The Exchange Rate of the Chinese Yuan for the

Post on: 16 Март, 2015 No Comment

The Exchange Rate of the

Chinese Yuan for the U.S. Dollar

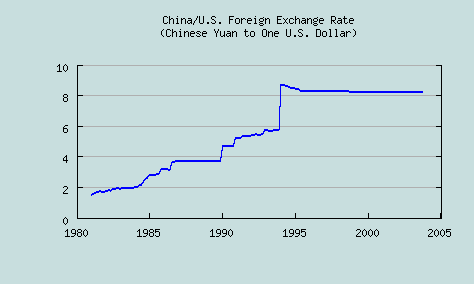

Currently (December 2005) the exchange rate of the Chinese yuan for the U.S. dollar is 8.08 yuan* per dollar. On July 21, 2005 announced that it was abandoning the pegged exchange rate and moving to a floating exchange rate regime. At that time the exchange rate was changed from 8.28 yuan to the dollar to 8.11. This seems to be an acceptance of the principle of a floating rate rather than an actual floating rate regime. The actual exchange system is still controlled and the government can still effectively determine the rate. The government policy now pegs the value of the yuan to a basket of currencies instead of strictly to the U.S. dollar.

Based upon the World Bank estimates of the Gross Domestic Product of China in U.S. dollars for 2003 at current exchange rate versus at purchasing power parity (PPP) the 8.08 yuan per dollar figure should be divided for 4.39 to get an exchange rate that refects the relative purchasing power of the two currencies. Thus a market-driven exchange rate would be approximately 1.84 yuan per dollar.

In the long run a market-driven exchange rate approximates the purchasing power parity of the two currencies. In the short run or even the medium term the market exchange rate would not necessary necessarily approximate the relative purchasing power of the two currencies. In the medium term relative interest rates could be the major influence on the market exchange rate. In the short run political events and any number of factors could affect exchange rates. But the World Bank estimates indicate that the yuan is now immensely undervalued as a result of Chinese government policy.

A more realistic exchange rate will be good for international financial balance but it will also mean Chinese demand for international commodities such as petroleum will drive up considerably the prices of those commodiites. The living standard of the Chinese people would increase considerably under such an appreciation of the Chinese yuan. The living standard of people outside of China (who are working) would decline as not only the prices of Chinese imports increase but also international commodity prices increase. This would be appropriate in as much as they were in the past benefiting from the artifical enhancement of their living standard due to the Chinese government’s policy of undervaluation of the yuan. Those outside of China who lost their jobs as a result of the past policy of undervaluation of the Chinese yuan might find their living standard improved as a result of better job prospects. The past and current exchange rate policy has made the effective wage rate of Chinese workers about $0.25 per hour and no country in the world can complete with it. Of course what the Chinese worker can buy with his or her pay for an hour’s work is worth a lot more than 25 cents American.

* The official name of the currency of China is renminbi. meaning people’s currency. Yuan is the common terminology and has a meaning roughly equivalent to dollar. In the past special foreign exchange certificates were issued to foreigners for use in financial transactions within China.

HOME PAGE OF applet-magic

HOME PAGE OF Thayer Watkins