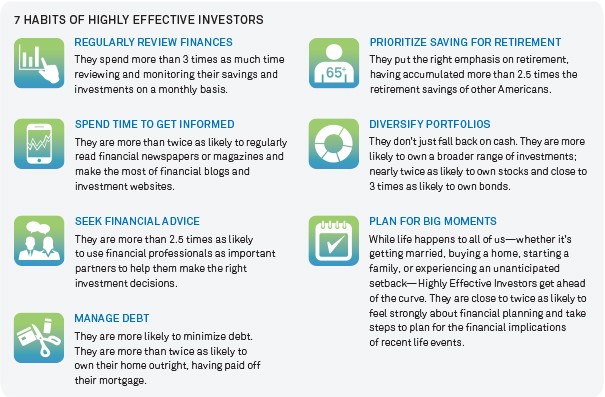

Seven habits of highly effective investors

Post on: 16 Март, 2015 No Comment

- Image Credit: Corbis/ArabianEye.com

Image 1 of 6 1 2 3 4 5 6

In the world of private bankers, a million dollars (Dh3.67 million), five million or 25 million can tilt the scales from being merely wealthy to high-net-worth (HNW) or ultra-high-net-worth (UHNW). In The Wealth Report 2012, released in March, Knight Frank, the global property consultancy, and Citi Private Bank define a high-net-worth individual (HNWI) as someone with more than $25 million of investable assets.

Merrill Lynch Global Wealth Management and Capgemini’s World Wealth Report 2012 puts the number of ultra-high-net-worth indivduals (UHNWIs, with investable assets worth more than $30 million) in the Middle East at 4,000 in 2010. This made up 0.9 per cent of the HNWI population in the region.

The UAE is home to 526,000 HNWIs, defined as those with investable assets of $1 million and more the standard classification for HNWIs.

Booz and Co.’s GCC Private Banking Report released last year puts the number of wealthy households not individuals in the GCC, with combined total investable assets of $1-$1.2 trillion at 1.1 million. In 2010, the UAE was home to 200,000 to 220,000 of them.

The differences continue when comparing the investment behaviour of HNWIs and retail banking customers. The most obvious difference is in risk profiles the more money you have, the more willing you may be, depending on your mandate, to take risks. That is the main difference, says Yusuf DeLorenzo, CEO, Riverbend Consulting and the Chairman of Dow Jones Islamic Market Index Sharia Supervisory Board. The corollary to this is that the simple investor with a lot of money is not going to be able to afford the best kind of investment advisors, whereas HNWI investors would be able to afford the fees of better investment or asset managers.

The HNWI investor, says Tamer Rashad, Head of Middle East, Merrill Lynch Wealth Management, is quite the citizen of the world. The higher you go in the world the more intertwined you are with the global economy and there is less variation in investment style.

Having said that, analysts maintain that there are several unique factors at play in the UAE HNW landscape. Family businesses, large expatriate communities, the desire for Sharia-compliant investment products and the need for both onshore and offshore offerings characterise the UAE investor. According to Booz and Co, GCC investors house 50 to 60 per cent of investments offshore among the highest rates in the world.

Among HNWIs elsewhere, becoming risk averse was one of the first fallouts of the global financial crisis. Rashad says, Generally speaking, there is less investment in alternative investments today than, let’s say, 2007, as a percentage of investment.

On the other hand, there are those who say that risks are still magical and the excitement of a new project or idea often holds sway over investment decisions. Once fear is past, some experts tell us, greed takes over.

Glen Ward, Business Development Manager, ICM Capital headquartered in London with an administrative office in Dubai which provides a trading platform for individuals with access to FX and CFD markets, says HNWIs have recently discovered the benefits of trading on retail platforms. They are attracted by risk. Our platform gives them the opportunity to trade on the markets directly and not put their trust in hedge funds. We see HNWIs trading off the news headlines as much as anyone, in fact more so, he says.