Forex Grid Trend strategy Currencies Direction and Open deals

Post on: 17 Август, 2016 No Comment

THE GRID TREND TRADING STRATEGY

Please read this module after you have read the preceding modules, webpages and video.

and watched this video

USES OF THE GRID TREND TRADING TECHNIQUE

The Grid Trend trading technique can be used on a continuous basis and or for session or day trading purposes. Most of this course covers the continuous trading technique as the principle of this technique applies to the session trading technique as well. The session trading technique will be covered in detail at the end of this course.

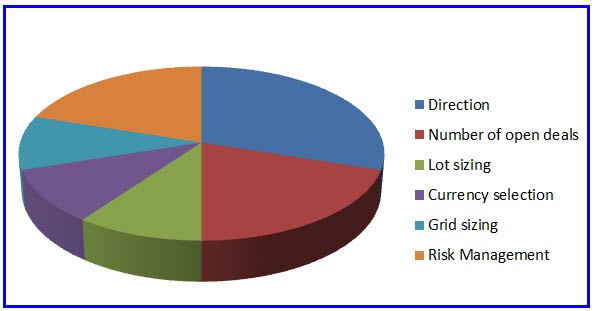

BALANCING THE GRID TREND TRADING VARIABLES

This is not the simplest trading system around and will only appeal to those who can see the benefits after doing the course and those who demo trade it for 1 to 2 months. The variables in the Grid Trend trading system that you have to get right are:

- Currency selection

- Direction

- Number of open deals.

- Stop loss strategy

- Grid sizing

- Lots sizing

- Risk management

They are all important and inter-related because if you make a poor decision about any of these variables you will be creating less than optimum results. Make sure that you understand the impact that making a decision on any of the above will have on your trading income.

Overall, direction is the most important element and will be covered in the next few modules so we will have a closer look at others in this module. We will cover the other variable in this module.

BALANCING RISK AND REWARD

The other challenging area when using this technique is getting the balance between risk management and giving the Magic multiplier enough room to work.

If you apply too much risk management such as hedging too soon, using too big grid sizing, reducing the number of open deals excessively the Magic Multiplier effect will not work well and you will throttle the income potential of the system. If you allow too many open deals and get the direction wrong initially, you could expose yourself to too much risk .

Too much risk management will reduce the magic multiplier effect

CURRENCY SELECTION

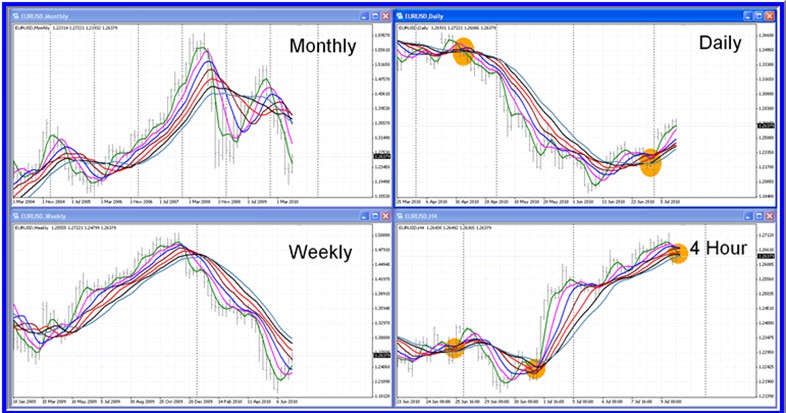

When selecting a currency to trade currency behaviour and volatility plays a very big role. The ideal currency profiles you are looking for should show this type of behaviour. This is shown in the illustration below.

You want to find a currency that will move in the direction you have chosen AND has many retracements. The retracements allow the Magic Multiplier to compound your income.

The movement of advancing price and retracements is important. In the above example there is a chance that the system will be profitable if a buy direction was selected rather than a sell direction because of this movement.

This movement can be as large as 600 to 700 pips or as small as 150 to 250 pips depending on your currencies overall volatility.

The current EURUSD daily chart is showing the kind of movement I am talking about advance and retracement moves of +/- 600 pips.

The recent daily charts of the EURCHF would suggest that the wave sizes or movement sizes between 150 and 250 pips.

So there is a relationship between the currencies overall volatility and the wave or movement size. It is still best to view the daily charts using a ZigZag to get the best feel of wave sizes and the nature of the waves.

So from the above it looks like the EURUSD has a wave size of +/- 600 pips and the EURCHF has a wave size of +/- 200 pips. This has importance when we start talking about direction and grid sizing in future modules.

The first reaction of many Forex traders is that they think that the EURCHF is a safer currency to trade because it is less volatile than the EURUSD. That could be true but volatility differences can be cancelled out by Grid size decisions and lots size decisions. You have to balance the currency decision with Grid sizing decisions and lots sizing decisions. As we will see later you can balance the risk of any currency with any other currency by taking the wave size, grid size and lot size into account.

In General the volatility of your chosen currency should impact the other areas as follows

The precise calculations of Grid size and Lot size will be discussed in future modules.

Please note that currency volatility is not the only currency selection criteria. You have to combine volatility with a price behaviour that has a healthy advance and retracement action as discussed above. The Magic Multiplier will not work well if you chose a currency that has strong one way trends.

DIRECTION

Overall direction is the most important element and will be covered in the next module, so we will have a closer look at others areas in this module.

However, there are aspects of direction that you need to be aware of. As you will see this is a long term trading technique – it is closer to an investment technique as you need to make an investment in open trades throughout the trading of this technique.

So you don’t want to use a direction finding approach that is going to give you a buy phase one day and then a sell phase the next. You want as few phase whipsaws as possible. You want your phases to last a long time if the market will allow for that.

You also want a method of finding the phase that you can use at any-time. That means that you need not start trading when the price moves into a particular phase the first time. You need something that will allow you to start trading even when the phase has been active for quite a while.

Please watch for future modules on specific methods of determining direction.

NUMBER OF OPEN DEALS

This is most probably the most important aspect of this technique and the most neglected and over managed in live trading. The beauty is that the number of open deals, grid sizing, lot sizing and risk management can be decided on BEFORE you start trading so that these elements do not become a reason for stress when trades are active.

The decision about the number of open deals is important as it will establish the balance between risk management and giving the Magic Multiplier effect to work. A small amount of open deals will not make it work effectively but a large amount of open deals and you may be exposed to excessive risk.

So in general and a guide to the number of open deals is that you should allow for at least 8 to 10 open deals with no interference to allow the Magic Multiplier to work. Anything less and you will not allow the Magic Multiplier to work and anything more and your risk will increase excessively.

So what happens when the open deals exceed the number you have chosen? Well that is covered under risk management – actions could include a stop out, total or partial hedging, opening an EA in the other direction and a few other options.

RISK MANAGEMENT HEDGING

Please watch future modules which will discuss same currency hedging, correlated currency selection and EA hedging

RISK MANAGEMENT VARYING GRID SIZES

Varying grid sizes is a means of increasing managing risk. This will be covered in future modules.

LOT SIZING

Only make the lots sizing decision after you have decided on a 1) currency, 2) the number of open trades, 3) the grid sizing and the 3) stops you are going to use. The best way of approaching lots sizing we have found is to start with your account size and the overall percentage of your account that you want to risk. Please watch future modules for more info.

STOPS

You can have an overall stop per EA application or an overall stop related to account size. This will be discussed in future modules.

DISASTER RECOVERY

What happens when you get it all wrong and the trend changes direction? There are many strategies which will be covered in future modules.

GAP SIZING

There are many guides on, and ways to calculate grid sizing such as

- Large gaps low risk but less chance of the Magic Multiplier effect.

- If you have high direction confidence use smaller gap sizes

- Low volatility currencies smaller gaps – high volatility currencies larger gaps

Many traders forget about the taking the impact of spreads (especially varying spreads) into account when establishing grid sizes.

Future module will cover this aspect

LIVE CONTINIOUS TRADING EXAMPLES

See live examples of how all aspects of the content of this course is applied.

SESSION OR DAY TRADING STRATEGIES

The Grid Trend trading technique does not always have to be used for continuous trading purposes. It can also be used for session or day trading purposes. Strategies for day trading and session trading will discussed in future modules.

QUESTIONS AND COMMENTS

We hope that you are finding this course interesting and informative. Please use the comments section on this page to for your comments and questions. Please do not email questions as this will allow other clients to see your comments and our responses.