Stock Market Dealer

Post on: 3 Сентябрь, 2015 No Comment

Career Overviews

Stock market dealers and traders buy and sell shares, bonds and other assets on behalf of investors. They may trade in different products, including:

- shares in companies listed on the Stock Exchange

- fixed-interest bonds

- futures and options

- foreign currencies

- gilts.

A trader’s working day is likely to include:

- making decisions on the products to buy and sell, using his or her judgement on how the markets are likely to move

- carrying out trades, either by phone or online

- checking share prices on screen

- analysing data about market trends.

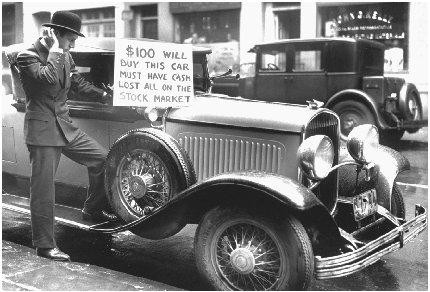

Traders must be constantly alert to sudden events that may result in large sums of money being made or lost in minutes. They have to be prepared to make quick, well-informed decisions in this pressurised environment.

A trader’s working day starts early, allowing time catch up with overnight developments and prepare for the 8am opening of the London Stock Exchange. Working hours may be from 7am to 5pm, and longer hours may sometimes be required.

Traders generally work indoors, in a dealing room. They sit by a monitor, which they use to check the markets. A great deal of trading is done by phone.

Salaries range from around £30,000 to more than £200,000 a year. In addition, many traders receive large bonuses that can be up to 100 per cent of their salaries.

Traders and dealers need to:

- be self-confident, self-motivated, ambitious and competitive

- work effectively under constant pressure

- have a strong understanding of the financial markets

- have strong analytical, numerical and literacy skills

- have good communication skills

- have an eye for opportunities and be able to make informed decisions quickly

- have a genuine enthusiasm for the financial world.

Stock market dealers and traders are employed by investment banks, fund managers, stockbrokers, commodity broking firms and the stock exchanges.

The majority of work is based in central London. There are smaller dealing desks in other financial centres, such as Edinburgh, Glasgow, Birmingham, Leeds and Manchester. Recession can lead to fewer positions and increased competition for jobs.

Most traders have a degree. Many employers require at least a 2:1 classification. All subjects are acceptable, although a degree that involves numeracy skills is helpful — examples include economics, business studies, accountancy, maths, science and engineering. The major investment banks recruit graduate trainees and offer internships. It may be possible to start off in an administrative role and progress to becoming a dealer or trader by gaining experience and making contacts.

Before carrying out any business, traders must gain a qualification listed on the ‘recommended’ or ‘appropriate’ database found on the Financial Services Skills Council (FSSC) website. When a trader passes the qualification, his or her employer can apply for approval from the Financial Services Authority (FSA).

After gaining qualifications and experience, traders who perform well may be promoted to analyst level. It is possible for traders to move up to associate, senior associate and director.

What is the work like?

Stock market dealers and traders buy and sell shares, bonds and other assets on behalf of investors. They use their knowledge and judgement to invest in a way that will make the highest profits whilst taking account of financial risk.

Traders fall into three main categories:

- market traders buy and sell products on behalf of clients

- sales traders deal directly with clients, and take instructions, place orders and advise clients of market developments and new financial ideas

- proprietary traders invest on behalf of their employing bank (this role is less prevalent).

They may trade in different products, including:

- shares (also known as stocks or securities) in companies listed on the Stock Exchange

- fixed-interest bonds — loans issued by a government or company, which pay interest

- futures and options (also known as derivatives) — an agreement to buy or sell a specified quantity of a commodity, such as oil, wheat or sugar, at a set price on a specified date

- gilts — government bonds issued to raise public funds

- foreign currencies.

A trader’s working day is likely to include:

making decisions on the products to buy and sell, using his or her judgement on how the markets are likely to move

carrying out trades, either by phone or online

checking share prices on screen

analysing data received from the bank’s researchers about market trends

keeping up-to-date with financial and political news across the world, which can affect prices

sharing information with clients and colleagues.

Traders must be constantly alert to sudden events that may result in large sums of money being made or lost in minutes. They have to be prepared to make quick, well-informed decisions in this pressurised environment.

To succeed, traders must build strong relationships with others in the market, including brokers, analysts and investors.

Hours and environment

A trader’s working day starts early, allowing time to catch up with overnight developments and prepare for the 8am opening of the London Stock Exchange. Working hours may be from 7am to 5pm. Longer hours may sometimes be required.

Traders generally work indoors, in a dealing room. They sit by a monitor, which they use to check the markets. A great deal of trading is done by phone.

The constant need to stay ahead of the market makes this a demanding job in a fast-paced environment. The atmosphere is highly pressurised and competitive.

The nature of the sector means that part-time opportunities are rare, though job sharing is becoming more common.

Salary and other benefits

These figures are only a guide as actual rates of pay may vary, depending on the employer and where people live.

- Traders may start on salaries between £30,000 and £45,000 a year.

- Experienced traders may earn between £45,000 and £75,000 a year.

- The top-earning traders may have salaries of well over £200,000 a year.

The above figures are for traders working in London. Traders working outside London tend to earn less.

Many traders receive large bonuses that can be up to 100 per cent of their salaries. Other benefits may include non-contributory pensions and mortgage subsidies.

Skills and personal qualities

A dealer or trader must:

- be self-confident, self-motivated, ambitious and competitive

- work effectively under constant pressure

- have a strong understanding of the financial markets

- have strong analytical, numerical and literacy skills

- have good communication skills

- have an eye for opportunities and be able to make informed decisions quickly

- have a good memory for facts, events and news, and be able to link these together

- build good relationships with colleagues and clients

- be trustworthy and responsible.

Interests

It is important to:

- have genuine enthusiasm for the financial world

- enjoy networking.

Getting in

Stock market dealers and traders are employed by investment banks, fund managers, stockbrokers, commodity broking firms and the stock exchanges.

The majority of work is based in central London. There are smaller dealing desks in other financial centres, such as Edinburgh, Glasgow, Birmingham, Leeds and Manchester.

As with most industries, recession leads to fewer positions and increased competition for jobs. Gaining work experience, often unpaid, with an investment bank can be an advantage. Submitting speculative applications, backed up with good research and persistence, can pay off. Many vacancies are filled as a result of effective networking and developing personal contacts.

Some large employers attend graduate career fairs. Employment opportunities are advertised in specialist sector publications, in the national press such as The Times (on Thursdays), and through dedicated recruitment agencies for financial careers and banking positions. Specialist websites such as www.efinancialcareers.com may also advertise vacancies.

Most traders have a degree. Many employers require at least a 2:1 classification. All disciplines are acceptable, although a degree that involves numeracy skills is helpful. Subjects such as economics, business studies, accountancy, maths, science and engineering may be viewed as being particularly relevant.

In addition to academic qualifications, employers look for energy and enthusiasm for the financial markets, as well as interpersonal skills.

Entry to a degree is usually with a minimum of at least two A levels and five GCSEs (A*-C), including English and maths, or equivalent qualifications. Individuals without the relevant qualifications may be able to prepare for entry to a degree by studying an Access course.

The major investment banks recruit graduate trainees and offer internships.

It may be possible to start off in an administrative role and progress to becoming a dealer or trader role by gaining experience and developing contacts.

The following qualifications may be useful:

- Diploma in business, administration and finance

- BTEC certificates and diplomas in business and finance subjects

- City & Guilds (C&G) qualifications in business and finance subjects

- ifs School of Finance Certificate or Diploma in financial studies.

Training

Traders are trained by their employer. This usually consists of shadowing an experienced trader, and attending seminars and conferences.

Before carrying out any business, traders must gain a qualification that is listed on the ‘recommended’ or ‘appropriate’ database on the Financial Services Skills Council (FSSC) website. When a trader passes the qualification, his or her employer can apply for approval from the Financial Services Authority (FSA).

The Chartered Institute for Securities & Investment (CISI) offers qualifications for traders advising or dealing in securities or derivatives:

- CISI Certificate in investments: securities

- CISI Certificate in investments: investment management

- CISI Certificate in investments: derivatives

- CISI Certificate in investments: financial derivatives

- CISI Certificate in investments: commodity derivatives

- CISI Certificate in investments: investment management.

Traders working for a retail firm may also take the CISI Certificate in investments: investment and risk.

The Chartered Financial Analyst (CFA) Society of the UK offers an Investment Management Certificate (IMC). This consists of two units; UK regulation and markets; and investment practice.

Most employers pay for examinations. Traders are usually expected to devote their own time to study.

Getting on

The Chartered Financial Analyst Program is a self-study, graduate-level programme for investment professionals. It takes three years and involves three levels of exams. Successful candidates can earn chartered status.

Traders wanting to progress to senior roles may also take the CISI Diploma, which usually takes up to two years to complete.

Traders are expected to develop their skills by undertaking continuing professional development (CPD). The CISI recommends that its members complete at least 35 hours of CPD each year. CPD can include such activities as attending courses and working towards further qualifications.

After gaining qualifications and experience, traders who perform well may be promoted to analyst level. They may also take charge of small teams or take on responsibility for a new trading desk.

It is possible for traders to move up to associate, senior associate and director.

Many investment banks have international offices, so there are opportunities to work abroad.

Further information

CFA Society of the UK, 2 nd Floor, 135 Cannon Street, London, EC4N 5BP. 020 7280 9620. Website: www.cfauk.org

The Chartered Institute for Securities & Investment, 8 Eastcheap, London, EC3M 1AE. 020 7645 0600. Website: www.cisi.org

Financial Services Skills Council, 51 Gresham Street, London EC2V 7HQ. 0845 257 3772. Website: www.fssc.org.uk

ifs School of Finance. ifs House, 4-9 Burgate Lane, Canterbury CT1 2XJ. 01227 818609. Website: www.ifslearning.ac.uk