Tax Lien Investing course

Post on: 1 Апрель, 2015 No Comment

**** For a Limited Time Receive $1044.00 In Bonus Gifts Today! ****

Fom: Joanne Musa

RE: Your Investment Portfolio

Do you worry about losing money in your investment portfolio every time the stock market goes south?

What if you had investments that werent tied to the stock market, or the real estate market. What if you had investments that made the same guaranteed rate of return no matter what the stock market or the real estate market did?

If your idea of investing for retirement is buy hold and pray then your nest egg could look like this when youre ready to retire:

Is that what youve been working so hard for all of these years?

What if there was a way that you could protect your nest egg and stay ahead of inflation?

Are You Concerned About Your Financial Future?

Let me ask you a question. How good would it feel if you never had to lose sleep over your investments again, or worry about losing your money, no matter what was going on in the markets and the economy?

Imagine This. wouldnt be amazing if you had access to an investment that gave you guaranteed interest rates and was backed by a real asset, not just paper.

Think about that for a moment. never having to worry about your retirement again and having peace of mind about your investments, because your money is invested safely and does not depend on whats going on with the markets or the economy.

The Wealthy Have Been Using This

Secret Investment Strategy For Decades

Robert Kiyosaki mentions it in his best seller, Rich Dad, Poor Dad, and Robert Allen talks about it in his best seller Multiple Streams of Income. Maybe you have heard about it before, but you just didnt understand how it works or how you can take advantage of it. Im talking about investing in high yielding Tax Lien Certificates. Until recently this investment strategy has been the secret of the very rich, but its always been available to anyone. Anyone can take advantage of this extremely profitable investment, you just need to know how.

The best part is. Im going to share it with you right now today.

Are You Ready?

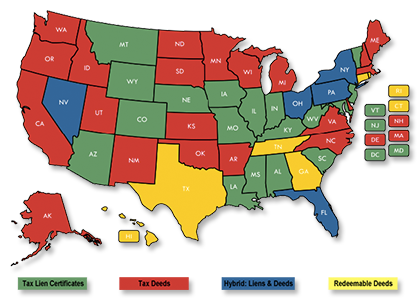

If youre not already familiar with tax lien certificates or tax deeds, or youre aware of what tax lien investing is but just dont know how to really profit from it, then youre in the right place because Ill explain it to you step by step.

Heres How You Too Can Make a

Tremendous Profit From Tax Lien Certificates

Counties and municipalities need the revenue they get from property taxes to meet their budget. They need to be able to pay civil servants, like firemen, policemen, elected officials, and school teachers and administrators. They also need this money to maintain roads and township buildings. They need a way to collect unpaid property taxes and one of the ways that some states use to do this is to sell unpaid property taxes to investors.

When you purchase a tax lien, you are not purchasing the property, in fact you have no ownership in the property at all. You are paying the taxes (plus any penalties that have been assessed to the property owner) and putting a lien on the property. The lien that is placed on the property is a very special type of lien. Just like a local government lien, it is in first position, even before a mortgage. That means that if anything should happen and the property owner is not be able to pay the lien, the tax lien holder has first right to any monies from the property. In fact in most tax lien states the lien holder can foreclose on the property if the tax lien isnt satisfied within a certain period of time.

What makes tax liens so attractive to investors, besides the fact that its a first position lien, is the interest and penalties that the investor is entitled to when the lien redeems. The interest earned on a tax lien certificate is specified by state laws. Sometimes the rate is bid down at the tax sale (these sales are typically conducted as auctions) but the default, or statutory rate, can be quite high. In one state the statutory rate is 18% every 6 months — thats 36% per year!

Her Guidance Is Top Notch!

If you are looking for a solution to Tax Lien and Deed investing younot ve come to the right place with The Tax Lien Lady. I started my search years ago with other providers without a single result, until I found Joanne Musa. Her coaching program has delivered, and her guidance is top notch.

Steven Iltz, Airline Pilot, Oregon

So How Do You Profit From Tax Lien Certificates?

record your liens with the county clerk

pay subsequent taxes

organize and track your tax liens

foreclose or sell your liens

When you buy more courses and spend more time learning, without doing anything, you are LOSING MONEY!

Thats why I created a no nonsense breakthrough system to help you build your own profitable tax lien or tax deed portfolio. Im known online as the most trusted authority in America on tax lien investing. Thats because I got sick and tired of all the hype and fluff thats being propagated about tax lien investing on the internet, and in a lot of seminars and courses.

So I conducted a live training where I taught my own students, people just like you from around the world, my secrets on how to be a successful tax lien investor. I recorded all of the lessons so that I could make the entire course available to anyone who wants to learn the real secrets of making money with tax liens. Ive created a training unlike youve ever seen. You see, Ive added a unique twist to this training which has been the missing element in most of the courses out there. Ill tell you more about that in a minute.

Want To Know How You Too Can Double, Triple, or Even

Quadruple YOUR Return On Your Investment?

To Invest PROFITABLY in Tax Lien Certificates or Tax Deeds You need to do follow these 7 steps: