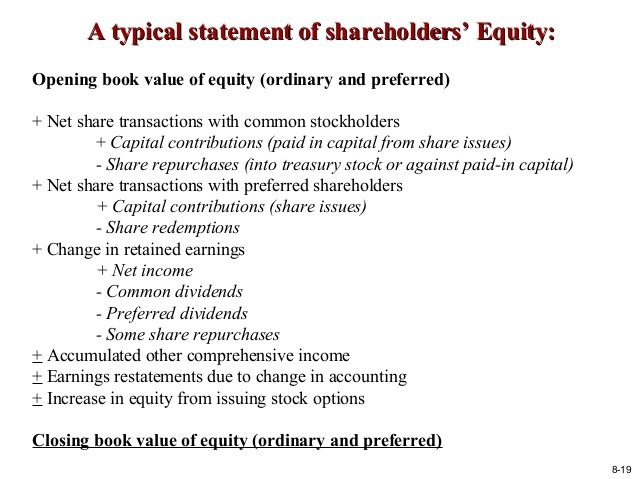

Stockholders’ Equity (Contributed Capital Earned Capital Comprehensive Income Treasury Stock)

Post on: 18 Август, 2015 No Comment

Assets are financed both by debt and equity. Equity represents the net assets of a corporation. This concept can be compared to owning a house (asset) with an outstanding mortgage note (liability). If the house is valued at $200,000 and the payoff on the mortgage note is $140,000, then the equity in the house is $60,000. A company’s balance sheet is viewed in much the same way. It is composed of many assets, a variety of liabilities, and a residual interest (equity) in those assets. The relationship between the three defines the balance sheet equation.

Advertisement

Furthermore, there continues to exist an inverse relationship between a company’s debt and its equity. If equity increases relative to total assets, then debt decreases proportionally. The greater the equity component in a balance sheet, the less pressure on the organization to cover related interest costs and generate a profit. Stockholders’ equity is generally divided into two categories. contributed capital and earned capital .

Let’s go to a bit details…………

Contributed Capital

Contributed capital is recognized when a company acquires assets through the sale or exchange of common stock. When this occurs, companies recognize additional contributed capital in the balance sheet as well as an asset or reduction in an existing liability. Most often the asset received is cash, but occasionally a building and/or equipment can be received as well. Companies also have the flexibility to settle existing debt obligations with the issuance of common shares. In all of these cases, the net assets of the companies change because of management’s decision.

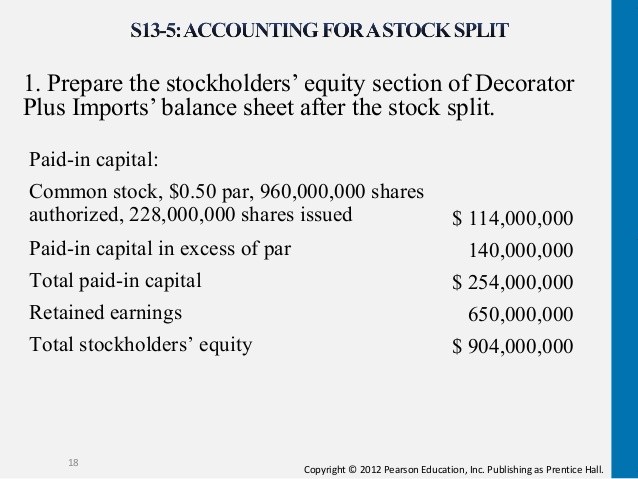

A company balance sheet may show that contributed capital consists of common stock and additional paid-in capital. Alongside these elements is the company’s disclosure of. authorized common shares, issued common shares, and outstanding common shares. Authorization establishes the ceiling on the total number of shares that may be issued by the company. The Articles of Incorporation identify this number, which can be exceeded only if the corporate charter is amended. The issued number of shares is the shares sold over time, while the number of shares outstanding can be less than or equal to the number of shares issued. If the number of shares outstanding is less than the number of shares issued, the company has reacquired some of its own common stock. Companies do this to enhance future earnings per share, reduce total future dividends paid, support executive compensation programs, or help fend off hostile takeovers. Reacquired shares are called treasury shares .

Understand that par value and fair market value are unrelated measures. Multiplying the number of shares outstanding by a par value, a value of $116 million is recorded in the company’s balance sheet, for instance. the $116 million also constitutes the legal capital of the firm. Legal capital is used as a protective means to prevent companies from distributing dividends in excess of earnings and additional paid-in capital. It provides some measure of value to creditors in case of liquidation.

The paid-in capital account represents the excess of selling price per common share over par value per share. Because company stock is sold periodically, the selling price will often vary depending on market conditions. Thus, paid-in capital can accumulate in different amounts with each public offering of the firm.

Earned Capital

The other component of shareholders’ equity is called earned capital or retained earnings . Earned capital represents the accumulated earnings of that company since its inception, less any dividends paid to the company’s shareholders. Many newly established companies pay limited dividends and instead concentrate on growth. Rather than acquire capital externally at an additional cost, they can use these internally generated funds in a more efficient way. Established companies, on the other hand, attract a different type of investor who looks to dividends as a source of periodic revenue. When a company first begins operations, accumulated or retained earnings are zero. With the passage of time however, earnings are reported and dividends are distributed. As a result, retained earnings may be positive or negative. A positive measure indicates that the company has attained some level of profitability (net income) and has distributed less than those earnings to shareholders. Negative retained earnings suggest that the company has sustained net losses over time or paid out dividends in excess of profits achieved. There is no relationship between retained earnings and a company’s cash position. Remember that retained earnings are a subset of equity, and equity supports all assets.

Accumulated Other Comprehensive Income

An additional component of stockholders’ equity is accumulated other comprehensive income . Accumulated other comprehensive income includes gains and losses related to certain events that have historically bypassed the income statement for income smoothing reasons. Therefore, for many years, the only reported measure of a company’s performance was net income.

A recent change in financial reporting now requires companies to report a more complete measure of income called comprehensive income . In essence, comprehensive income includes not just net income but other comprehensive income. As increases and decreases in other comprehensive income occur during the reporting period, these are reported in the statement of change in stockholders’ equity or in a separate statement of comprehensive income. But any accumulated balance of these unrealized gains and losses is reported under stockholders’ equity in the balance sheet.

These items normally include unrealized gains and losses on available for sale securities, translation gains and losses on foreign currency, and excess of additional pension liability over unrecognized prior service cost .

Shares Purchased For Compensation Plans

The last element that appears on the balance sheet is the cost of shares reacquired for compensation plans, also known as a company’s treasury stock . Treasury stock represents stock that has been repurchased by the issuer for some intended purpose. For example. companies that buy back their shares do the following :

- Take advantage of current market conditions and lower stock prices Reacquisition of shares at low prices eliminates future dividend payments to existing shareholders, therefore enhancing future cash flow.

- Support ongoing executive compensation programs If key executives exercise stock options, the company must have existing shares to issue to these individuals. A stock option gives the holder the right to buy company stock at a predetermined price, often at a great discount. Essentially, stock options represent a form of deferred compensation.

- Enhance future earnings per share If shares of stock are no longer outstanding, they are removed from the computation of earnings per share. Fewer outstanding shares increase earnings per share in subsequent accounting periods. Companies often seek opportunities to enhance this measure.

For example. if Royal Bali Cemerlang reacquires 100,000 shares to be held in treasury and pays $30 per share, treasury stock is reported at $3 million. On the balance sheet, treasury stock is a contra-equity account and is therefore deducted from stockholders’ equity. Some users of financial information believe treasury stock should be considered an asset but fail to recognize that a company cannot own itself.

Read also part of this Classification and Element Of Balance Sheet post series are: