Real Estate Proforma Statement Are They And How Are They Used

Post on: 27 Октябрь, 2015 No Comment

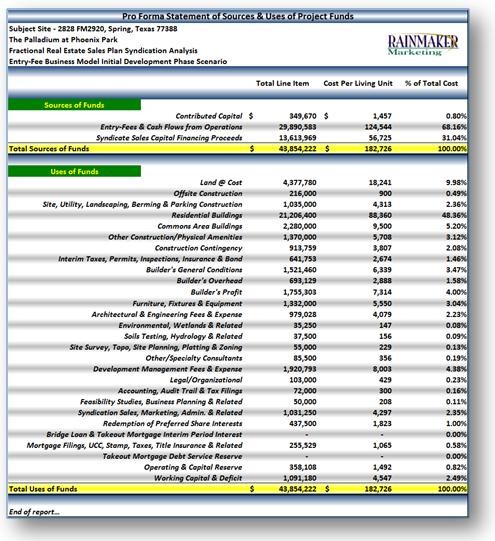

Understanding And Using Investment Real Estate Proforma Statements

Real estate proforma statements do serve a purpose in helping you evaluate an income producing real estate property. After all, it is the income that an apartment building generates that typically determines its value. However, as a prospective purchaser it is vital that you understand that proforma (also spelled pro forma) financials do not tell the whole story, and in many cases can be misleading.

Proforma statements are primarily used in business and accounting for two main purposes.

1. To normalize revenues and expense

2. To project the financials into the future

Real estate proforma statements can be used for both of these purposes.

In my 16 years as a commercial real estate investor I have been on both sides of the transaction table, so to speak, as a buyer and a seller. I have prepared real estate proforma statements and I have received them from sellers and/or their commercial real estate agents. (You will also see pro forma or normalized income and expense statements used by real estate appraisers in their reports as well). Here are just a couple of line items on a pro forma income and expense statement that you should pay particular attention to.

Potential Gross Income: Often times real estate pro forma statements will include the word ‘potential’ in front of gross income. What does this mean? It could mean a couple of things. First, it could simply mean that the potential gross income, if all of the suites are rented, is $X. Or it could mean that once all of the suites are rented at market rates the potential (read: projected) gross income would be $X. Note that there is a big difference between the two meanings. Ultimately you will have to cross reference this amount with the actual rent rolls that you receive from the vendor in order to verify the figure. Also, don’t be afraid to be up front with the vendor or the commercial realtor if one is involved. Ask them point blank if they can support the revenue figures on the real estate proforma statements with their current rent rolls.

Repair and Maintenance Expense: This figure is almost always quoted as a ‘normalized’ amount on real estate proforma statements. It is either expressed as a percentage of the gross, or on a per suite basis. Why not just use the actual amount? Here are a couple of reasons. First, investors and appraisers like to ‘normalize’ certain expenses so that they can better compare one building to the next for valuation purposes. Any major repair or capital expenditures that are necessary can be applied to the building’s value for adjustment purposes later in the valuation process. Second, (and this point ties in somewhat with the first point) if an owner spends an extraordinary amount of money rehabbing a property in the time frame just before listing the building for sale, these expenses should not be considered ‘ongoing’ and hence should not be included on an income and expense statement for valuation purposes.

Actually, the first thing I typically do with real estate proforma statements is take the information that I want, and insert it into my commercial real estate analysis software. From there I can fill in the missing information (information that is conveniently left out of most proformas) and get a true understanding of the value of the property I am looking at. Here are a couple of software spreadsheets/programs to consider.

and

Not only is this type of software great for doing quick analysis, it also ensures that you don’t leave out any important components of your analysis.