VIX Options How to Video

Post on: 16 Май, 2016 No Comment

VIX Options

Hello, my name is Brian Overby. I am the Senior Options Analyst at TradeKing, and author of The Options Playbook. Inside our Trader Network at TradeKing I’ve received a lot of questions lately about VIX options, basically options on the VIX index. In order to talk a little bit about those today I first of all need to describe what is the VIX index.

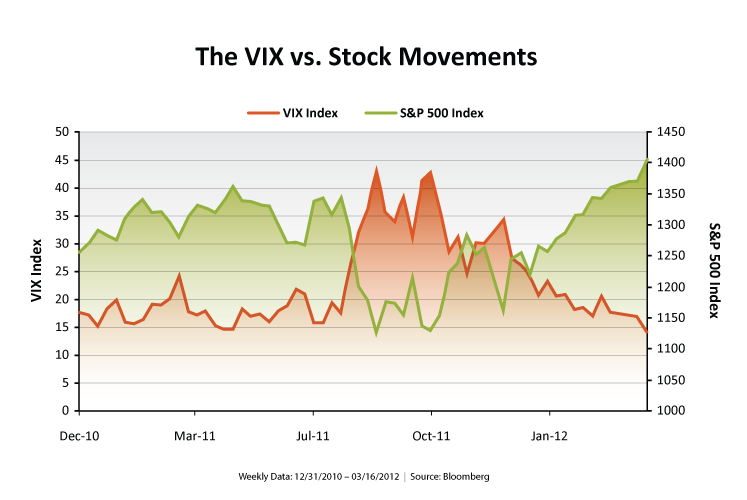

The VIX index you see quoted on a lot of the national news sources and TV channels that actually follow the marketplace is a fictitious index that’s based on a 30-day option in the S&P 500 index. So, I’m not going to get into the intricacies of the math that’s involved, but the concept is that they’re going to make a fictitious 30-day option that will never become a 29- or 28-day option. So using other options that are trading in the S&P 500 index with different expirations, they fixate this index and always have what’s called a 30-day implied volatility in the S&P 500 index options. That trades under the ticker symbol VIX.

All right, now you can’t buy the VIX index outright. The VIX index is just a gauge that moves as the market direction in the underlying S&P 500 index moves. But with that said, you can trade option on this particular index. It’s important to note that VIX options are extremely volatile, and I’m going to try to address some of the hazards that are involved with the VIX index.

So, if I go on out and I look at VIX options in general that are tracking this index it’s important to note that this index is extremely volatile, and the way that I like to address it is that it’s a lot like trading options on the weather. You never know what the weather is going to do next, and that type of volatility is what’s in these option contracts. Also, on top of it, you can’t go out and physically buy the weather, right? So the weather in general, as that marketplace is moving all over the place, you can’t hedge those options by physically buying a weather contract, nor can you go out and just buy the VIX index.

So here’s the most important thing to note if you want to try to trade VIX index options. The VIX actual index isn’t the underlying that drives the option prices. Let me say that again, because it’s very important. The actual VIX index isn’t the underlying that drives the option prices, and I’ll show you.

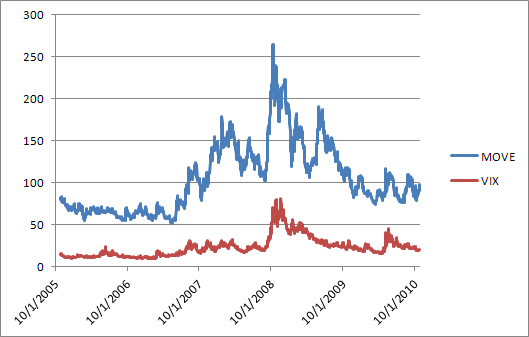

For example, there are many futures that trade on the VIX index. There’s a future for every different expiration of the VIX index options. And if you look at a graph and you compare the VIX to some of the futures contracts, you’ll see big spikes up and big spikes down in the actual spot VIX index, and a lot of times the futures contracts just make little blips alongside of it.

The price of the option contract is going to be following that futures contract. Why? Because I can’t buy the VIX index, so the market makers that trade them have to hedge using the futures contract. And just like trading options on the weather, options on the VIX, if you look at it, there’s no rhyme or reason why the VIX is where the VIX is.

So if I’m looking at these option contracts, a lot of times where that future is trading is just market supply and demand and there’s no actual way to really justify that level. On top of it, if you think about the weather, just because today we just happened in Charlotte, North Carolina to have a spike in the temperature to 120 degrees today doesn’t mean that the actual temperature next week is going to be 120 degrees. Over long time periods, if we can see that huge spike up in the actual temperature over time that might mean a trend is happening and we’re going to have something like global warming. But in general, it doesn’t necessarily affect our longer term forecast just because we had an anomaly of one day. So how can I use it? Well, think about the VIX. If the VIX makes a big spike up in one day, does that really affect the longer term options and the longer term outlook for volatility? Not necessarily.

If you’re going to trade VIX options, one of the things that you must understand is that the VIX option contracts will follow the underlying futures contract that has the same expiration date as the option contracts. And the next thing you must know is that there aren’t standard expirations on the VIX. The expiration date is usually the Wednesday before or the Wednesday after the third Friday of the month for most expiration dates. So make sure you understand first of all where the futures contract is trading for the expiration that you’re trading, and also understand when that expiration is for your option contract.

If you’re going to trade VIX options, they are very scary, very, very volatile option contracts, and you must beware of all of these little nuances that are involved.

My name is Brian Overby. I am the Senior Options Analyst at TradeKing, and author of The Options Playbook. If you’d like to learn more about investing, please check out our education center on tradeking.com, the companion website for my book, optionsplaybook.com, and our Trader Network, where investors connect to share ideas and strategies for trading stocks, options and more.

You must Log In to post to this blog.

Not a member? Register Now to

- See what other traders are doing

- Make your own trades public

- Share your thoughts on a trade

- Join or start a group

- Connect with like-minded traders