Gold Up or Gold Down

Post on: 1 Август, 2015 No Comment

* We will NOT share your email address *

* Can cancel eletter any time *

When I give speeches, I love the Q&A part of the program. It gives me the chance to connect with people. To hear whats on their minds and to provide, as best I can, insight on what might lie ahead.

The topics people want to discuss change with the times, but some topics are evergreen. For example, interest rates are always front and center of peoples minds. And for the last several years, gold has been a hot topic. Is it gold up or gold down? Buy gold or sell gold? Should we be gold bugs and gold bears? What can we expect from the gold market?

Interestingly, Ive found that instead of being something people want to talk about, it seems gold is something people want to either defend or crucify theres little middle ground.

Thats a problem because it puts people into dangerous positions while leaving opportunities on the table. Instead, you should do what we do.

Here at Survive & Prosper. we are NOT gold bugs. Nor are we gold-haters. We are merely observers of economies, markets and trends. This puts us at odds with both gold bugs and gold-haters because we dont clearly stake out a position and hold onto it for dear life. We dont do this because we dont see how either position is supported by the facts.

Instead, we use those facts to determine our path to maximum gains. And right now, our facts are telling us the gold price could melt down to $700 in the years ahead.

What Will the Gold Price Be in a Year?

Well that depends. Golds worth is a combination of whats happening with monetary and credit expansion and whatever you think the value should be.

Credit and monetary expansion is easy. If theyre growing, the price of gold in dollars or euros should move up. In other words: gold up.

The whatever you think the price of gold should be is the hard part. And this is where people get angry.

The gold price should be at $5,000 per ounce because our government is killing the currency! is a common cry among the gold bugs.

Or, The gold price should be priced for its use as jewelry, around $100 per ounce, because it is not part of the monetary system, to quote the gold-haters.

But how about a third rail? Instead of gold being worth nothing or a zillion dollars, cant it be a fluctuating barometer of current demand and views, exacerbated by ETFs like GLD?

Its not gold up all of the time. Its not gold down all of the time.

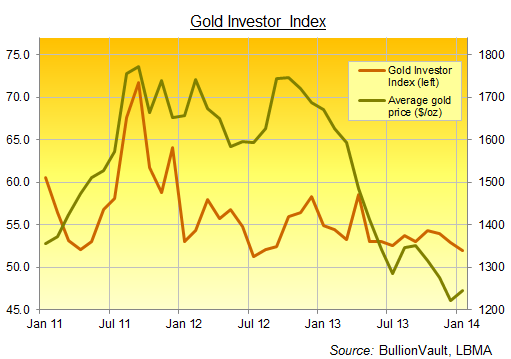

In the early years of the current economic climate, which we call the economic Winter Season, the gold price rose sharply in response to fears about economic collapse. Weve seen central banks take extraordinary measures to pump up financial systems while private and public debtors collapse their credit (think mortgage write-downs, credit card charge-offs, GM bankruptcy and Greek debt cram-down). These opposing forces kept fighting over the direction of overall money and credit.

Eventually that fear trade grew long in the tooth. This doesnt mean investors no longer fear economic collapse or upheaval. It just means weve lived with it for some time. Its become normal.

So this leaves us with the mushy middle. Gold has already dropped sharply. Now it hovers in no-mans land. So whats next?

Our view is that gold will continue to melt down, all the way to $700, if not lower because of the great economic crash we forecast for early 2014.

There are at least 13 different triggers that could become responsible for the collapse (another topic for another time). Regardless, the result will be continued frustration for gold bugs at the lack of respect the barbaric relic receives and the steadily collapse of their beloved yellow metal.

Our suggestion? Sell your gold investments.

As far as your physical gold goes, the gold that sits in storage for no purpose other than to provide you with peace of mind, thats for you to do with what you will.

The time has come to sell gold, not buy gold. As the gold price deflates to $700 an ounce, it will be lucrative to go short the precious metal. As a subscriber to the free eletter, Survive & Prosper. well tell you the best ways to take advantage of golds demise

One of the Greatest Investment

Opportunity of Our Lifetimes!

Our mission at Survive & Prosper is to empower you to see ahead of the curve so that you can not only survive during the great gold meltdown ahead, but prosper as well. The only way to do this is to show you what no one else is paying attention to predictable, profitable trends.

We look ahead for things the average investor just cant see the next Harley Davidson’s and Microsofts the best times to buy gold and sell gold and be in real estate. When to get into Dow stocks and when to get out.

Subscribe to Survive & Prosper and discover what most investors will never know about making money. Plus, youll get instant access to my FREE, eye-opening report called Gold Will Fall to $700/oz. Inside, well show you how it will all unfold. how you can be one of the few to sidestep the carnage as we head towards gold $700.

Simply enter your email below.

Six days a week youll get your Survive & Prosper eletter. Its the first letter of its kind to accurately predict the future using demographic trends (check it out and see for yourself). We believe that knowing what consumers are going to buy next or what theyll stop buying soon is the best way to protect your portfolio and maximize your investments.

Each week day we share with you our investment research on consumer spending patterns, demographic trends and economic cycles, just like this one.

Are you prepared for gold $700?

Simply sign up to receive my free eletter, Survive & Prosper delivered six days a week straight to your inbox