The Flaws of the CaseShiller Index

Post on: 4 Январь, 2016 No Comment

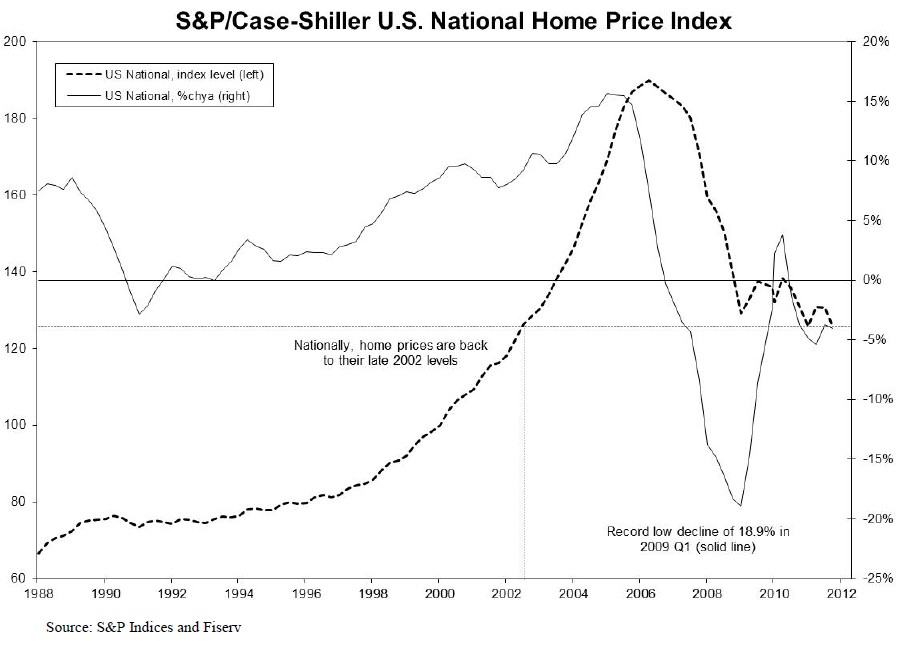

When the Case-Shiller index, the most widely quoted index of housing prices, reported this week Read report that home prices rose 8.6% for its 10-City index and 9.3% for the 20-City index for the year to February, the news was greeted with headlines such as CBSs Us Home Prices Surging.

Well, as the Beach Boys sang a long while ago, You Know I hate to be a Downer, but this is a good time to remind everybody that, as I have mentioned regularly in my year end reviews, the Case-Shiller Index has serious flaws.

Dan Green in his The Mortgage Reports (www.TheMortgageReports.com) takes up the argument this week, pointing out that:

1.The Case-Shiller Index tracks values of detached, single-family homes only

2.The Case-Shiller Index includes sales of discounted, distressed homes

3.The Case-Shiller Index publishes on a 2-month time delay

In this way, the Case-Shiller Index ignores multi-unit homes and condos; and allows its findings to be dragged down by foreclosures and short sale which sell at discounts of 20%; while applying price data from contracts written as many as 5 months ago.

Furthermore, the home index falls apart when we consider its limited scope. All real estate is local, yet the Case-Shiller Index tracks 20 U.S. cities and calls itself a national index. There are 3,100 municipalities in the United States. The Case-Shiller Index accounts for fewer than 1 percent of them.

Another flaw is that Case-Shiller uses only repeat sales, that is houses that have sold at least twice, in order to try to give a true apples-to-apples comparison, but in so doing excludes all new construction.

Because distressed properties foreclosures and short sales typically sell at around a 20% discount to non-distressed sales, I always exclude distressed sales from my median price comparisons (I include them in the actual number of sales). Indices that include distressed sales will overstate the decline in prices on the way down, but conversely will overstate the increase during the recovery phrase.

Another aspect of the Case-Shiller Index is that it does not include condos in its main report. Condo prices are tracked separately for major condo cities. In the year to February, Case-Shiller reported price increases of 7.8% in Boston, 12% in New York and no less than 28.1% in San Francisco.

Case-Shiller is still relevant, not least because it is so widely quoted, but it is important to understand the methodology it uses.