Pro Forma Income Statement Forecasting Rental Property Performance

Post on: 23 Октябрь, 2015 No Comment

November 23, 2013 By James Kobzeff

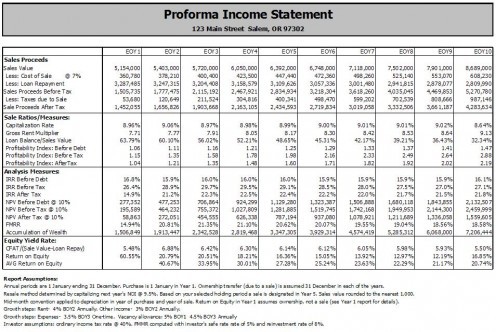

The pro forma income statement is a commonly-used cash flow forecasting report used by real estate investors to evaluate the future financial performance of real estate investment property.

More robust than most other real estate analysis reports like an APOD, which is perhaps the most popular report used by analysts but only gives a snapshot of the propertys performance for the first first year, a pro forma income statement projects the investment propertys financial data over a given time period into the future that exceeds the first twelve months of ownership.

So the proforma provides real estate investors a concise way to anticipate what he or she can expect in the way of profitability, rates of return, tax benefits, and sales proceeds from a rental property over time.

Overview

Click to enlarge

As stated, a proforma income statement is a financial report that projects a rental propertys performance and profitability over a given period of years into the future (e.g. 2-10 years into the future).

The objective is straightforward.

The investor wants to see how changes in the propertys performance over time might impact the bottom line (i.e. cash flow and rates of return). After all, the propertys financials are rarely static and will likely change as the months roll by.

Rents, for instance, are likely to increase sometime in the future. Perhaps not immediately nor even all at once for each of the units, but rents do change. As a result, so does the cash flow, rate of return, and profitability.

Operating expenses are also likely to increase. These are the expenses associated with the property that keep it in service such as property taxes, insurance, water and sewer, utilities, and maintenance and repairs. In some cases these additional expenses could easily negate any appreciable income benefit due to rent increases, and maybe even worse, they can severely impact the financials and reduce cash flows and rates of return.

Then, of course, theres the propertys potential future sale price. Sale proceeds play a major role in the investors bottom line and ultimate profitability. So prudent investors will want to account for it with some amount of forecasting.

You get the idea.

The Pro Forma Income Statement provides real estate investors a way to make those forecasts and with a series of projections help to highlight the pros and cons of an investment real estate opportunity.

Of course, it would be unwise to make a buying or selling decision based solely upon the results of a Proforma alone. It is, after all, simply a projection with speculative numbers. But when used cautiously with conservative rather than overly aggressive numbers, a Pro Forma Income Statement can be a worthy real estate analysis tool.

So You Know

ProAPOD Real Estate Investment Software solutions do automatically create a Pro Forma Income Statement.