FHA Loan Guidelines and FHA Loan Limits Checks in Your Area from FHA Mortgage

Post on: 30 Сентябрь, 2015 No Comment

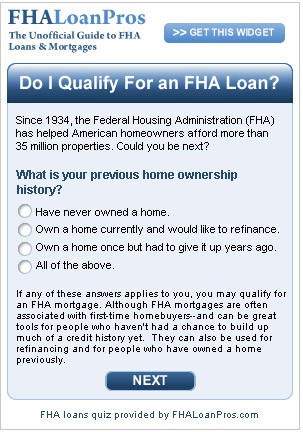

What is a FHA Loan? Is it the right option for me? FHA Mortgage Center.com is here to answer these questions. We specialize 100% in government-backed home loan programs.

There are certain guidelines you must adhere to in order to be approved for an FHA Loan. You must collect all the necessary information, put it together in a file, and send it to the underwriter. The underwriter is the person who reviews your file and determines if you are approved, denied, or suspended in your request for a loan. You will also want to verify the FHA Loan Limit in your area. FHA Loan limits were updated by the HUD in March 2008!

Many borrowers looking to finance a home purchase or refinance their current home through the FHA have questions about what information our FHA Specialists will need. The information which may be required to process your file and to help us find the best solution for you is as follows:

- The addresses of all your residences over the past two years

- Your Social Security Number.

- The names of your employers over the past two years

- Your current gross monthly salary

- Names, addresses, and account numbers with balances on all checking and savings accounts

- Addresses and loan information of any other real estate you owned

- Estimated value of your furniture and personal property

- W2’s for the past two years and current paycheck stubs

- Certificate of Eligibility and DD-214 (Veterans only)

- Self-employed individuals will need to provide personal tax returns for the past two years and a current income statement and balance sheet for the business

- Students will need to provide evidence of enrollment. If you have student loans, you need to provide verification information

Please remember that this is only a short list of common items required to obtain an FHA Loan. Start the process now by filling out our short form. and one of our FHA Specialists will walk you through each step. If you are just looking for more information about FHA Home Loans-no problem. We are happy to answer your questions and educate you about your options before moving toward finding financing-obligation free.

More on What You Need for a FHA Home Loan

It is also important to recognize whether or not you can make a 3% down payment on the house you are looking to buy before you apply for an FHA Loan.

A credit report is not required when applying for an FHA Loan. but it is useful to help you obtain your loan. Underwriters can make a more informed decision about whether to approve you for an FHA Loan by looking at your credit score to help them determine if you are likely to pay your mortgage on time.

When you send in your information to the underwriter, it is important that you have a stable source of income, you do not have any outstanding debt, and that, if you have a co-signer, you co-signer shows credibility for the loan as well. The underwriting process can take between 2-5 days, so you should plan ahead.

Once you meet these requirements, you are on your way to acquiring your FHA Mortgage. and by extension, the home of your dreams.