The PuttoCall Ratio A Primer

Post on: 9 Май, 2015 No Comment

The Put-to-Call Ratio: A Primer

12Aug08

I’m going to be doing a couple of posts on trading with the put-to-call ratio so I wanted to first do a “what is the put-to-call ratio?” primer for the uninitiated. If you’re already savvy, you should skip ahead.

The put-to-call ratio is the volume of put options relative to call options purchased.

A quick options review in case youre a bit rusty. In very simple terms, purchasing a put is similar to shorting the investor is betting on (or at least hedging against) the price of an asset falling. Purchasing a call is similar to going long the investor is betting that the price of an asset will rise.

By measuring the total volume of puts versus calls purchased, we (hopefully) get some insight into investors expectations about future prices. High put-to-call ratios would indicate a bearish sentiment among investors (more puts in place than calls), while low ratios would indicate the opposite, a bullish sentiment.

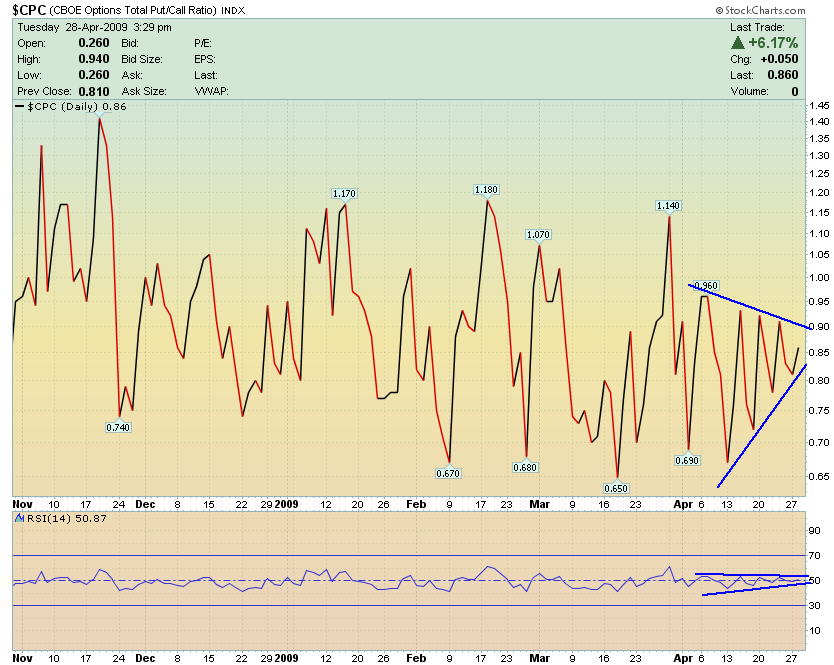

The graph below shows the S&P 500 (red) against the CBOE put-to-call ratio (blue) earlier this year. Notice how the ratio spiked during the first two sharp drawdowns as investors took a more defensive or pessimistic stance towards the market (but curiously did not during the third even larger one).

There are multiple measurements that break the put-to-call ratio down even further:

- The CBOE slices it three different ways with three different indices total option volume, index option volume, and equity option volume. Index option volume includes a lot of institutional hedging and might be a less useful gauge of speculative (direction-taking) trading. The CBOE put-to-call ratio can be charted at StockCharts.com using $CPC for total volume, $CPCI for index volume, and $CPCE for equity volume.

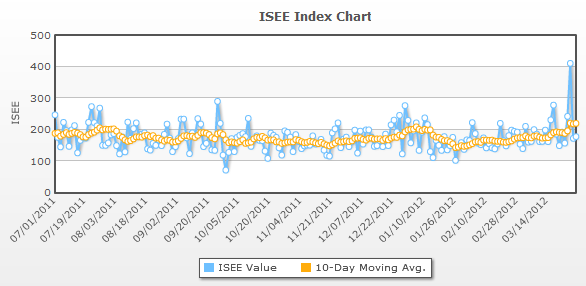

- The ISE provides another index, the ISE Sentiment Index, or ISEE. Doing its part to keep the world of finance as confusing as possible, the ISEE is a call-to-put ratio. More importantly however, the ISEE excludes institutional traders, making it (in theory) a better gauge of purely-speculative trading.

In most of my posts I’ll be using the CBOE total volume put-to-call ratio, not necessarily because I think that it’s better, but because there is a lot more historical data available for it than the alternatives.

Happy Trading,

P.S. Thank you to Bill Luby of VIX and More for double-checking me on the subtle nuances of the put-to-call ratio. Thanks Bill!

To stay up to date with what’s happening at the MarketSci Blog, we recommend subscribing to our RSS Feed or Email Feed .