Financial Analysis Report

Post on: 16 Март, 2015 No Comment

What is a Financial Analysis Report?

Comprehensive financial analysis reports accentuate the strengths and weaknesses of a company. Communicating the companys strengths and weaknesses in an accurate and honest manner is helpful in convincing the investors to invest in your business. A financial analysis report is, basically, a document that attracts high interest of investors as it contains a detailed appraisal of a company’s financial health.

How to write a Financial Analysis Report

1. Start the report with an Executive Summary of important findings from the financial analysis. Also state the time period focused by the study in addition to identifying the firm requesting the report.

2. Set up an introduction emphasizing the objectives of the report. Also define financial terms necessary for understanding those objectives.

3. Move on to a section with “Resources” title. Give a general description of the analyzed data and where has it been sourced from. Some examples of resource include balance sheets, income statements, operating costs, inventory ratios, and warehouse statistics.

4. Further describe the resources under the heading “Method of Collecting Data”. Mention whether the data was received from different sources, like government agencies or departments within the firm. Also explain each source’s method for reporting data. Explain about the method of accounting analysis for these distinct reporting methods.

5. Title the next section as “Significant Financial Events” and under this section, enlist the events which occurred during the studied time period and which altered results.

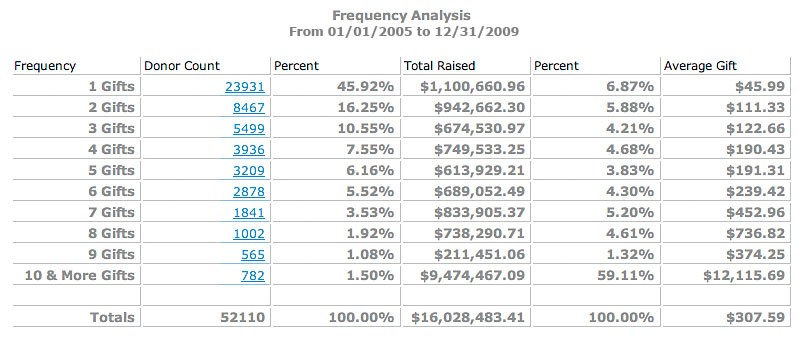

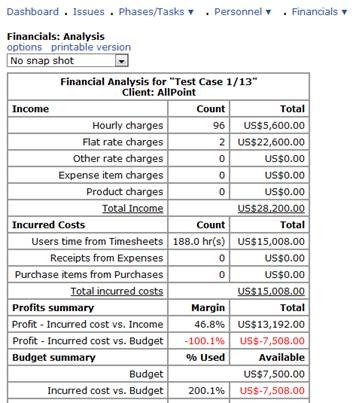

6. Proceed with a section titled “Detailed Results” which includes a comprehensive analysis about the investment returns, balance sheets, income statement, and productivity ratios. Also comment on each of these factors in addition to providing support for your statements with graphs and tables.

7. Evaluate results from various quarters in a section titled “Analysis of Variance”.

8. Prepare an appendix for “Financial Revenues” defining how that term was used for preparing the report. Tabulate the revenues over the analysis’ time period.

9. End the report with an appendix for “Observations” discussing any problems faced while performing analysis and thereafter explaining about how research method handled problems. Conclude the report with a statement projecting future performance on the basis of past years’ performance.