Trade The Covered Call Without The Stock

Post on: 8 Февраль, 2017 No Comment

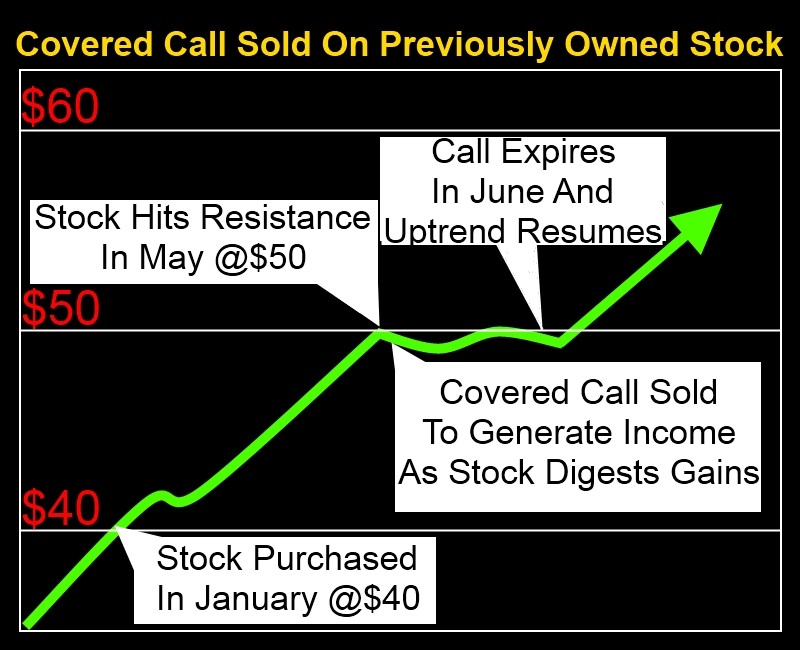

Possibly the most routinely used option trading strategy beyond simply buying calls or puts is the covered call . As most people define it, this strategy involves selling (or writing) a call option against a stock position. Typically this involves selling a call against a stock position already held. Other times an investor may see fit to buy 100 shares (or some multiple thereof) of some stock and simultaneously write one call option per each 100 shares of stock held. (To get a better understanding of options, check out our Options Basics Tutorial .)

The Standard Covered Call

Most often the standard covered call is used to hedge the stock position, and/or to generate income. Some will debate the usefulness of a covered call as a hedge simply because the only hedge provided is the amount of premium received when the option is written. As an example, assume that an investor buys 100 shares of stock for $50 a share and sells a call option with a strike price of 50, collecting a premium of $2. At this point, he has paid $5,000 to purchase the stock (ignoring fees) and has received $200 to write the call option. As a result his breakeven price on this particular trade would be $48 a share ($50-$2) at the time of option expiration.

In other words, if the stock fell to $48 a share he would lose $200 on the stock position, however, the option would expire worthless and he would keep the $200 premium, thus offsetting the loss on the stock. (Take a look at a study that discovered that three out of every four options expired worthless. See Do Option Sellers Have a Trading Edge? )

If the stock were to rise above the strike price of 50 at the time of option expiration, the stock could be called away from the investor. In fact, the maximum profit potential on this trade, up until option expiration, is $200 [((strike price + premium received) – stock price paid) *$100]. This points out one of the potential flaws that most people don’t consider in entering a typical covered call position: the trade has limited upside potential and unlimited, albeit slightly reduced, downside risk.

For this reason, investors will often write options that are reasonably far out of the money in hopes of taking in some income (i.e. premium) while also reducing the likelihood of getting their stock called away. Another problem related to the typical buy/write strategy (i.e. buy the stock and sell the call) is that the amount of capital needed to buy the stock can be relatively high and the rate of return can therefore be relatively low. So let’s consider an alternative strategy for an investor interested in generating income without the expense and unfavorable reward-to-risk scenario associated with the typical covered call positions. (This different approach to the covered call-write offers less risk and greater potential profit, read An Alternative Covered Call Options Trading Strategy .)

The Directional Covered Call Without The Stock

In this iteration of the covered call strategy, instead of buying 100 shares of stock and then selling a call option, the trader simply purchases a longer dated (and typically lower strike price) call option in place of the stock position and buys more options than he sells. The net result is essentially a position also referred to as a calendar spread. If done properly, the potential advantages of this position relative to a typical covered call position are:

- Greatly reduced cost to enter trade

- Potentially higher percentage rate of return

- Limited risk with the potential for profit.