Portfolio Diversification Definition

Post on: 16 Март, 2015 No Comment

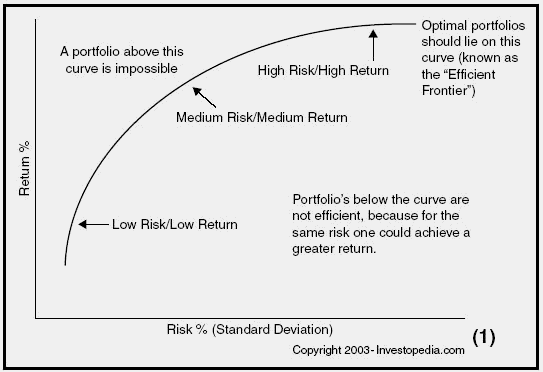

Portfolio diversification can be defined as an inclusion of multiple assets in a portfolio, so that going down of one asset and the resulting losses can be compensated by other assets. Thus, it can be claimed, that portfolio diversification is aimed at reducing the risks. As well as that the aim of risk diversification strategy is to reach the optimal risk return-ratio of an investment.

Most experts agree that even though diversification does not guarantee absolute return, it is still the most essential means of achieving one’s financial goals — reducing the risks of the created portfolios. Since it lessens the variability of returns around the expected return, it is an important component of an efficient investment strategy.

A separate asset or a portfolio is considered to be efficient when there is no other asset or portfolio with an equal or preferable risk-return ratio. The portfolio with the highest likely return should not by all means be the one with the least uncertainty. Even the most reliable portfolio with considerably high return may undergo a high degree of uncertainty. Similarly, the portfolio with least uncertainty may result in an unexpectedly low “likely return”. Between these two extremes, there are portfolios of various degrees of return and uncertainty.

Asset Allocation

The main emphasis in Markowitz’s portfolio diversification is made on the portfolio’s risk-return concept. It is based on the asset allocation which aims at balancing risk and return, by apportioning portfolio’s assets based on investor’s goal and risk tolerance. If the correlation among assets is lower, the risk reduction is higher.

Which correlations are most effective?

Positive correlation does not reduce portfolio risks as it suggests that:

- The returns are in direct linear relation.

- If investors are aware of the return on one security they are also perfectly able to predict that of the other’s.

Zero correlation implies that there is no relationship between returns on two assets. By combining two securities with zero correlation, the risk is reduced but not eliminated.

Negative correlation suggests that the returns are in inverse linear relation. This kind of combination can eliminate the risk altogether.

It is in investors’ best interest to use statistics of asset allocation for their own benefit by choosing adequate asset weights, so that the resulting portfolios are efficient and have minimum risk at a desired level of return. By changing the desired level of return, efficient asset allocation in the portfolio also changes.

Therefore, it is possible to create more than one efficient portfolio with different risk-return ratios.

start practicing and create your own portfolios with our Asset Allocation software — NetTradeX