Active Share and Tracking Error

Post on: 16 Март, 2015 No Comment

BPV’s Research department recently brought you a high-level view on a relatively recent investment metric: active share. During that piece, we also discussed the measurement of tracking error. To review, active share is the percentage of the fund’s portfolio that differs from its benchmark. Tracking error is a measure of how closely the return of a portfolio follows the return of an index to which it is benchmarked. While they ultimately measure different things, these two measures can work together to provide a clearer picture of active management across different fund styles and sizes.

How do they complement each other?

As we mentioned previously, active share looks at portfolio composition, and is therefore a reasonable measure for stock selection. On the other hand, tracking error focuses more on returns, and is a better measure for systemic risk factors. Yet, these two measures together touch upon two very important ways that active managers attempt to outperform their benchmark or index: difference in stock selection, and factor bets. After all, in order to beat an index or benchmark, a manager has to be different from it. 1

The table below was introduced in 2009 by Cremers and Petajisto and illustrates the two dimensions of active management and their corresponding management styles. Their research suggests that diversified stock pickers tend to have a high Active Share and a low tracking error, whereas funds that focus on factor bets will tend to display the opposite qualities. Concentrated funds combine stock selection with factor bets, thus scoring high on both measures. Closet indexers score low on both measures. 2

Source: Cremers and Petajisto

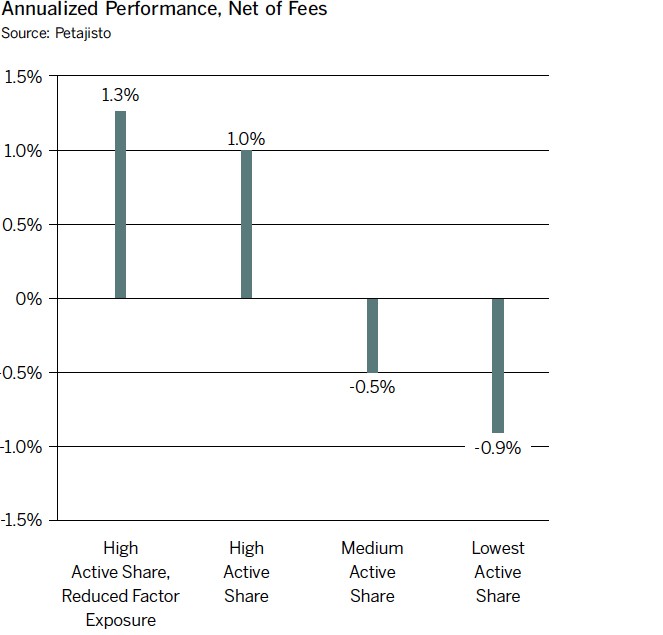

So which of these active manager types is the best, then? In a 2013 study, Petajisto examined the relationship of active share and tracking error using data from 1990-2009. The study found that even though the average actively managed fund underperformed its benchmark by 0.41% per year, the Diversified Stock Pickers outperformed their benchmarks by 1.26% annually after fees and expenses. 3

The Pros and Cons of High Active Share

Higher active share is obviously no guarantee of future outperformance, but it can still be an extremely helpful metric for evaluating managers and may have some potential benefits, according to a February 2014 study conducted by Fidelity. Their research found that over the past 15 years, higher active share has on average been accompanied by higher excess return and high tracking error. However, with higher active share does also come increased exposure to downside risk, a phenomena that is consistent with the typical risk-return tradeoff. 4

Source: Fidelity

One Big Caveat: Style Drift

One other important consideration when looking at active management is the ability of the active manager to provide excess return without style drift or mandate creep. In other words, the manager’s active share could be coming from differences from the benchmark that are not consistent with the Fund’s mandate. It is vital for an investor or advisor to understand the stated investment philosophy, process, and strategy of the fund in order to monitor where alpha is being generated. This is particularly important as active share becomes a more prevalent metric, and managers have a higher incentive to produce higher active share values.

Conclusion

The opinions expressed are as of the date written and may change as subsequent conditions vary. This paper is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader.

www.forbes.com/sites/oppenheimerfunds/2013/11/20/rethinking-active-share-and-tracking-error