Nominal and Real Interest Rates; Compounded and Continously Compounded Interest Rate Formulas

Post on: 20 Октябрь, 2015 No Comment

Interest is the amount of money charged for the borrowing of money to compensate the lender for the lost opportunity cost of not having the money and to compensate the lender for the various risks of lending money, such as inflation risk and credit default risk. Indeed, the word risk is derived from the Tuscan word rischio. which the Tuscans considered the amount necessary to compensate for the lending of money. Usually, the amount of interest being charged is expressed as an interest rate, which is a percentage of the principal or balance per unit of time.

The concept of interest has a long history. Aristotle thought interest was evil, and according to the Koran, God condemned the charging of interest. The earliest known examples of interest were in ancient Mesopotamia, beginning in the 3 rd millennium B.C. when an interest rate of either 20% or 33% was charged depending on whether the loan was paid in silver or barley. However, the interest rate did not depend on the amount of time. [No doubt this simplified calculations that required using a sexagesimal (base 60) numbering system and pressing wedge-shaped (cuneiform) styles into wet clay tablets.]

Interest and Interest Rates

Interest rates are the rate of growth of money per unit of time. It is one of the most fundamental factors in investments, since so many financial assets depend on its value. It is used to determine the present and future value of money and of annuities. Many securities either pay interest or the payoff depends on the interest rate. Whether a business will invest in capital or issue securities depends on the interest rate. Hence, the interest rate allocates economic resources more efficiently. Governments control their economies by adjusting key interest rates through monetary and fiscal policies.

Interest is the cost of money, in the form of a loan, and like the price of virtually everything else, it is determined by supply and demand. In the United States and most other developed countries, the government has a major influence on the interest rate, adjusting it higher to cool the economy and adjusting it lower to stimulate it. The government can also increase the money supply by printing money, or through other monetary and fiscal policies. Another source of supply is the savings of people, businesses, and other organizations. The main demand for money is for loans by people and businesses. Demand can also be affected by the monetary policies of the government.

Charging interest on a loan is sometimes called usury. although in more recent times, it has acquired a negative connotation of excessively high or illegal interest rates being charged. In fact, when the usury rate is limited by law, the rate is referred to as a usury ceiling. However, at least 2 states in the United States do not have usury limits: Delaware and South Dakota, which is why many credit card issuers are located in those states.

Nominal and Real Interest Rates

The nominal interest rate is the stated interest rate. If a bank pays 5% annually on a savings account, then 5% is the nominal interest rate. So if you deposit $100 for 1 year, you will receive $5 in interest. However, that $5 will probably be worth less at the end of the year than it would have been at the beginning. This is because inflation lowers the value of money. As goods, services, and assets, such as real estate, rise in price, it takes more money to buy them.

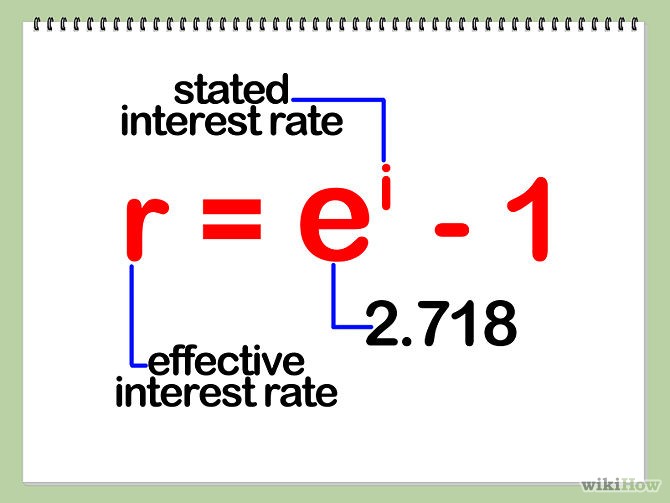

The real interest rate is the nominal rate of interest minus inflation, which can be expressed approximately by the following formula:

Real Interest Rate = Nominal Interest Rate – Inflation Rate = Growth of Purchasing Power.

For low rates of inflation, the above equation is fairly accurate. However, the actual growth of your purchasing power is equal to the nominal interest rate divided by the inflation rate:

Formula Relating the Real Interest Rate,

Nominal Interest Rate, and Inflation Rate