Getting Started in Hedge Funds From Launching a Hedge Fund to New Regulation the Use of Leverage

Post on: 16 Март, 2015 No Comment

Synopses & Reviews

Publisher Comments:

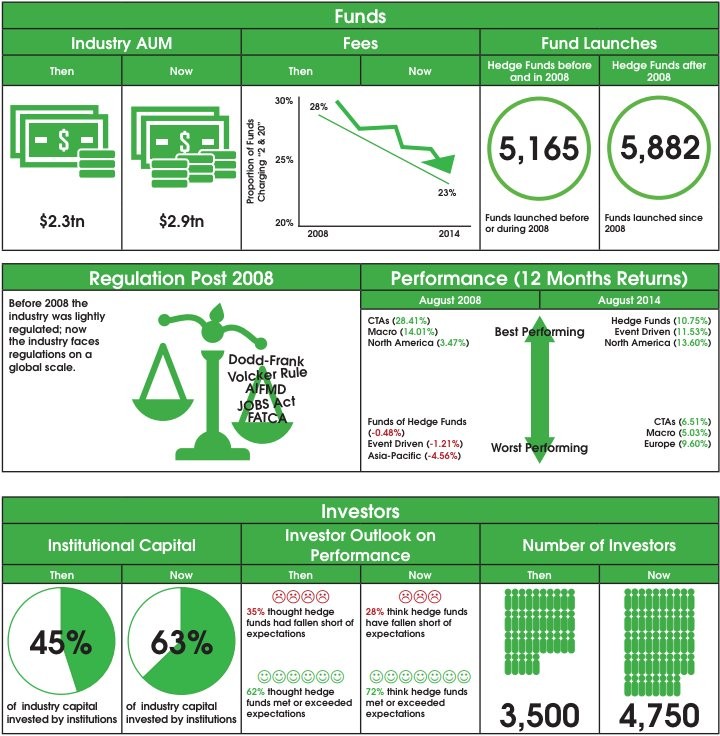

an overview of hedge funds,updated to reflect their place in today’s post-financial market meltdown economy

GETTING STARTED IN HEDGE FUNDS THIRD EDITION

Dan has a unique insight and a depth of experience in the hedge fund industry that few can claim. He articulates a clear map as to the history of the business as well as the direction it’s heading. It’s a great read for anyone looking to enter the business or simply further their knowledge in the area of hedge fund investing.ROBERT A. SCHAEFFER, Managing Director, HBM GROUP, HBM Fund Services

Getting Started in Hedge Funds is a must-read for those who are considering operating a hedge fund or for anyone seeking a better understanding of the industry. Dan provides not only the history of the industry with insight from current managers, but also a road map and real-life examples on how to accomplish this goal.JAY LEVY, CPA, Partner and Financial Services Industry Co-Practice Director

Getting Started in Hedge Funds, Third Edition offers a completely updated guide to hedge funds, focusing on the current state of the industry, why certain hedge funds survived and thrived throughout the crisis and why others didn’t, and what it all means for investors. Written by veteran financial insider Daniel Strachman, this revised edition also includes:

A brief history of hedge funds

How hedge funds work, including how to start one

An analysis of the Madoff scandal and the ripple effect it caused throughout the industry

Profiles of four highly successful hedge fund managers and what new regulations mean for them

The book on hedge fund basics, completely updated to reflect todays post-crisis industry

The hedge fund industry has been reeling in the wake of recent Ponzi schemes and insider trading scandals as well as the loss of billions of dollars in assets under management due to fund closures. Getting Started in Hedge Funds, Third Edition focuses on the current state of the industry; how hedge funds did or did not survive the subprime and subsequent credit crisis; and, what the future holds for investors. Getting Started in Hedge Funds, Third Edition also provides readers with a brief overview of the industry’s history, and describes the inner-workings of these complex investment vehicles, including how to start a hedge fund, and what new regulations means for managers and investors.