Understanding and Trading the VIX Your Ultimate Resource

Post on: 3 Май, 2016 No Comment

As an option trader, you need to be following the VIX every day. If youre not, you need to start now. Gaining an understanding of the VIX will make a significant difference to your trading. Luckily for you, Ive put together the ultimate resource for understanding and trading the VIX and its related derivative products. In this post, Ill explain in detail what the VIX is, what instruments are available to trade volatility and some pros and cons of using VIX derivatives to hedge your portfolio from fat tail or black swan events.

What is the VIX?

The VIX is a market volatility index created by the Chicago Board Options Exchange (CBOE) that reflects the markets expectations for volatility over the next 30 days. It is calculated by looking at the implied volatilities of numerous SPX puts and calls. In order to calculate the 30 day volatility, the CBOE has to use options from 2 expiry months and blend them.

You have probably heard the VIX referred to as the Fear Index due its characteristic of gauging future price volatility (high volatility often signals financial crisis). If youre a bit of a nerd like me, you can check out the CBOEs white paper for full details of how the VIX is calculated.

Why Should You Care?

As the saying goes, When the VIX is low its time to go, when the VIX is high its time to buy . This saying reflects the fact that some of the best times to buy shares is during financial panics (when the VIX is high). In other words, buy when people are fearful (VIX is high) and sell when they are greedy or complacent (VIX is low).

History of the VIX

The CBOE introduced the VIX in 1993 based on a formula suggested by Professor Robert Whaley in The Journal of Derivatives. This VIX index was slightly different to the one we know and love today. The calculation of the index was different in that it focused only on at-the-money options rather than the wide range of options used in todays calculation. Also, the original VIX was based on the S&P 100 rather than the S&P 500. The current VIX index was introduced on September 22, 2003, at which time the old VIX was assigned the ticker symbol VXO, which is still tracked today. You cannot trade the VIX index, but there are a number of products such as futures, options and exchange traded notes that are based on the VIX which can be traded.

VIX futures were the first derivatives introduced on March 26, 2004. VIX options followed a few years later on February 24, 2006. Two exchange traded notes (VXX iPath S&P 500 VIX Short Term Futures ETN and VXZ iPath S&P 500 VIX Mid-Term Futures ETN ) were added into the mix on January 30, 2009. So while we cannot actually trade the VIX index, there are plenty of choices available to traders which I will discuss below.

While the VIX was only introduced in 1993, the CBOE have used the calculation to reverse engineer the VXO index back to 1986 in order to see what level the volatility index was during the 1987 Black Monday crash . The figure they came up with was 172! Can you imagine the VIX at 172? The scariest thing is that this theoretical index was trading at 28 only 2 days before the crash.

The VIX is a Statistic That Reverts to the Mean

The first thing investors need to understand about the VIX is that it does not behave like a stock. This is because it is a statistic, whereas stocks are based on a business with revenues and expenses. I think Jared Woodard explained it best in his recent article on Condor Options:

VIX is just a statistic. It’s an estimate of the annualized implied volatility of SPX derived from options at a weighted 30-day horizon. It’s not a share entitling you to the cash flows generated by a business in the physical economy. Support and resistance and trend lines and momentum effects all depend on the existence of buyers and sellers in the asset being analyzed. But you can’t trade VIX directly, so the VIX can never find “support” because no one previously bought VIX “shares” at that price level. And for those of you who are thinking ahead, the same goes for ETPs: no one has ever bought VXX shares at 16 as a “deep value” play .

The VIX is a mean reverting, range bound index. This means that it cannot go to zero (the lowest level recorded was 9.39% on December 15 th. 2006), and following sharp spikes during market corrections, it will slowly drift back down towards its mean. The mean for the VIX index dating back to 1990 is 20.12 according to Bill Luby of VIX and More . When we get a spike up to the 30 or 40 level, market participants know that eventually the VIX will return down to around 20.

VIX Derivatives

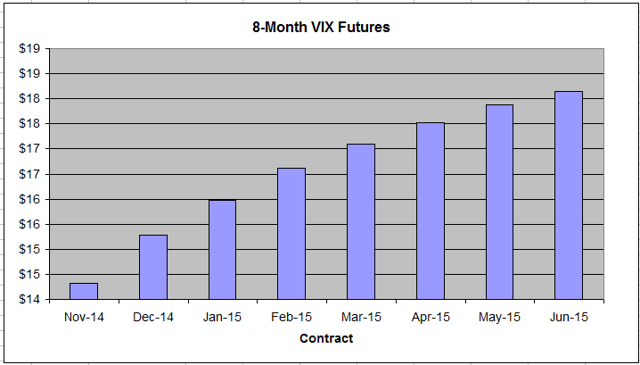

We cannot trade the VIX directly, but there are a number of derivatives available to investors, some better than others. One of the issues with VIX derivatives is that none of them can track the VIX index exactly. They can’t track the exact performance of the VIX because they only allow investors to bet on the future value of the VIX rather than its current value. Here is a list of some of the major VIX related products that are now available for trading:

Some of these VIX related products have been incredibly popular, with trading volumes going through the roof. However, despite the increase in volume, the general public’s understanding of these VIX derivatives seems to be minor at best at non-existent at worst. To paraphrase a popular Warren Buffet quote, “only invest in things you understand”.