Three Reasons Why Municipal Bonds May Offer More Than Just TaxExempt Income

Post on: 3 Октябрь, 2015 No Comment

Tax-exempt income historically has been the main reason why investors buy municipal bonds. As a result of newer tax laws, including several provisions that expired at the end of 2013, tax bills for high-income earners have increased in recent years. Some of the significant changes to tax law include:

• A top marginal rate of 39.6%, up from 35%

• A 20% tax on long-term capital gains and dividends, up from 15%

• A new 3.8% tax on investment income, from which municipal income is exempt

We believe that these higher tax rates increase the incentive for taxpayers to seek tax-exempt income using municipal bonds. Municipals have the potential to offer a broad range of investment options that are exempt from federal income tax and, potentially, from state and local income taxes. In addition to those considerations, investing in this market has several other potential benefits that are often overlooked, including:

1. Attractive yields on a before- and after-tax basis, with relatively low volatility

The gap between perception and reality that was created in 2013 represents an opportunity for long-term investors who have a focus on after-tax income. As shown below, yields on municipal bonds, particularly high yield, are attractive relative to other fixed income asset classes — even on a before-tax basis. There is no guarantee that low-volatility stocks will provide low volatility.

Source: Barclays, as of September 30, 2014. High Yield Municipal Bonds are represented by the Barclays High Yield Municipal Bond Index; High Yield Corporate Bonds are represented by the Barclays U.S. Corporate High Yield Index; Senior Loans are represented by the S&P/LSTA Index; Investment Grade Municipal Bonds are represented by the Barclays Municipal Bond Index; Investment Grade Corporate Bonds are represented by the Barclays U.S. Corporate Investment Grade Index; Broad Fixed Income are represented by the Barclays U.S. Aggregate Bond Index. Past performance is not a guarantee of future results. An investment cannot be made directly into an index.

* 2013 top marginal tax rate for single taxpayers with more than $400,000 in taxable income or couples with $450,000 or more. NIIT is the Net Investment Income Tax of 3.8% on investment income for single taxpayers with more than $200,000 in taxable income or couples with $250,000 or more.

Contrary to popular belief, the vast majority of municipal bond issuers remain creditworthy, and municipal default rates have remained relatively low, especially when compared with US corporate bonds. As shown in the chart below, when the credit structure decreases, the odds of a default rise. However, the percentages are much higher for investment-grade corporates compared with municipals. Since 1970, there has never been an Aaa-rated municipal bond default. Similarly, in the same time frame, only 0.01% have defaulted with an Aa-rating. By contrast, Aa-rated -corporate issuances have had a nearly 1% default rate since 1970. 1

Source: Moody’s Investors Service as of May 2014. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. For more information on Moody’s rating methodology,please visit www.moodys.com and select ‘Rating Methodologies’ under Research and Ratings on the homepage.

3. Diversification potential

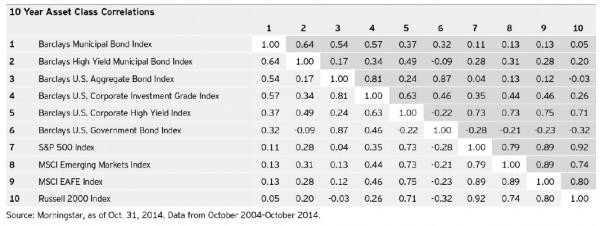

Diversification can potentially increase opportunities for growth and reduce overall portfolio volatility. Because municipal bonds, more specifically high yield municipal bonds, have historically had very low correlation to other asset classes, including equities and Treasuries, they can be effective portfolio diversifiers.

Over the last 10-year period, ending Oct. 31, 2014, the Barclays High Yield Municipal Bond Index has exhibited a low 28% correlation with the S&P 500 Index. This is in contrast to the Barclays U.S. Corporate High Yield Index, which has had a much higher 73% correlation with the S&P 500 Index over the same time period. This lower correlation demonstrates that high yield municipal bonds have not moved to the same degree as their corporate counterparts when the equity market rises or falls. We believe that this low correlation can potentially enhance a portfolio’s diversification benefits.

Source: Morningstar, as of Oct. 31, 2014. Data from October 2004-October 2014. Changes in the value of two investments or asset classes may not track or offset each other in the manner anticipated by the portfolio managers, which may inhibit their risk allocation process from achieving its investment objective.

Talk to your advisor

While municipal bonds are rightly renowned for generating tax-exempt income, there are several other reasons to consider them as well, including their relatively attractive yields, low default risk and diversification benefits. Talk to your advisor to get more information about the benefits and risks of using municipal bonds in your portfolio.

Source 1: Moody’s Investors Service, US Municipal Bond Defaults and Recoveries, 1970-2013, May 7, 2014

Important Information

Correlation indicates the degree to which two investments have historically moved in the same direction and magnitude.

Yield-to-Worst is the lowest potential yield that can be received on a bond without the issuer actually defaulting.

Diversification does not guarantee a profit or eliminate the risk of loss.

Municipal securities are subject to the risk that legislative or economic conditions could affect an issuer’s ability to make payments of principal and/ or interest.

Most senior loans are made to corporations with below investment-grade credit ratings and are subject to significant credit, valuation and liquidity risk. The value of the collateral securing a loan may not be sufficient to cover the amount owed, may be found invalid or may be used to pay other outstanding obligations of the borrower under applicable law. There is also the risk that the collateral may be difficult to liquidate, or that a majority of the collateral may be illiquid.

High yield bonds invest in noninvestment-grade bonds and are therefore subject to greater volatility than investment-grade bonds.

Securities which are in the medium- and lower-grade categories generally offer higher yields than are offered by higher-grade securities of similar maturity, but they also generally involve more volatility and greater risks, such as greater credit, market, liquidity, management, and regulatory risks.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

The tax information contained herein is general and is not exhaustive by nature. It is not intended or written to be used, and it cannot be used by any taxpayer, for the purpose of avoiding tax penalties that may be imposed on the taxpayer under U.S. federal tax laws.

The Barclays U.S. Corporate High Yield Index is an unmanaged index considered representative of fixed-rate, non-investment-grade debt. The Barclays High Yield Municipal Bond Index is an unmanaged index considered representative of noninvestment grade bonds. The S&P/LSTA Leveraged Loan Index is a weekly total return index that tracks the current outstanding balance and spread over Libor for fully funded term loans. The Barclays Municipal Bond Index is an unmanaged index considered representative of the tax-exempt bond market. The Barclays U.S. Corporate Investment Grade Index is an unmanaged index considered representative of publicly issued, fixed-rate, nonconvertible, investment-grade debt securities. The Barclays U.S. Aggregate Bond Index in an unmanaged index considered representative of the US investment-grade, fixed-rate bond market. S&P 500 Index is an unmanaged index considered representative of the US stock market. The MSCI EAFE Index is an unmanaged index considered representative of stocks of Europe, Australasia and the Far East. The index is computed using the net return, which withholds applicable taxes for non-resident investors. The MSCI Emerging Markets Index is an unmanaged index considered representative of stocks of developing countries. The index is computed using the net return, which withholds applicable taxes for non-resident investors. The Russell 2000 Index is an unmanaged index considered representative of small-cap stocks. The Russell 2000 Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. The Barclays U.S. Government Bond Index is an index that measures the performance of all public U.S. government obligations with remaining maturities of one year or more.

Stephanie Larosiliere

Client Portfolio Manager 1

Stephanie Larosiliere is the client portfolio manager for the Invesco Municipal Bond team. Ms. Larosiliere works with the fund management team, acting as its representative to retail clients and other intermediaries.

Her responsibilities include working with sales staff and clients to provide insight on the municipal fixed income market and the investment strategies utilized by the team. She is also responsible for ongoing product development and marketing for the municipal bond products.

Ms. Larosiliere joined Invesco in 2011 as a senior product manager supporting the municipal and convertible businesses. Prior to joining Invesco, Ms. Larosiliere served as a vice president in the Goldman Sachs Asset Management fixed income product management team where she was responsible for portfolio analysis, product development, client retention and marketing. Prior to joining Goldman Sachs in 2008, she worked as an institutional product management associate for Brown Brothers Harriman. She began her career in the industry in 2003 as a risk management analyst with JPMorgan Chase where she was responsible for performing daily value at risk (VaR) analysis and monthly stress risk tests on the bank’s credit portfolio.

Ms. Larosiliere earned a BBA degree in finance and investments from Baruch College — The City University of New York (CUNY).

1 Not involved in managing assets of any fund.

Leave a Reply Cancel reply

We invite you to share your thoughts regarding this post. Managing money for our investors is our priority, so please understand if you don’t receive a response immediately. Also, please know that we review all comments before posting. View our commenting guidelines .