Sentiment Market Indicators (Introduction)

Post on: 23 Сентябрь, 2015 No Comment

Updated 07-01-2010 at 08:23 PM by Magic (Fixed Links)

This entry into the Sentiment Section covers several Market Indicators based on Market Sentiment . My purpose is to organize and provide charts for the major ones so anyone intersted can find those they think will help with analyzing their particular market. I’ve covered many of these some time ago and my novice understanding shines through. I will update them (with my improved novice understanding ) and add some others as I continue this section.

The basics are that the market rises and falls on expectations. Technical analysis requires investors to identify a trend, position with that trend, and then exit the trade when the trend shows signs of reversing. While many of the technical patterns can indicate reversals, Sentiment Indicators can be used in with them to gauge the market’s expectations. Sentiment indicators provide insight into the underlying, broader market strength of price movements.

Of course, these are of little, if any, use to the scalper or day trader. But they are invaluable for acheiving longer positions. With sentiment indicators, the normal, day-to-day readings are discounted. That is, when reading sentiment indicators look for extreme readings as an indication that prices are set to reverse.

Underlying Concepts

Below is a lists of some concepts it would be good to know before getting into some of the major market indicators. For instance, Open Interest is very important in futures and options trading, but necessary for getting at the heart of the COT Report. Liquidity and volatility seems innocently simple as I presented them before, but they aren’t so simple and will be updated.

Open Interests

Relative Strength

CarryTrade (Though I should complete these first, before moving on to the Major Market/Sentiment Indicators, there has been some interest in an update to the COT Report. And since my original entry has some errors, I will do it next, then come back to these.)

Broadview Sentiment

We have been surprised in the equities and currencies markets by world events lately. The EU is planning austerity measures, China and India are nearing possible hyper-inflation scenarios that will effect every economy and security while the US is testing Keynesian stimulus to the extreme. Keep an eye on the World, then the world leader:

World Indices

Major Economic Indicators

No indicator works by itsself. Some are confirming indicators and some need confirmation. Some are leading indicators and some lag. Some produce long-term direction and their announced changes (news events) can turn a market in an instant. Some have broad economic implications, while others like the LIBOR-OIS can have narrow, yet very important, implications on certain markets like the financials or MBSs.

Business Cycle Indicator — BCI [Chart ]

Interpretation of BCI involves much more than simply reading graphs — an economy is too complex to be summarized with just a few statistics. Although past business cycles have shown patterns that are likely to be repeated to some degree, business cycles can start and end quite quickly for reasons that an indicator may not account for. Thus, investors, traders and corporations must realize that it is unreasonable to believe that any single indicator, or even set of indicators, always gives true signals and never fails to foresee a turning point in an economy.

[Investopedia]

Fed Funds Futures [Chart ]

Traders can buy and sell futures based on the Fed funds rate and expectations for changes in that rate. If you think the Fed will raise rates in the future you would sell these futures and if you think the Fed will lower rates, you would buy these futures contracts. These are a great way for institutional traders to hedge interest rate risk and speculate on changes in the future.

CBOE Volatility Index (VIX) [Chart ]

The VIX is often referred to as the fear index. Based on option prices, VIX increases when investors buy put options to insure their portfolios against losses. A rising VIX indicates an increased need for insurance. By looking for spikes in the index, we can identify moments where fear has overwhelmed the market, giving us the opportunity to buy stocks at reduced levels. Look for a spike where the current price is 10 points above the 10-day moving average (MA). Such a quick move higher indicates mass fear.

The Baltic Dry Index (BDI) [Chart ]

The BDI is a measure of what it costs to ship raw materials—like iron ore, steel, cement, coal and so on—around the world. The BDI is compiled daily by The Baltic Exchange. To compile the index, members of the Baltic Exchange call dry bulk shippers around the world to see what their prices are for 22 different shipping routes around the globe.

The LIBOR-OIS Spread [Chart ]

The LIBOR-OIS spread is the difference between the LIBOR and the overnight index swap rate, and is commensurate with the amount of perceived credit risk in the interbank lending market. Ordinarily, when the central banks lower their rates of interest, both the LIBOR and the OIS rates decline with it. However, when banks are unsure of the creditworthiness of other banks, they charge higher interest rates to compensate them for the greater risk. The LIBOR-OIS spread is a better measure of credit risk in the interbank lending market than the LIBOR.

The yield curve is a simple comparison of short term, mid term and long term bond yields. A bond’s yield is how much it will return to you on an annualized basis from the time you purchase it until it matures. Typically the curve of yields means that you will be paid more for a long term bond and less for a short term one. This is because it is riskier to tie up your money for a long time than a shorter time frame. We can make pretty good estimates about what should happen in the next three months but no one knows what will happen over the next 30 years. That means that buyers will be paid a higher yield for the 30 year note than they will for the 13 week note. Long term buyers are being paid more to compensate for that uncertainty.

Performance Charts

National Economic Indicators

You can check all these and more together as meters or as individual charts at

Gross Domestic Product (GDP)

As the barometer of the nation’s total output of goods and services, GDP is the broadest of the nation’s economic measures.

Producer Price Index (PPI)

The Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

Consumer Confidence Index (CCI)

The Conference Board maintains this index of consumer sentiment based on monthly interviews with 5,000 households.

Job Growth

A key to understanding consumer sentiment is job growth. Consumers feel more at ease when the job market is expanding. But when job growth contracts to 100,000 or less month to month, watch out — the economy could be headed for a slowdown.

Housing Starts

A monthly report issued by the U.S. Census Bureau jointly with the U.S. Department of Housing and Urban Development (HUD). The data is derived from surveys of homebuilders nationwide, and three metrics are provided: housing starts, building permits and housing completions. A housing start is defined as beginning the foundation of the home itself.

Capacity Utilization

This refers to the extent to which an enterprise or a nation actually uses its installed productive capacity. It’s the relationship between actual output that is produced with the installed equipment and the potential output which could be produced with it, if capacity was fully used. If market demand grows, capacity utilization will rise. If demand weakens, capacity utilization will slacken. Economists and bankers often watch capacity utilization indicators for signs of inflation pressures.

Getting down to the Specifics

IMO these should be checked for any market or time-frame. These are the sentiments of the commercials — Smart Money. A thorough knowledge of them will tell you what SM is thinking and will do.

The Commitment of Traders (COT) report is released weekly by the Commodity Futures Trading Commission (CFTC) in the US every Friday at 15:30 Eastern Time. The COT report shows how large speculators, commercials and small traders have placed their bets in the futures markets in terms of open interest information based on the previous Tuesday, and is an invaluable tool you can use to track the market sentiment.

A ratio of the trading volume of put options to call options. It is used to gauge investor sentiment. For example, a high volume of puts compared to calls indicates a bearish sentiment in the market. (see also: ISEE Sentiment Indicator )

The shape of the futures curve is important to commodity hedgers and speculators. Both care about whether commodity futures markets are contango markets or normal backwardation markets. Supply meets demand where market participants are willing to agree about the expected future spot price. Their consensus view sets the futures price. And that’s why a futures price changes over time: market participants update their views about the future expected spot price. Contango and normal backwardation refer to the pattern of prices over time.

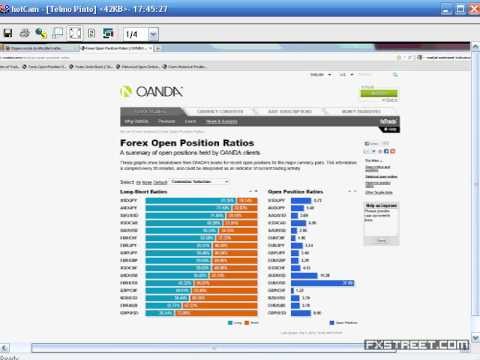

Sentiment Chart Indicators

For my friends who scalp and day trade, these indicators may prove helpful for gaining a broader, sentiment, view of your market. Test them on your longer time-frames.

A measure of how much volume is behind advancing and declining shares. If the stock market is over-bought, meaning stock prices have risen sharply, it is ripe for a reversal to the downside. Likewise, if the stock market is over-sold, investors are likely to jump on bargains and reverse the decline in prices.

One of the most common of the market internals. This tool compares the number of stocks on the New York Stock Exchange that are rising to the number of stocks that are falling.

A popular market breadth indicator that is calculated by dividing the number of stocks in a given group (an exchange, an industry, etc.) that are currently trading with Point and Figure buy signals, by the total number of stocks in that group.

The measurement looks at the 30 stocks of the Dow Jones Industrial Average (the Dow) and measures the number of Dow stocks rising and the number of Dow stocks that are falling. The resulting number tells you whether there are more stocks rising (upticking) or falling (downticking).

A momentum indicator that is applied to the advance/decline statistics. When the 19-day EMA (shorter moving average) moves above the 39-day (longer moving average) EMA, it signals that advances are gaining the upper hand. Conversely, when the 19-day EMA declines below the 39-day EMA, it signals that declining issues are dominant. As a momentum indicator, the McClellan Oscillator attempts to anticipate positive and negative changes in the AD statistics for market timing.

Though I don’t like price-based indicators cluttering my charts, you might want to consider the Ichimoku Cloud Charts for another method of getting to AAG charting. Another is the Twiggs Money Flow Indicator derived from the Accumulation Distribution line which is based on price/volume.

More Tools and Charts