The Best ETF For Hedging This Market AdvisorShares Ranger Equity Bear ETF (NYSEARCA HDGE)

Post on: 29 Май, 2015 No Comment

The S&P 500 is within 3% of a new four-year high, but the sentiment amongst investors remains cautious at best. Not even the best close in 10 weeks was enough for investors to begin to get giddy about prospects of a breakout to a new high in August. The overwhelming message I get from clients and individuals is that they do not believe in the current rally and would rather look to hedge their portfolios versus add money to the market.

There are several ways to hedge a portfolio that already has a decent number of long positions. The most convenient for the individual investor is the implementation of an inverse or hedging ETF. The options available for investors looking to either hedge or profit from a falling stock market have increased dramatically over the last two years and more products are set to launch by the end of the year.

The process of deciding which hedging ETF is the best for the current environment can be tricky and I am going to offer some thoughts on a few of the more popular options.

Short the S&P 500

From the multi-year closing high set on 4/2/12 the SPDR S&P 500 ETF (SPY ) is down 2.2% as of Friday’s closing price. The ProShares Short S&P 500 ETF (SH ), which is designed to return the daily inverse performance of the S&P 500, is only up 0.6% during the same timeframe. The reason SH was not up 2.2% is because of the fact it tracks the daily performance of the index and therefore high volatility will cause returns to not be exactly the inverse over time.

Another option for investors is the ProShares UltraShort S&P 500 ETF (SDS ), a favorite among short-term traders. Again the ETF lagged what many people would perceive as what it should be returning. The ETF was up 0.7%, not the gain of 4.4% that a large number of uneducated investors assume. Again, this has to do with the daily resetting of the ETF tracking.

Hedging Option

Instead of using an inverse ETF that tracks an index, investors could choose to buy into an actively managed inverse ETF. The AdvisorShares Active Bear ETF (HDGE ) strives for capital appreciation through short sales of domestically traded equity securities. The ETF is typically composed of 20-75 short positions with each position size between 2% and 7% of the allocation. The short positions are chosen from a bottom-up fundamental strategy that looks at earnings, accounting, and other factors.

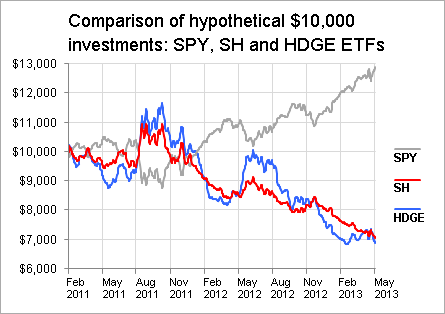

Since the market topped out on 4/2/12, HDGE has gained an impressive 12.1%, easily beating the two ProShares inverse ETFS. Granted this is one example, so to make this fair I looked at the ETFs performance over the last 6 and 12 months.

Over the last year the SPY is up 6.5% as SH dropped by 13.7% and SDS lost a whopping 28.9%. Considering the market was up over that timeframe it is not surprising to see losses or the inverse ETFs, however they are sizable. HDGE over the last year also fell, but only by 5%. Not bad considering what has taken place in the market.

The last 6 months SPY has gained 5.2% as SH and SDS once again lost ground with losses of 7.1% and 14.5%, respectively. Surprisingly HDGE was able to join SPY in the green with a gain of 3.4%. So how is this possible for a short ETF? Because it comes down to the fact that the portfolio of short positions in HDGE are falling even has the value of the overall market is increasing.

For HDGE it comes down to the success of the ETF’s managers to pick the best short candidates. If they are able to continue with the recent trend the ETF has the ability to hedge during down markets and not take a big hit if the markets rally.

Caution

The market looks strong as of today and if the trend of the last two months continues it will likely lead to a new multi-year high for the S&P 500. Therefore I caution against being too heavily invested in short ETFs at this time. That being said, I do have HDGE in many of my client’s portfolios as a hedge against any big market sell-offs that could occur.