The S P CaseShiller Home Price Index Tucson RE

Post on: 9 Январь, 2016 No Comment

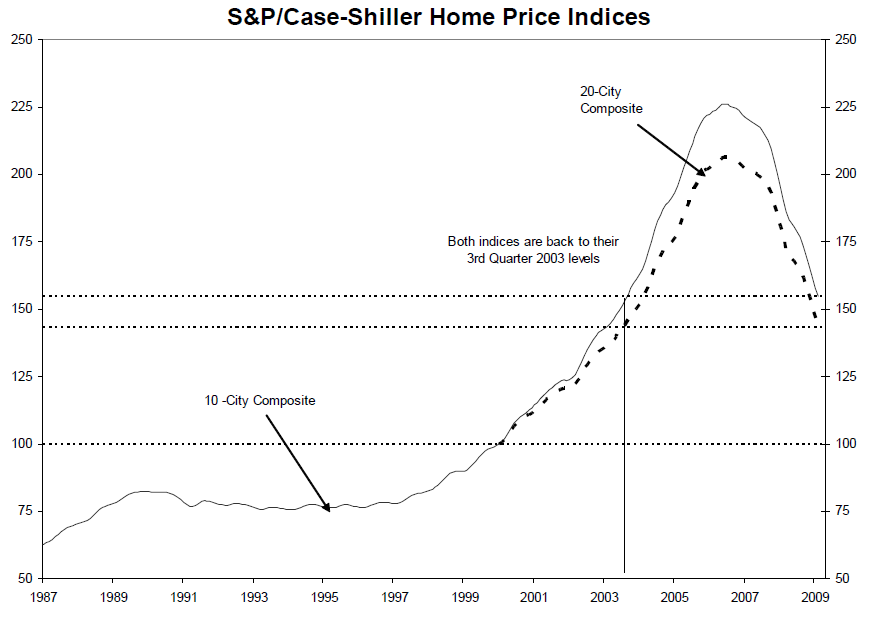

The S&P/Case-Shiller Home Price Index report gets a lot of press coverage each month when it comes out. But does anyone you know including yourself take the time to find out what the data reporting criteria is for this report? If you dont know the basis on which the conclusions are being drawn then you dont understand the results of what is being reported. Most major media outlets are counting on this.

Lets start 2008 looking at a couple of these reports that come out and are often quoted. It will help each of us understand better what we are reading.

It can also make you the voice of reason the next day at work when everyone is quoting from some bad new in the real estate market report. While they are playing into the bad news game you can say, But did you know that if you own your home for a long period of time it is downgraded in the report?

Index Construction

REPEAT SALES PRICING

The S&P/Case-Shiller Home Price Indices began as a research

project in the 1980’s when Karl E. Case and Robert J. Shiller

began to construct a methodology to measure housing price

movement. They mastered the repeat sales index technique,

now widely considered the most accurate way to measure

valuation changes in various U.S. housing markets over time.

The methodology measures price movements by collecting

data on sale price data pertaining to individual single-family

homes within each geographic market comprising an index.

When a specific home is eventually resold, the new sale

price is matched to the home’s first sale price. These two

price points for a specific home are called a “sale pair.â€

The difference in the sale pair is measured and recorded.

All available sale pairs within the geographic market being

measured are then aggregated into one index. Sales pairs are

carefully screened for any data points that would distort the

index such as foreclosures, non-arms length transactions, and

suspected data errors where the order of magnitude of the

change is substantially different from others in the region.

WEIGHTING OF SALES PAIRS

The indices are designed to measure the change in the price of

homes that have not undergone significant changes in quality.

Sales pairs are assigned weights to account for fluctuations