John Bollinger s 22 Rules For Using Bollinger Bands

Post on: 3 Июль, 2015 No Comment

Bollinger band is a band plotted two standard deviations far from a easy shifting average, developed by means of well-known technical trader John Bollinger.

Bollinger Bands are broadly and efficiently utilized by forex traders international. Probably the most nice joys of getting invented an analytical methodology corresponding to Bollinger Bands is seeing what other folks do with it. Whereas there are various methods to make use of Bollinger Bands within the forex market, following are a number of ideas that function a excellent starting level.

- Bollinger Bands present a relative definition of excessive and low. By means of definition value is excessive on the higher band and low on the decrease band.

- That relative definition can be utilized to match price action and indicator motion to reach at rigorous buy and sell choices.

- Acceptable symptoms can also be derived from momentum, quantity, sentiment, open passion, inter-market information, and so on.

- If multiple indicator is used the indications must now not be right away associated to at least one any other. As an example, a momentum indicator would possibly complement a quantity indicator efficiently, however two momentum symptoms are not higher than one.

- Bollinger Bands can be utilized in sample reputation to outline/make clear pure value patterns similar to M tops and W bottoms, momentum shifts, and many others.

- Tags of the bands are simply that, tags no longer signals. A tag of the higher Bollinger Band is NOT in-and-of-itself a sell signal. A tag of the decrease Bollinger Band is NOT in-and-of-itself a buy signal.

- In trending markets value can, and does, stroll up the higher Bollinger Band and down the decrease Bollinger Band.

- Closes outdoor the Bollinger Bands are in the beginning continuation signals, now not reversal signals. (This has been the foundation for a lot of a hit volatility breakout programs.)

- The default parameters of 20 sessions for the transferring average and standard deviation calculations, and two standard deviations for the width of the bands are simply that, defaults. The true parameters wanted for any given market/process is also completely different.

- The average deployed as the center Bollinger Band will have to no longer be one of the best one for crossovers. Somewhat, it must be descriptive of the intermediate-time period trend.

- For constant value containment: If the average is lengthened the selection of standard deviations must be elevated; from 2 at 20 classes, to 2.1 at 50 sessions. Likewise, if the average is shortened the choice of standard deviations will have to be decreased; from 2 at 20 sessions, to 1.9 at 10 classes.

- Conventional Bollinger Bands are based totally upon a easy transferring average. Its because a easy average is used within the standard deviation calculation and we are looking to be logically constant.

- Exponential Bollinger Bands do away with unexpected adjustments within the width of the bands as a result of huge value adjustments exiting the again of the calculation window. Exponential averages need to be used for BOTH the center band and within the calculation of standard deviation.

- Make no statistical assumptions in line with using the standard deviation calculation within the building of the bands. The distribution of safety costs is non-commonplace and the everyday pattern dimension in most deployments of Bollinger Bands is simply too small for statistical value. (In follow we usually in finding ninety%, now not ninety five%, of the information inside of Bollinger Bands with the default parameters)

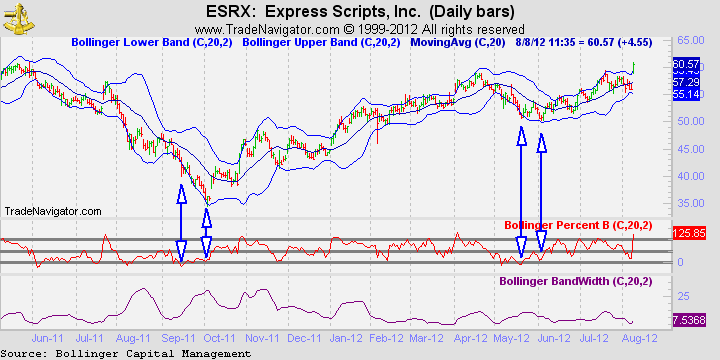

- %b tells us the place were in terms of the Bollinger Bands. The place throughout the bands is calculated the usage of an adaptation of the method for Stochastics

- %b has many makes use of; among the many extra vital are identification of divergences, sample acceptance and the coding of trading techniques the usage of Bollinger Bands.

- Warning signs will also be normalized with %b, disposing of mounted thresholds within the course of. To try this plot 50-duration or longer Bollinger Bands on a hallmark after which calculate %b of the indicator.

- BandWidth tells us how broad the Bollinger Bands are. The uncooked width is normalized the usage of the center band. The use of the default parameters BandWidth is 4 occasions the coefficient of adaptation.

- BandWidth has many makes use of. Its hottest use is to indentify The Squeeze, however can also be helpful in determining trend modifications.

- Bollinger Bands can be utilized on most monetary time sequence, together with equities, indices, overseas exchange, commodities, futures, options and bonds.

- Bollinger Bands can be utilized on bars of any size, 5 minutes, one hour, day-to-day, weekly, and so forth. The secret is that the bars should incorporate sufficient process to present a strong image of the associated fee-formation mechanism at work.

- Bollinger Bands dont present steady recommendation; slightly they lend a hand indentify setups the place the chances could also be on your favour.

Bollinger Bands are on a regular basis displayed on prime of safety costs, however they may be able to be displayed on a trademark. These feedback discuss with bands displayed on costs.