Stock Cash Flow and Dividend Analysis Calculator Don t Quit Your Day Job

Post on: 21 Июль, 2015 No Comment

Share the post Stock Cash Flow and Dividend Analysis Calculator

Two methods which are often used to guess the underlying value of a stock are the discounted cash flow analysis and the dividend discount model . Since ownership of a stock is a claim on future earnings, discounting that cash into the future is one way to get a hold on what a stock is worth according to your estimates.

This calculator uses analyst growth estimates, earnings, and dividends information from Yahoo! Finance to fill in information for the stock you are interested in evaluating. We use a two stage dividend discount model and a two stage discounted cash flow calculator to give a fair value for your stock.

So, heres another must bookmark DQYDJ investment calculator. Here are the rest .

How to use the Discounted Cash Flow and Dividend Discount Model Calculator

Enter a ticker in the DDM/DCF Stock Valuation Calculator form, hit Populate Fields, check the values are correct in the Valuations Options Form and hit the Calculate button. According to your assumptions (or the defaults), the values for the Dividend Discount Model Price and Discounted Cash Flow Price will pop in below.

- Stock Ticker — The stock ticker of a publicly traded company.

- Dividend Growth Percentage — The rate at which the dividend at the company is growing (the calculator will use it for the next five years in the model). By default, uses the year over year change.

- Earnings Growth Percentage — The rate at which the earnings at the company are growing (the calculator will use it for the next five years in the model). By default, uses the Yahoo! PEG ratio, which comes from Thomson Reuters .

- Perpetual Growth Percentage — The rate you want the calculator to use for growth into perpetuity. This will apply to earnings & dividends. We use 2%; you may want to play with this a bit (keep it low no company can grow too quickly forever).

- Discount Rate — The rate you think you can get investing in things other than this stock (into perpetuity). 10% is aggressive but safe; be careful here though since massaging this number can change values quickly.

- Current Stock Price — The current price the stock is trading at.

- Stock Beta The beta of the stock. (You can turn off beta in the model with the text box).

- Current Dividend Per Share The current yearly dividends per share.

- Current Earnings Per Share The current trailing twelve month earnings per share.

How to the Discounted Cash Flow and Dividend Discount Model Calculator Works

These two valuation metrics use a discount rate, current stats, and future growth to estimate what the sum of future cash flows or dividends is worth today. In the same way that a dollar today is worth more than a dollar in a year due to inflation, future cash flows arent worth as much as money today (which is, of course, the money you are considering investing in this stock over every single other investment).

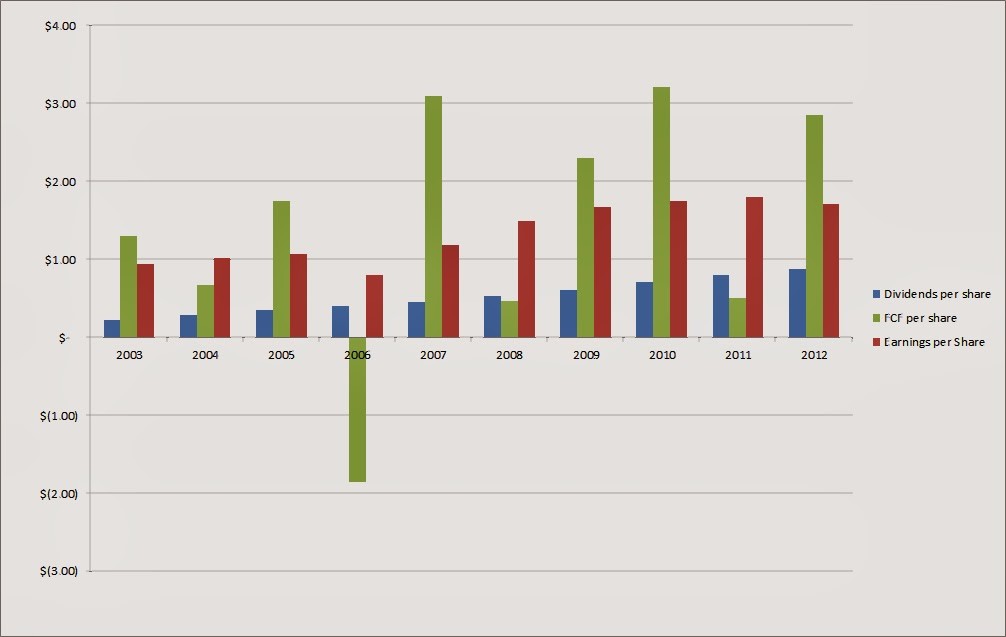

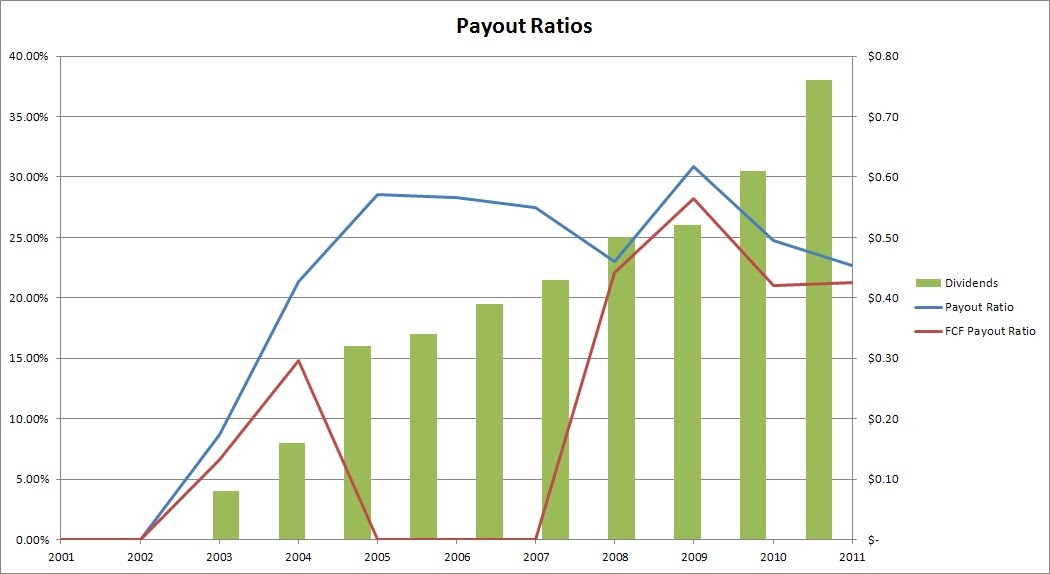

They both work in much the same way in our calculator. The DDM calculation uses todays dividend rate plus the growth rate for the next 5 years. The DCF calculation uses todays earnings per share and the estimated growth rate for the next 5 years. Both calculations then use the perpetual growth rate.

Each years earnings are then discounted back to their current value using your discount rate, everything is summed and tossed into the box

and its up to you to discount how much you value these calculations.

As a disclaimer, you should of course run different scenarios and double and triple check all your numbers. Consider modeling earnings and dividends as a good first step. Its a pretty big first step, though.

Share the post Stock Cash Flow and Dividend Analysis Calculator