Why Volatility Index VIX Is Important for Asset Allocation (ETF SPY) SPDR S&P 500 Trust ETF

Post on: 9 Июнь, 2016 No Comment

Portfolio management is all about getting the highest return for the risk that you bear. Modern financial planning methods such as Monte Carlo simulation allow users to account for the total risk in the portfolio. One of the fundamental drivers for estimating total portfolio risk is the projected future volatility in the market as a whole.

There are good simple ways to measure market volatility and to account for the fact that market volatility varies in time, reflecting investor sentiment and buying and selling tendencies. It is not necessary to predict future volatility levels, but simply to account for the range of volatility that the market can generate. It is also important to look at volatility levels so as to understand whether recent periods of time are periods of higher or lower than normal volatility.

Investment risk is usually described in terms of the standard deviation in returns. The standard deviation is a basic statistical measure of uncertainty—even EXCEL calculates it. The simplest way to think about standard deviations in return is as the size of ‘normal’ fluctuations in return. If the S&P500 is projected to have an average return of 8% per year with a standard deviation of 15% per year, it is reasonable to conceptualize a normal year as having returns somewhere between 23% (8%+15%) and -7% (8%-15%). Statistically, these normal years constitute about 2/3 of all years and the remaining 1/3 of years will have returns above or below one standard deviation from the average. As a fairly good primer on standard deviation as a measure of risk, see this article in Moneychimp.

Let’s say that you are new to ideas of measuring risk. Where do you start? The easiest way to look at the volatility in the broader market is to look at volatility indices. There is a stock market index called VIX for Volatility IndeX which reflects market expectations for near-term volatility in the S&P500. You can see current levels of VIX on Yahoo! Finance, for example, by searching for ^VIX.

VIX is calculated using a mathematical formulation and a series of options quotes for the S&P500. You don’t need to understand options to appreciate what VIX shows, however. The prices at which options trade are driven primarily by the price of the underlying (the S&P500) and an assumption about future volatility on that underlying. VIX takes the prices of options and the price of the underlying and then backs out the level of volatility that need to be assumed so that the options prices make sense—and this is called implied volatility.

When people buy or sell options, they are implicitly betting on the future volatility of the thing that they are buying options on. The VIX value is a form of the implied volatility in the current options for the S&P500. This is a complicated idea and can be a bit confusing. For more information on calculating implied volatility as it relates to financial planning, you may want to look at one of our articles on this topic.

Fortunately, you don’t need to deal with options models to get value from VIX and there is a nice simple way to interpret what VIX means. VIX tracks very well with the SD in monthly returns on the S&P500 over the most recent twelve months (See figure below). This graph shows historical VIX as compared to the trailing 12-month standard deviation [SD] in month returns on SPY and on the S&P500.

We could reproduce VIX using historical SD of returns even more closely if we used a more complicated function that weights recent months more heavily, but the simple trailing 12-month value suffices to motivate the explanation.

VIX Compared to 12-month SD of Monthly Returns

In short, you can look at VIX as a proxy for standard deviation in monthly return. In fact, you can approximate VIX fairly well if you multiply the standard deviation in monthly return over the past twelve months by a factor of 525. If you want to know how volatile the market has been recently, and whether we are in a period of high or low market volatility, you can just look at VIX rather than calculating the SD of monthly returns. This is an important concept because the market tends to go through periods of high and low volatility and these have a major impact on total portfolio risk—especially portfolio components with high Betas.

We can think about VIX as a measure of how volatile the market as a whole is and this can also be important for thinking about portfolio allocation. Consider, for example, the period from January 2004 through the present in the chart above. Over this period, VIX has averaged around 13.8, and has been in decline over this entire period. Since the start of 1993 when VIX was first calculated, VIX has averaged about 19.5. The past several years have seen volatility in the S&P500 that is only about 71% of the historical average. In other words, the volatility of the S&P500 has been quite low over the past several years and appears to be getting lower.

As is evident from the chart, however, the volatility of the market appears to cycle and we are in a low period but it would be reasonable to use longer-term average values of market volatility as the basis for planning. The long-term market average for the Standard Deviation in annual return is about 15%, which translates to a standard deviation in monthly return of 4.3%. Over the last two years, the SD of monthly return has averaged less than 2.5% (see the chart above). It is reasonable, however, to assume that the volatility of the market as a whole will move up and the market for long-dated options supports this view (see the RiskOutlook2006 paper cited above).

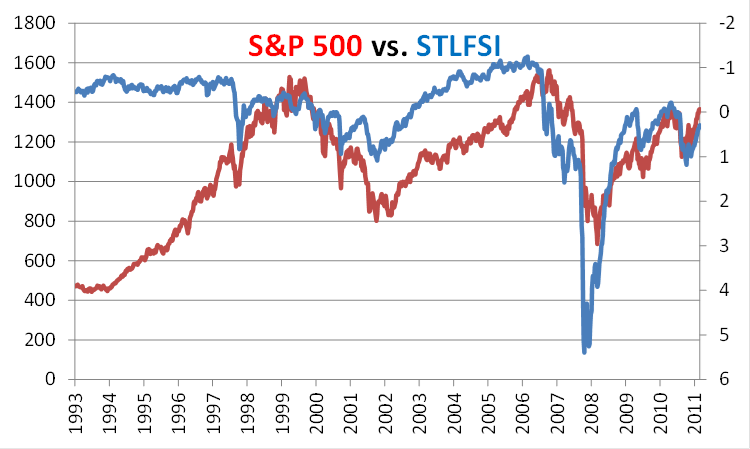

Some portion of the volatility in your portfolio is due to movements in the broader market—and this is determined by portfolio Beta. High values of VIX compared to historical averages suggest that the market is getting frothy—more speculative. Low values of VIX mean that recent levels of volatility should be corrected upwards for long-term planning. You can get a sense of this if you track the closing price of the S&P500 or SPY vs. VIX (see below). Note that volatility, as reflected in VIX, is driven by both price gains and price declines. When the market as a whole peaked at the start of 2000, VIX had been sustained between 20 and 25 for about three years. The average VIX over this period was 24.6. This anomalously high VIX (volatility) during a bull rally suggests a high level of speculative interest. As we see, this volatility continued and the underlying speculative action drove the decline.

We are now in a period of sustained gains in SPY and declining volatility. Low volatility means that this rally is currently held up less by speculative forces, which is good for investors and encourages more aggressive near-term investing but also must serve as a warning that we are not seeing nearly the level of risk that we may see in the long-term for assets with high Betas and investors should be aware of this. A portfolio with a high Beta will tend to get riskier as VIX increases, and the fact that we are near long-term lows for VIX means that total portfolio risk must be carefully monitored.

Historical VIX vs. SPY

Interestingly, very low market volatility (measured by VIX or simply a measure such as trailing SD in returns) often signals the start of a market rally. This is quite notable if you look back at the 1980’s. You can see the increase in market volatility as the bull rally gains momentum, and you can also see market volatility hit highs that had not been seen since the mid 1970’s. Using our simple calculation for a proxy VIX equal to 525 times the trailing 12-month SD of return, the proxy value for VIX in January of 1987 was around 32 (see below). Market volatility (measured by our simple proxy for VIX) dropped dramatically down to between 15 and 20 after the enormous market decline in the Fall of 1987.

Proxy for VIX vs. S&P500 for 1980’s Market Rally

To account for market volatility in portfolio planning, there are several factors that must be considered. First, market volatility tends to persist for some periods of time and market volatility cycles as markets become more or less speculative. In a period of high market volatility, it is critical to understand that this environment often heralds the potential for fast gain and fast decline. Investors in this sort of environment need to listen to the warning that the market is sending. That said, if the market declines during a high volatility period, investors often take flight to ‘safe’ assets, thereby missing the gains at the start of the next recovery. In a period of low volatility (such as we are in now), it may be attractive to be more aggressive in the short to medium term, but you need to remember that the long-term risk in today’s portfolio may be considerably larger than what you experience over the next several years.

If you want to account for total portfolio risk, you need to be able to calculate portfolio Beta, which tells you how sensitive your portfolio is to the broader market. You also need to be able to account for correlations between portfolio components that is not captured by Beta—the so-called non-systematic correlation. You may have a portfolio with fairly low Beta that has a very high level of non-systematic correlation and high non-market volatility. This portfolio could be very volatile and risky, despite the fact that you have fairly low exposure to the broader market index. The only way that I know of capturing all of the components of portfolio risk is via Monte Carlo modeling of the portfolio. That said, if you are not going to use a Monte Carlo portfolio planning tool, keeping an eye on VIX and portfolio Beta is a good qualitative way to track and account for market volatility in your portfolio. For more background information on VIX, visit the CBOE.

As a final note, periods when market volatility is low but increasing tend to be very favorable for medium- and long-term investors in the broader market. We are in just such a market state today. As volatility increases, high Beta assets become considerably more volatile but also tend to provide their greatest gains. Investor must be aware that an asset allocation that is well behaved in low volatility environments may become too volatile in a market with increasing VIX. The data suggest that we are in this type of transition market. The fact that we are coming off of a low VIX / volatility environment and seeing volatility levels increase is an important factor in portfolio planning with Monte Carlo tools—and you will find a discussion of this issue in many of our other articles analyzing various asset allocations.

For more information on accounting for risk in portfolio planning, please visit Quantext.

Conduct in-depth research on SPY and 1,600+ other ETFs with SA’s ETF Hub