Predicting the Volatility of Volatility

Post on: 10 Апрель, 2016 No Comment

When the CBOE Volatility Index (VIX) was first introduced back in 1993, it was a revolutionary concept. For the first time since exchange traded options began (some 20 years prior), traders had a way to measure and track the near-term implied (anticipated) volatility of the marketplace.

The original VIX was calculated using the implied volatilities of near-month put and call options that were trading on the S&P100 (OEX). Over time, people began to view the VIX as a measure of the fear in the market.

It is a widely held belief that the market is driven by two things; fear and greed. If that is true, then having a way to help measure one of these things could be pretty beneficial.

The VIX remained true to its original formula for about 10 years. Then in 2003, an important change took place, as the CBOE stated it, to ensure that VIX remains the premier benchmark of U.S. stock market volatility. Without going into too many details, the formula essentially changed so that it includes more options, different weightings, and it uses S&P 500 (SPX) options instead of S&P 100 options to better represent a broader section of the market.

The CBOE even provides retroactive calculations on the VIX all the way back to 1986 using the new formula. To appease those people who dont like change, the CBOE even created a new symbol, VXO, which continues on to this day, using the old formula.

At the time of the formula change, there was also talk that one day there might be derivatives products traded on the VIX. As promised VIX futures began trading in early 2004 on the CBOE Futures Exchange (CFE) but for those of us who are partial to the listed options markets, the bigger news was the introduction of VIX options on the CBOE in February 2006. The combination of how well known the VIX was among option traders and recent spikes in volatility have caused these new options to grow in popularity very quickly since their introduction.

A Different Option

While this is an exciting new product, it is important to realize just how different VIX options are from other options. What we are talking about is an option on implied volatility, and not on a stock, ETF or index.

If youve ever traded options, you probably know that the price of an option is partially based on the implied volatility of the underlying instrument; in this case that underlying instrument would be implied volatility. If that is true, then the implied volatility of VIX options is the implied volatility of implied volatility, which would be the second derivative of the price of the SPX.

Unless you are a brilliant mathematician, it kind of gives you a headache just thinking about it. This component may make VIX options appear significantly more or less expensive than traditional options.

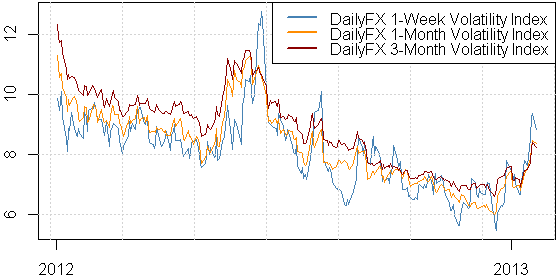

It might surprise you that until a mid-June 2006 spike, volatility (as measured by the VIX) had been at historically low levels for nearly three full years. By contrast, precisely because of spikes like June, the actual (historical) volatility of volatility is quite high.

Trading Volatility

Now that the CBOE has begun trading options on the VIX, you have the opportunity to trade one of the most, if not the most, volatile issues in the entire marketplace. This creates all sorts of potential opportunities that were previously unavailable.

No longer do you have to establish expensive long straddles and strangles or short butterflies and condors to make a volatility play; if you expect increasing market volatility, you can use a long call option on the VIX to attempt to capitalize on your forecast. Similarly, you can replace negative volatility strategies like short straddles and strangles or long butterflies and condors with a long put option on the VIX.

Another way to consider using VIX options is as an insurance policy against a sharp market move.

While in theory implied volatility is non-directional, in practice it appears to demonstrate far more sensitivity to downside moves than to upside moves. This means that instead of attempting to hedge a portfolio of stocks by buying an ETF or index put option, you may be able to do it more cheaply by buying a VIX call option instead.

While no option strategy can provide a perfect hedge to your portfolio unless you own shares in the exact proportions of the benchmark index, historically the VIX has appeared to overreact to market downturns, which means VIX calls might rise in value much faster than a typical index put option, allowing you to offset some or all of the losses in your stocks at a much lower cost.

Volatility is certainly a fascinating subject. Imagine a mathematical formula for gauging human emotion what could be more interesting than that? Watch any of the financial channels and youll always hear the market experts carrying on about volatile markets, but how do you measure such an arbitrary thing? The VIX is not the only volatility gauge out there. Volatility on the Nasdaq can be measured with the VXN and volatility on the QQQQs can be measured using the QQV; however, neither of these trade options yet.

Words of Warning

A few final notes of caution since VIX options are a second derivative, standard pricing models based on the old Black-Sholes formula, wont work the same on VIX options as they do for other options. Consider that at least in theory, any stock can go to zero or infinity.

Without too much thought, it is pretty obvious that volatility cant go to infinity, and it also cant go to zero. This means that the lognormal distribution curves that option pricing models are based on dont really apply because the upper and lower tails will be much fatter than for an individual equity.

Additionally, since volatility is mean reverting, even when it does spike sharply higher, it isnt likely to remain there for very long. As a result, you should always watch your position closely as exit opportunities may be short lived.

To complicate matters further, the CBOE decided to base the price of VIX options not on the current level of the VIX, but on the anticipated level of the VIX at expiration. This means youll probably see a closer correlation to the VIX futures on the CFE than to the actual level of the VIX index.

In other words, prices for VIX options expiring in the month of May will most closely reflect the level of the June futures contract while prices for VIX options expiring in August will most closely reflect the level of the September futures contract.

Dont assume that VIX options reflect the current quote of the VIX index. If you do, it can give the appearance that options with farther out expiration dates are cheaper than options with nearer expiration dates or that the options are trading at a discount to the intrinsic value, which is not the case. Even more confusing, they expire on the Wednesday that is 30 days prior to the third Friday of the calendar month immediately following the expiring month.

For some months this means the expiration date could be prior to the regular equity option expiration and for some months it will be subsequent to the regular equity option expiration. To learn more about the nuances of VIX options, you should visit the CBOE Web site.

If youre smart enough to know how to estimate the implied volatility of the implied volatility or determine whether or not VIX options are fairly priced or not based on their implied volatility component, then mathematics is probably your forte.

Even if you cant completely understand the mathematics behind it, the VIX is definitely a fascinating thing and now you can trade it but please, use caution.

Randy Frederick is Director of Derivatives at the Schwab Center for Financial Research. To learn more about him, read his bio .

This article originally appeared on The Options Insider Web site .