It is common for the IRS to allow only a portion of the requested reduction, necessitating a claim for refund be filed at the end of the year to collect any portion retained by the IRS which exceeds the capital gain tax owed.

8 Withholding Affidavit and a Notice of Application for a Withholding Certificate .

9 Keep in mind that any property being sold that was used as rental property may have generated income that was not reported since the owner did not have an ITIN. This problem will have to be addressed.

10 The seller must make sure that the buyer has, or applies for, an ITIN/TIN as well, since both parties are required to submit them on the Application for a Withholding Certificate.

This article is designed to introduce you to the importance of asset planning and the need to protect your wealth. It is published as part of general information series for visitors to our web site. If you need to pursue an asset protection strategy, make sure you do it with the assistance of a professional.