When leveraged funds are bad they re very very bad

Post on: 7 Июль, 2015 No Comment

Give me a lever and a place to stand, Archimedes said, and I will move the Earth.

On Wall Street, using leverage means using borrowed money or more exotic tools to amplify returns. No one knows who invented leverage. But it’s not hard to imagine him saying, Give me enough leverage and a place to sit, and I will blow up your portfolio.

Today, thanks to the wonders of financial engineering, many mutual funds use leverage to amplify their returns. But don’t give in to temptation. You’re better off avoiding such funds.

Leverage can be a tool for good or evil, depending on which side of the trade you’re on. Homeowners, for instance, discovered both the joy and the sorrow of leverage in the past few years.

Suppose you put down $25,000 for a home that cost $250,000. You borrowed $225,000 from your friendly bank. If you turned around and sold the home for $300,000, you’d be able to repay the bank its $225,000. You’d keep your $25,000 down payment and pocket $50,000 in profit. This is the happy side of leverage: You’ve made a 200% profit on your down payment, and you’ve earned the right to be insufferable at the family barbecue. (To keep it simple, we’re assuming you sold before you made any payments.)

But let’s say you sold that home for only $200,000, thanks to the sinking housing market. You still owe your now not-quite-so-friendly bank the $225,000. So you’d lose your $25,000 down payment and have to come up with another $25,000 to pay off your mortgage. This is the unhappy side of leverage: You’ve lost your deposit, plus a sum equal to it.

Similarly, borrowing to invest in securities raises your potential risks as well as your potential rewards. This is a lesson that investors in a hedge fund run by investment bank Bear Stearns learned the hard way. The fund had borrowed up to $30 for every $1 of securities it owned. Many of those securities were, in turn, backed by mortgages. The hedge fund collapsed in July, burying investors with heavy losses.

Mutual funds that use leverage do so in a much more contained way. Still, the risk may be more than you can bear. Let’s start with bear-market funds, if only because you’ll see them prominently displayed in any list of this year’s top performers. The top-performing fund for the first quarter, for example, was the Direxion Nasdaq 100 Bear 2.5 Fund, (DXQSX) which has soared 26.7% this year.

That fund aims to deliver a return that’s 250% opposite the performance of the Nasdaq 100 stock index each day. If, for instance, the Nasdaq 100 were to fall 2% in a day, the fund would rise 5%. (The fund’s expenses would reduce its overall return, but you get the idea.) Because the Nasdaq 100 fell sharply in the first quarter, the Direxion Nasdaq 100 Bear 2.5 fund soared.

The fund achieves these financial gymnastics by using sophisticated new strategies. The traditional way to make money from a falling stock is by selling it short a somewhat complicated maneuver. Say you think the fictitious company Squidbymail.com is awash in red ink. You borrow shares of its stock from your broker and sell them for $50 a share. If the stock falls to $40 a share, you can buy the stock back and pocket the $10 per share difference.

Shorting the Nasdaq 100 stock-by-stock would be tedious and expensive. Instead, most bear funds use futures or options. (Futures and options are investments whose value depends on the movement of an index, stock or commodity.) Thanks to computer models, the funds can control their exposure to the index fairly precisely. Hence, the proliferation of funds that aim to move in one, two and 2 times the opposite direction of the index.

The danger of a bear fund and particularly a leveraged bear fund is that the stock market tends to rise more than it falls over time. The average bull market since 1900 has lasted about 1,300 days, according to the Stock Trader’s Almanac. The average bear market, by contrast, has lasted 406 days. You’re more likely to make money betting on the market to rise than hoping for it to fall.

Not surprisingly, long-term bear bets tend to be losers. Consider Rydex Dynamic Inverse OTC 2x fund, which aims to rise 2% when the Nasdaq 100 falls 1%, and vice versa. It, too, fared well last quarter. But it’s lost 71.3% over the past five years, which qualifies as a catastrophic loss. Just to get back to break-even after losing 71.3%, you’d have to gain 245%. Good luck.

Clearly, a long-term investment in a bear market fund doesn’t make sense. To use one successfully, you have to dabble in market timing, and that takes more time and luck than most investors can muster.

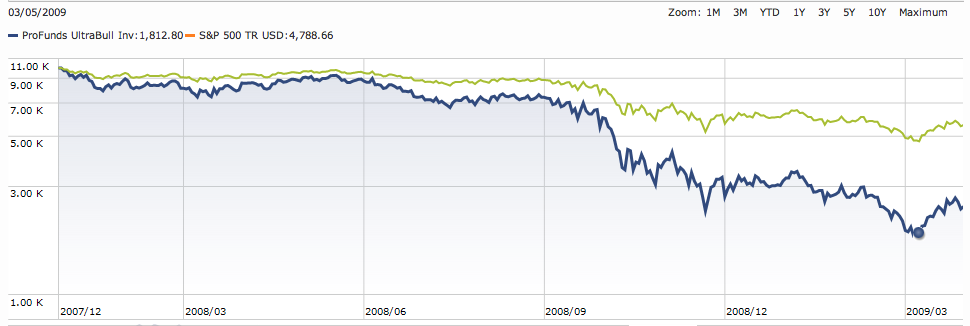

What about long-term bullish bets with leveraged funds? The returns don’t seem worth the risk. Let’s use the Profunds UltraBull fund as our example. It uses leverage to double the returns from the S&P 500.

The fund is up 8.8% over the past five years, vs. 18.6% for the S&P 500. What gives? The fund charges 1.45% a year in expenses, which reduces its returns. (The S&P 500, being an index, has no expenses.) More important, leverage magnifies the fund’s daily losses, too and that reduces its long-term returns.

Are there times when you could use a bear fund? Maybe. If you have all your retirement money in an S&P 500 index fund and don’t want to sell, you might consider hedging with an inverse fund. But for most people, using a leveraged bull or bear fund would be unwise.

Leave the leverage to the pros, who seem able to blow up their own portfolios quite well.

John Waggoner’s column appears Fridays. E-mail: jwaggoner@usatoday.com.