Investment Companies Audit and Accounting Guide

Post on: 16 Март, 2015 No Comment

Available Formats:

Updated as of May 1, 2014, this edition provides an up-to-date review of the latest auditing and regulatory guidance specific to investment companies. Youll receive authoritative how-to advice for investment company accounting and auditing, including implementation guidance and illustrative financial statements and disclosures.

This guide is the industry standard resource, supporting practitioners in a constantly changing industry landscape packed with continuous regulatory developments.

Key Benefits Include:

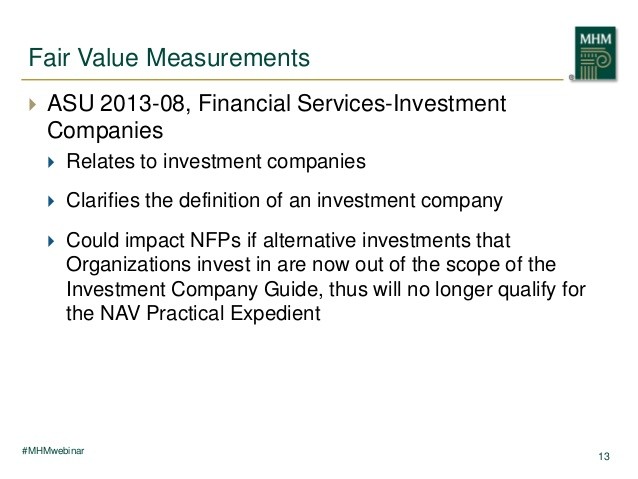

- Fully updated for the new definition of an investment company within the scope of FASB ASC 946.

- Expanded application guidance and illustrative disclosures related to balance sheet offsetting under FASB ASU No. 2011-11 and ASU No. 2013-01.

- A new appendix which identifies the PCAOB standards that broadly correspond with the Clarified Auditing Standards.

- Newly added overview of centrally cleared swaps.

- The latest auditing and regulatory guidance specific to investment companies.

- Background on the investment company industry as well as interpretive guidance for both new and existing rules.

- Best practice discussion provided on several new and recurring complex industry-specific issues, including: investment valuation, financial instruments, capital accounts, BDCs, master-feeder funds, multi-class funds, UITs, separate accounts of life insurance entities, and many more.

- Illustrative reports on both: examinations of securities, and controls at a custodian, pursuant to Rule 206(4)-2 of the Investment Advisers Act of 1940.

- FASB ASU No. 2011-11: Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities

- FASB ASU No. 2013-01: Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities

- FASB ASU No. 2013-07: Presentation of Financial Services (Topic 205): Liquidation Basis of Accounting

- FASB ASU No. 2013-07: Financial ServicesInvestment Companies (Topic 946): Amendments to the Scope, Measurement, and Disclosure Requirements

- FASB ASU No. 2013-11: Income Taxes (Topic 740): Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists (a consensus of the FASB Emerging Issues Task Force)

Whether you are a financial statement preparer or auditor, it is critical to understand the complexities of the specialized accounting and regulatory requirements for investment companies. This comprehensive guide has been designed to be beneficial for a wide range professionals, including those within the investment company industry, as well as those practicing in small, regional, and large accounting and auditing firms. The guide provides auditing considerations applicable for practitioners conducting audits of both registered and nonregistered investment companies (i.e. AICPA and PCAOB audits).