FHA Loan Costs On the Rise Are They Still a Good Deal

Post on: 16 Ноябрь, 2015 No Comment

Related Posts

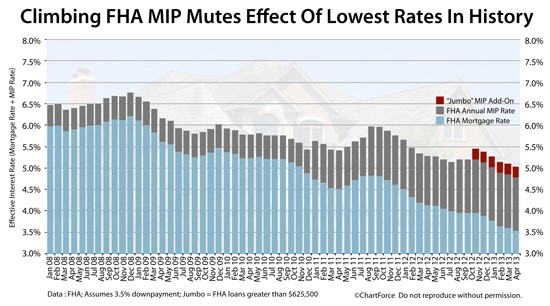

Effective April 9, the Federal Housing Administration (FHA) increased the cost of FHA mortgage insurance for the second time in a year. The increase affects both the up-front cost and recurring monthly cost of FHA-insured mortgages.

Increased Up-Front & Monthly Mortgage Insurance Costs

Get your free monthly credit score! No credit card required!

Who is Affected?

New single-family homebuyers and refinance borrowers who do not qualify for an FHA “streamline refinance” are most affected. If you already have an FHA loan you won’t see any change to your insurance premiums. In a strange twist, certain Streamline Refinance borrowers will actually see a decrease in the cost of UFMIP and are not subject to the increase in annual MIP. As long as the FHA loan being refinanced was endorsed on or prior to May 31, 2009, UFMIP for a streamline refinance will fall from 1% to .1%. This decrease, however, won’t take place until after June 11, 2012.

How Does the Increase Affect FHA Homebuyers?

Assuming a $200,000 loan amount, the up-front cost would increase by $1500 and monthly payments would increase by another $17 per month. Fortunately, the up-front cost won’t necessarily need to come out of your pocket because FHA still allows you to finance up-front costs into the loan amount. Though, ultimately, you will pay the bill to the tune of an additional $8,578 in combined costs over the life of a 30-year loan at 4%.

So, with the second rate hikes in the up-front cost of FHA insurance in two years, it begs the question, are there options out there on the mortgage market that are better than the venerable FHA loan? Fair question, let’s examine your options.

Why go FHA?

When it comes to certain lending criteria, FHA is the only game in town. For example, FHA only requires a 3.5% down payment and they allow that down payment to be from flexible sources, such as gifts from family members. With most other options you are looking at coming up with at least 5% to 10% of the purchase price and those funds very likely need to be from your own savings, no gifts allowed. FHA also is more liberal in terms of standards for credit and income. If your FICO score is less than a 680, or your debt-to-income is higher than 40 percent, an FHA loan is probably your best option.

Option 1: Private Mortgage Insurance

What is PMI. If you have reasonably good credit. decent income and your own down payment in the bank, you might want to consider a conventional loan with private mortgage insurance (PMI). The PMI companies have eased their lending standards after tightening in the face of the housing bust. In fact, a few PMI companies are looking to aggressively book new insurance to offset the claims they paid out over the past few years. Compared to FHA insurance, PMI typically has no up-front cost and the monthly premium is comparable. The downside of PMI is that you may have two underwriters reviewing your loan which not only adds time, but also the possibility that your loan might not be approved at all.

Option 2: Piggyback Second Mortgage

Similar to the PMI companies, banks and credit unions are beginning to dip their feet back into the second mortgage lending waters once more. A second mortgage can be a great way to eliminate the need for mortgage insurance altogether. With a piggyback second mortgage, you might get a first mortgage up to 80% LTV (loan to value) and then add a second mortgage up to 90% combined LTV. The downside here is that you’ll need to have a much larger down payment —at least 10% and the availability of piggyback second mortgages is still highly limited in less stable real estate markets.

Make no mistake, there is a lot to be said for FHA loans – they’re easy to get, accommodate low down payments, and are more lenient to consumers with less than perfect credit. For many homebuyers, especially first-time homebuyers, they could be the only game in town. But with the new rate hikes in place, consumers should at least compare your mortgage loan options to see if there’s a better deal out there. For some, this just might be the case.

Related Stories: