Puts and Calls Put Call Ratio

Post on: 17 Май, 2015 No Comment

An option is one of the more advanced trading vehicles. Most investors focus on stock trading. but few know of the power that options provides to a trader, or investor. There are two types of options, puts and calls. Put and call options are polar opposites of each other. Put options allow the buyer to force the seller to purchase shares at a predetermined price at some point in the future while call options allow the buyer to acquire a stock at a predetermined price. Puts and calls are bought and sold as a contract, where each contract represents 100 shares of the underlying security. Call options increase in value as the underlying security moves higher while put options increase in value when the underlying moves lower.

Traditionally; options are used to hedge against unforeseen risk, but many speculators attempt to use the leverage of an options contract to their advantage and speculate on market movement. For example, if you buy a June $100 (1 month from current date) call option on IBM for $2, you will pay $200 (100 shares * $2) for the option to buy 100 shares of IBM one month from now at $100. If the stock is at $110, your option will be worth $1000, for a profit of $800. Notice how a $200 options investment yielded the same amount of profit as a $10,000 investment in the stock would have.

Put Call Ratio

The buying and selling activity for puts and calls can be used to help gauge investor sentiment in the market. The put call ratio measures the relationship between the number of puts being bought versus calls being bought. Some traders or investors will refer to this ratio as the call put ratio, but this terminology is incorrect. This is because the formula is calculated by taking the total count of puts and dividing it by the total number of calls. This relationship takes into account all of the equity and index options on the Chicago Board of Exchange. If there are a large number of puts relative to calls, this is a sign that investors are bearish on the market. However, this indicator has gained popularity in its application as a contrarian indicator. When there is a large number of puts being bought, this usually indicates that there is fear in the market and that a bottom may not be that far off. The opposite is true for a very low put call ratio reading.

There is one caveat to the ratio. Some traders like to remove the put call data on index options because it is biased towards puts. This is because many large institutions and hedge funds will purchase puts on index options insurance against long positions. So, some traders like to focus on the put call ratio of equity options as this represents the bullish and bearish sentiment of the issues on the exchange.

Additionally, with the advent of inverse ETFs and the explosion of volume in these trading vehicles, it has become increasingly difficult for investors to gauge the relevance of a high or low put call reading. A large number of puts and calls are being bought on these securities which actually bet against the market. Therefore, a large number of calls being bought on the SDS (inverse S&P ETF) will indicate a bearish posture and cause technical analysts to misread the message of the put call ratio.

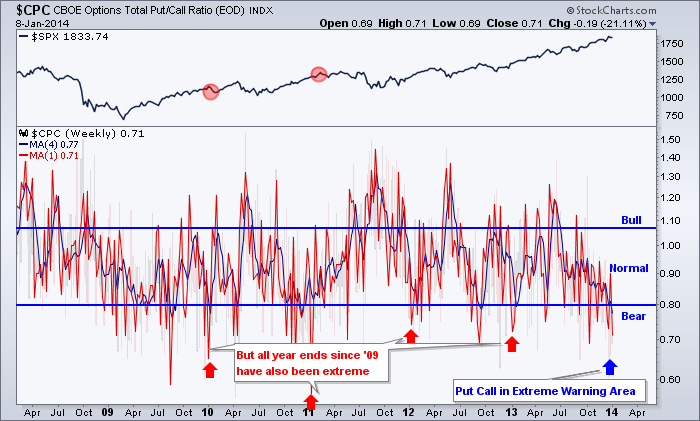

Weekly Timeframe

Looking at the put call ratio on a daily basis can generate a number of false signals. This is because the volume of puts and calls traded on a daily basis can fluctuate widely during volatile trading periods in the market. On strong up days, there is a spike in call volume. While, on large down days, the put volume while explode and one-day moves that spike over 1. The best method for monitoring the relationship between puts and calls is to perform analysis on a weekly basis. This is because market sentiment can not be quantified in a day, but rather takes a number of snapshots over a period of time in order to determine the true nature of the market. In recent years, a weekly put call reading greater than .75 has marked significant market bottoms, while readings below .5 have marked market tops. However, the bear market of 2007 – 2008 set new weekly records for the put call ratio. The relationship to put and call options during the credit crisis sent the ratio over 1.4 on three occasions in a 12-month period. As you can see in the below chart, the line graph of the CBOE put call ratio resembles that of an EKG reading. Many traders will overlay a simple moving average or exponential moving average to smooth out the line to better identify the trend of puts and calls in the market. Most free charting platforms will provide the put call ratio as a market breadth chart. Traders that use their own custom applications can receive daily and historical put call volume data directly from the CBOE.

Contrarian Trading Approach

Another method for profiting from the put call ratio is to go counter to the broad market when extreme readings are hit. One of the key components for doing this effectively is to also monitor divergences with technical analysis indicators. So, if a trader sees that the market is making lower lows while the RSI is making higher highs and this falls inline with a put call ratio greater than 1.4, there is a good shot the market will bottom in the coming days or weeks. Like any other technique in the market, a trader can not solely rely on the relationship of puts and calls, but it does fit into the bigger picture of the sentiment of the market.

Summary

To recap this article, puts and calls provide the means for limiting risks, but still provide the ability to make decent profits with low risk. Another method for trading with options is to monitor the put call ratio to gauge market sentiment. So, if you are in a winning short position and you see the put call ratio exceeding 1.4, it is probably wise to take some money off the table. Conversely, if the ratio of puts and calls drops below .4, it is probably a good idea to sell some of your long position. Remember that the market is ever changing, so last years extreme reading is this year’s normal reading. So be sure to monitor the put call ratio over the last five to ten years in order to put the ratio in the context of the market you are facing on a daily basis.