The Time Value of Money

Post on: 6 Октябрь, 2015 No Comment

A Dollar Today

Posted on August 6th, 2008 by Trevor Shipp

is worth more than a dollar tomorrow.

Weve all heard this saying at some time or another. But what, exactly, does it mean really? The answer to this question is something Id like to explore. It has a lot to do with the time value of money.

But first, let me introduce myself as financialnuts first ever guest poster! My name is Alexandra Shipp thats right: Trevors famous (or infamous, depending on how you choose to view it ) wife! He has been asking me for some time now if I would impart some words of wisdom on his blog, and Ive finally decided on a topic to write about. But a tid bit about me: I currently attend Brigham Young University majoring in Business Management with a general emphasis. Ive sort of formed it into a personal double emphasis of entrepreneurship and marketing. One important thing to know about me is that I really cant decide what I want to do with myself, so I spend a lot of time learning things all over the board. Thats why I chose businessit leaves me plenty of options for some sort of future career.

Anyhow back to our topic! So why is a dollar today worth more than a dollar tomorrow?

1) Inflation: We all know what this is say you stuff a dollar under your mattress today and keep it there for 50 years. When you finally take it out in the year 2058 you probably wont even be able to buy a third of your favorite candy bar. Thats right the dollar grows weaker every year due to inflation! And dont ask me why it happens. I really cant remember from all my finance and accounting classes. Im sure theres a perfectly good reason, but no matter what the reason, we still have to plan for itabout a whole 3% a year.

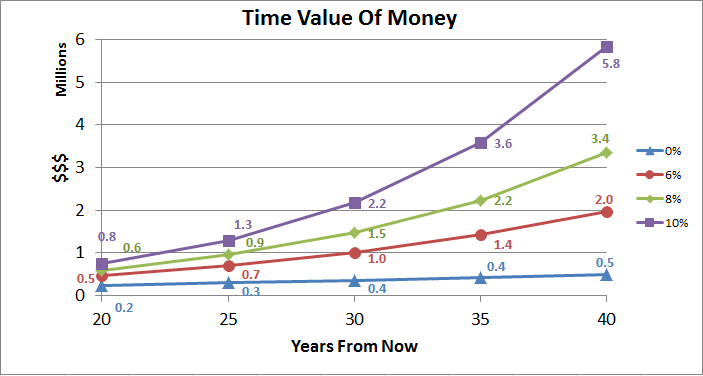

2) The Time Value of Money: Essentially, this is the exact same thing that I just explained above, but its a more general term to describe any type of interest rate that you may earn on your money.

To illustrate my point, lets look at a retirement savings plan!

Scenario 1: You start saving $500 a month at age 30. you plan to retire at age 65. and youre investing in some sort of account that earns 12% a year, compounded monthly (the average growth of an index fund).

This means by retirement, you will have saved $3,215,479.74 !

Scenario 2: Lets say everything stays the same, except you start saving at age 29 .

This means by retirement, you will have saved $3,629,479.30. Thats a difference of $414,144.56 by starting only ONE year earlier! How can that be? Its because the money you save in the very beginning is compounded over and over and over and over again, and the money you save right before retirement only gets compounded a few times before you retire. This proves that a dollar today, if you start saving NOW, will be very fruitful for you in the futuremore so than any future dollar, even a dollar tomorrow! Wow.

Thats why my husband and I try to save as much as we can starting now so we can retire early, and retire richer than we would if we started saving tomorrow.

Dont take this law for granted. Start saving anything you can today. Anything is better than tomorrows money. Thats the time value of money!

Thanks for letting me preach to youIm sure most of you already knew this!