Economics and the Bond Market

Post on: 21 Октябрь, 2015 No Comment

Economics and the Bond Market

The concept of choice is essential to economics- it is how economic agents (i.e. consumers and producers of goods and services) make choices in the face of constraints that drive economic theory. Economists assume that economic parties always act in self-interest, seeking to maximize their own well being. This means that consumers will seek to maximize their purchases within the constraints of their income, and producers will seek to maximize their output within the constraints of their cost of production.

The Law of Supply and Demand

One of the most fundamental laws of economics is the law of supply and demand. Producers of goods and services determine supply, while consumers determine demand. Producers will seek to supply the amount of goods or services to the point where their profit is maximized against rising production costs. To put it another way, they produce to the point where incremental revenue equals the incremental cost of production. Consumers purchase to the point where the incremental value of the good or service is equal to its incremental cost. The producer’s profits are a function of consumer demand.

The quantity that a producer is willing to supply is determined by the price they can get for their product. A supply curve is a graph that plots the quantity of product a producer would produce at different price levels. Because producers will supply more of a product at higher prices, the supply curve is positive sloping.

A demand curve is a graph that plots the amount of product a consumer would purchase at various prices. Because consumers will purchase more of a product at lower prices, demand curves a negatively sloped.

The market equilibrium price is the price where the quantity that producers are willing to supply is equal to the quantity that consumers are willing to purchase. This is the point at which the supply curve and demand curve intersect, and it illustrates the law of supply and demand.

If demand exceeds supply, prices will rise until consumption is reduced to meet supply, and vice-versa. If supply exceeds demand, prices will fall until consumption increases to meet supply, and vice-versa.

If we aggregate economic agents to encompass all the producers and consumers in the U.S. economy, we end up with a chart of aggregate supply and aggregate demand for our economy.

Expansionary fiscal or monetary policy shifts the aggregate demand curve to the right, resulting in higher equilibrium price (P’) and output level (Y’) (more about fiscal and monetary policy will be discussed later):

The strength of the economy determines how much a shift in aggregate demand effects prices. If the economy is in a recession . an increase in demand will impact prices more than output, while in a booming economy a similar increase will impact output more than prices. In hard economic times both wage earners and businesses are concerned about keeping their jobs and businesses intact and are less aggressive about seeking increases in wages and prices.

Macroeconomics and Interest Rates

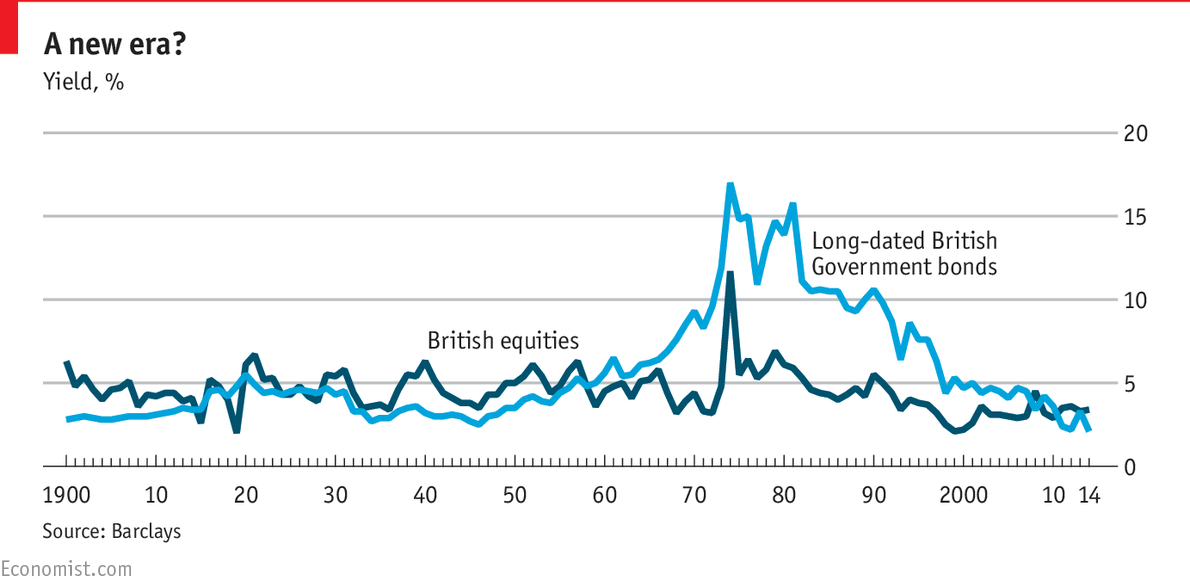

While an understanding of economics is important to understanding any financial market, it is particularly important when it comes to the bond market. One of the prime determinants of bond prices is the general level of interest rates and the level of interest rates is driven by macroeconomics . The overall macroeconomic health of the nation has a tremendous influence on the fixed income markets. For example, an economic decline will have an impact on the financial fortune of the issuers of most bonds, be they corporations or state and local governments, thereby affecting the price of the bonds. Issues of lower credit quality are typically more affected, as they are less able to withstand an environment of lower revenues and earnings. In fairly significant downturns, investors usually sell out of equities and lower quality bonds and purchase much safer treasury instruments; most often short maturity treasury bills (T-Bills). This phenomenon is known as a “flight to quality’ and can lead to an increase in the price of certain treasury issues for a period of time.

Experienced bond investors and traders keep a close eye on economic indicators and indexes, such as gross domestic product (GDP) . which is the sum of all of a country’s goods and services produced in a year; and the consumer price index (CPI) which measures the overall rate of change in the prices of consumer goods and services.

A faltering economy is not the only concern for bond investors- an economy that is growing too rapidly will lead to excessive demand for goods and services, which will eventually lead to rapidly increasing prices, or price inflation (the law of supply and demand). A declining economy, as evidenced by a declining GDP, and an “overheated” economy, as evidenced by a rapidly increasing GDP, which will eventually lead to significant increases in the CPI, will both have a significant impact on bond prices. In an effort to promote a healthy economy, the U.S. government seeks to maintain moderate growth in GDP. Each administration sets GDP growth targets that may vary according to current and expected economic conditions (e.g. the Obama administration is targeting 6.5% growth for 2010), so it is important to monitor what GDP is doing relative to government targets. If changes in GDP stray too far from the target, the government will take action to bring it back into line, and these actions will have a significant impact on the financial markets.

The government has two policy tools that it uses to influence the economy- fiscal policy and monetary policy. We will explore each of these tools in detail.

Fiscal Policy

The government uses fiscal policy to influence aggregate demand . Aggregate demand is the total consumption, government spending, and investment that occurs within an economy. The government uses their spending and/or tax rates to influence aggregate demand- increasing it during an economic slowdown, and increasing it when there is excess growth.

During a recession, the government can increase spending in government projects in order to increase demand. Alternatively, they could cut taxes to households, who will hopefully spend part of the tax savings on goods and services; and/or cut taxes to businesses who will hopefully increase investment. An important concept in fiscal policy is the multiplier effect. When the public or private sector spends money, that generates income to whoever is receiving the money spent. A portion of this income is then spent by the receiving party and the process is repeated to create a ripple effect throughout the economy.

During an economic boom, the government can increase tax rates and/or reduce its spending and create a reverse multiplier effect to decrease aggregate demand. Often, the government will combine changes in spending with changes in tax rates.

Expansionary fiscal policy can be problematic when the government is experiencing budget deficits, as an increase in government spending and/or tax cuts will exacerbate the deficits. Also, many economists believe that fiscal policy takes too long to affect the economy and, by the time the policy has an effect, it is no longer needed. According to the critics, this results in exaggerated swings in economic cycles.

Different administrations have different philosophies when it comes to the use of fiscal policy to control economic activity. One administration may be hesitant to utilize fiscal measures, and would prefer to leave it to the Federal Reserve to control the economy. Administrations that choose to use fiscal policy may favor tax cuts over spending increases or vice-versa. Knowing the current administration’s fiscal policy philosophy can help investors and traders anticipate the likely impact of changes in economic data.

Monetary Policy and the Fed

Monetary policy is the use of the supply of money and short-term interest rates to influence economic growth and inflation. Monetary policy is implemented by the Federal Reserve Bank (the Fed).

Established in 1913, the Federal Reserve System consists of 12 regional Federal Reserve banks, each with an independent president, and 25 branches throughout the country. The System is supervised by the Federal Reserve Board of Governors in Washington, D.C.

The Board of Governors is comprised of seven members who are appointed by the President and confirmed by the Senate for 14-year terms. The terms are staggered to ensure that the entire board is not replaced at once, which would disrupt monetary policy and allow a single president to exert undue influence on the Board. The goal is to keep the Board as apolitical as possible. The Board of Governors is responsible for setting the discount rate and reserve requirements (more on these later).

The primary decision-making body of the Fed is the Federal Open Market Committee (FOMC) . The FOMC is made up of the Board of Governors and five of the regional presidents. The president of the New York Fed is permanent, and the other presidents rotate membership in one year terms. The FOMC meets eight times a year to review economic conditions and determine the proper course of monetary policy needed to pursue its stated goals of “price stability and sustainable economic growth.” The FOMC pursues monetary policy through open market operations .

The Discount Rate

The discount rate is the interest rate that depository institutions pay on loans they receive from the Fed. These loans are obtained through regional “discount windows” through four different programs:

- Primary Credit: short-term loans (up to 90 days) to financially sound institutions

- Secondary Credit: loans to institutions that are not financially sound enough to qualify for primary credit

- Seasonal Credit: loans to smaller institutions to help them manage significant seasonal swings in their loans and deposits.

- Term Auction Facility (TAF): Institutions that qualify for primary credit can bid for term loans of 28 or 84 days. These loans must be fully collateralized.

Discount window loans are designed to relieve liquidity strains and are not a normal practice of banks. Therefore, changes to the discount rate are seen as a symbolic indication of which direction the Fed wants interest rates to go.

Reserve Requirements

The Reserve requirement dictates the percentage of banks’ liabilities must be kept in reserve in vault cash or deposits with Federal Reserve Banks. Reserve requirements have a direct impact on the ability of banks to create credit. If the Fed wishes to stimulate economic activity, they can lower the reserve requirement and free-up more bank funds that can be lent and circulate through the economic system. Raising the reserve requirement would have the opposite effect. A change in the reserve requirement is a particularly powerful tool due to the multiplier effect . This is a monetary tool that the Fed rarely uses.

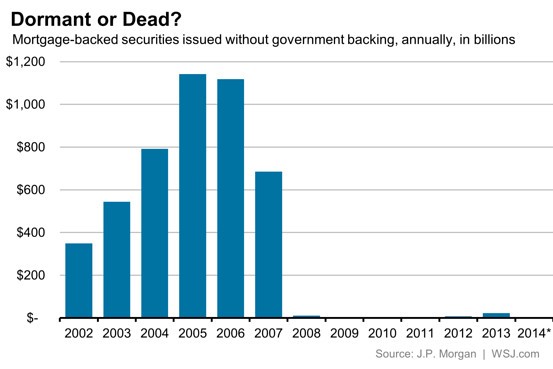

Open Market Operations

As the most widely used monetary policy tool, open market operations entail the purchases and sales of U.S. Treasury and federal agency securities to implement monetary policy based on short-term objectives set by the FOMC. This objective can be either a desired quantity of reserves, or a target federal funds rate (the rate at which depository institutions lend to each other on an overnight basis at the Fed). Changes in reserve levels change the money supply, while changes to the fed funds rate influences economic activity by changing the cost of funds both shorter and longer-term. Here is a simplified description of how it works:

- The Fed wishes to slow economic activity:

- The Fed sells treasury securities to dealers who pays the Fed out of funds from the dealers’ banks;

- This reduces the amount of reserves held by the banks, which exerts upward pressure on the fed funds rate; and

- This increase in borrowing costs slows both consumer and business spending.

- The Fed wishes to stimulate economic activity:

- The Fed purchases treasury securities from dealers the proceeds are deposited in the dealers’ banks;

- This increases the amount of reserves held by the banks, which exerts downward pressure on the fed funds rate; and

- This decrease in borrowing costs stimulates both consumer and business spending.

The Budget Deficit

Two of the most powerful economic forces that influence interest rates and bond prices are the twin evils of budget deficits and inflation. An understanding of this relationship is required for anyone interested in being able to forecast changes in interest rates and bond prices.

A government budget deficit is the result of spending more than the tax revenues received by that government. The national debt is the cumulative total of annual budget deficits accrued over time, and it is the amount of money borrowed by the government. For example, if The U.S. government experienced a $5 trillion deficit every year for five years, the national debt would be $25 trillion and that is the amount of treasury debt that would have to be issued to finance the deficit.

While running chronic deficits would eventually bankrupt an individual or institution, our government can simply print more money and issue more bonds to finance its spending. However, such spending can lead to higher inflation and damage the domestic economy in other ways that includes:

The Crowding-Out Effect

Chronic deficit spending forces the government to raise funds in the capital markets. Since there is a finite amount of investment dollars available to borrowers, the government reduces the amount of investment funds available to private institutions to fund their operations. This can force borrowers to have to pay higher rates of interest to raise capital for their projects. Because the economic viability of these projects are largely determined by the cost of the capital needed to fund them, some projects may not see the light of day because the government has crowded it out of the capital markets.

Dependence on Foreign Investors

The U.S. government has become dependent on foreign central banks, institutions, and individuals to purchase treasury securities issued to finance our deficit spending in recent years. If these foreign investors decide to sell these securities, it would have a negative impact on the value of the U.S. dollar and bond prices.

Monetary Tightening

Government deficits increase aggregate demand which will drive GDP higher. If the Federal Reserve believes the stimulation of the economy is leading to higher inflation, they may decide to tighten monetary policy to combat the inflation. This will lead to higher interest rates.

Inflation

The most widely followed inflation index is the consumer price index (CPI) . The CPI is the average change over time of the prices paid by urban consumers for a basket of goods and services. The goods and services are weighted by their relative economic importance to the average household.

CPI is normally quoted as a percentage change over s specified period of time such as a year or a quarter of a year. Economists and investors also follow the producer price index (PPI), which represents changes in prices at the wholesale level. A decrease in these indexes is referred to as deflation, while increases are known as inflation. Economists classify inflation based on the underlying cause of the inflation:

Demand-Pull Inflation

Demand-pull inflation occurs when the aggregate demand of individuals, the government, and investors exceeds the ability of producers of goods and services to supply in the short-term (too many dollars chasing too few goods and services). As suppliers gear up production to meet the demand, the hiring of additional labor and increased investment drives up wages and the cost of factors of production, which exacerbates the problem.

Cost-Push Inflation

There are times when rising consumer prices occur without an increase in aggregate demand. This occurs when there is an increase in cost to one or more factors of production such as wages or raw goods, but is most often caused by an increase in wages. An increase in wages is often the result of the collective bargaining of labor unions. An increase in costs of raw materials is usually the result of an increase in demand in one sector of the economy that results in an increase in material that is used by other sectors. For example, an increase in demand of airplanes may drive up the cost of steel, which will impact all industries that utilize a significant amount of steel in their production.

Severity of inflation

The severity of inflation is often measured by how rapidly prices rise. On this basis, economists often classify inflation into three categories: Moderate inflation; running and galloping inflation; and hyperinflation.

Moderate Inflation

Moderate inflation is considered a mild and tolerable form of inflation, and occurs when prices are rising slowly in a steady, predictable manner. When the rate of inflation is less than 10 per cent annually (a single digit inflation rate), it is considered to be a moderate inflation. Moderate inflation is typical today in most industrialized countries.

Moderate inflation is not seen as serious by many because of the fact that the predictable nature of it allows consumers and institutions to plan for it. Economists have arbitrarily specified a 3-4 per cent price rise per annum as a tolerable rate of inflation in modern economies. However, some economists feel that even moderate inflation should make us more cautious, as it represents a warning signal for the occurrence of running and eventually a galloping inflation if it is not checked in time.

Running and Galloping Inflation

When the movement of price accelerates rapidly, running inflation emerges. When prices rise by more than 10 percent a year, running inflation occurs. Economists have not described the range of running inflation. But, we may say that a double digit inflation of 10-20 per cent per annum is a running inflation. If it exceeds that figure, it may be called ‘galloping’ inflation. Galloping inflation is really a serious problem as it causes people to hold physical assets, such as real estate or gold, over cash. It causes economic distortions and disturbances because lenders are being repaid in dollars that are worth considerably less than the dollars lent.

Hyperinflation

In the case of hyperinflation, prices rise in a constant and literally unlimited manner. When prices rise over 1000 per cent in a year, it is called a hyperinflation. Austria, Hungary, Germany, Poland and Russia witnessed hyperinflation in the wake of World War I. Hyperinflation notably took place in Germany in 1920-1923, eventually leading to the German price index rising 854,000,000,000% from July to November 1923. Hyperinflation can lead to the fall of a government, and many historians believe that the German hyperinflation led to the rise to power of Adolph Hitler.

Sever inflation tends to randomly redistribute wealth as borrowers profit at the expense of lenders by paying back loans with dollars that are worth significantly less than they were at the outset of the loan.

Deflation

Deflation is a drop in general prices, which would be evidenced by a negative CPI. Many economists fear deflation because of the prospect of a deflationary spiral . which occurs when lower prices leads to a decline in production, which leads to lower wages. Lower wages leads to lower demand which exacerbates the falling prices. While deflation is a fairly rare phenomenon, the prospect of deflation can have an influence on Fed monetary policy.

The Balance of Trade

The U.S. balance of trade, the difference between national investment and national savings, is an indication of our financial strength relative to the rest of the world. Currently, our national investment exceeds savings, so we have a current account deficit. The balance of trade is comprised of:

The balance of trade account represents the difference between the nominal value of our imports and exports of goods and services. Since our imports exceed our exports, the U.S. is currently experiencing a trade deficit.

The Income Account

The income account represents the amount of income received from foreign countries versus the payments made to them. This account primarily reflects interest on U.S. debt held by foreigners versus interest on foreign debt held by the U.S.

Transfers

The transfer account represents the differences in transfer payments between the U.S. and the rest of the world. The largest transfer of payments is in the form of U.S. aid payments to other countries.

Balance of trade deficits can influence all financial markets, but the largest impact is on the U.S. dollar in the foreign exchange markets.

The Business Cycle

A concept that is critical to an understanding of financial markets is the business cycle (also known as the economic cycle). The business cycle refers to fluctuations in economic activity, most often as measured by changes in gross domestic product (GDP). These recurring fluctuations are somewhat random and do not follow a predictable pattern. There are five stages in a business cycle:

- Expansion

- Peak

- Contraction

- Trough

- Recovery

Typically, the expansion stage of the cycle is characterized by rising employment wages and profits that fuels the expansion of supply and demand for goods and services and consumer confidence that encourages spending. Expansion is most often accompanied by the accommodative monetary policies of low interest rates and expanding money supply.

Eventually, the expansion leads to inflation as there are ‘too many dollars chasing too few goods.’ The Fed adopts more restrictive monetary policy and raises interest rates. As the supply of money contracts and high interest rates discourage consumer and business spending, unemployment increases and economic activity peaks and eventually begins to decline.

The Fed begins to loosen monetary policy until economic activity reaches a trough and begins to recover. A graph of the business cycle looks something like this:

The concept of choice is essential to economics- it is how economic agents (i.e. consumers and producers of goods and services) make choices in the face of constraints that drive economic theory. Economists assume that economic parties always act in self-interest, seeking to maximize their own well being. This means that consumers will seek to maximize their purchases within the constraints of their income, and producers will seek to maximize their output within the constraints of their cost of production.