DEVELOPMENT NEGATIVE EFFECTS OF TRADE AND CAPITAL LIBERALIZATION

Post on: 16 Март, 2015 No Comment

SUNS 4331 Wednesday 25 November 1998

DEVELOPMENT: NEGATIVE EFFECTS OF TRADE AND CAPITAL LIBERALIZATION

Geneva, 23 Nov (Chakravarthi Raghavan) — Trade liberalization in developing countries have had some modest benefits, but the simultaneous current and capital markets liberalization have been

associated with strong exchange rates and high interest rates, creating problems with productivity growth and income distribution and development, economists Jose Antonio Ocampo and Lance Taylor argue in the September issue of the Economic Journal of the Royal Economic Society.

Ocampo, a Colombian economist, is executive director of the UN Economic Commission for Latin America and the Caribbean. Taylor, an American economist, is at the Center for Economic Policy Analysis, New School of Social Research. The article has been written in their personal capacities.

In micro-economic terms, Ocampo and Taylor note, trade liberalization theories invoke general equilibrium models with constant or decreasing returns to scale, with individual agents, interacting solely through the market and as price takers, arriving at rational decisions.

Across countries, trade theories and models based on specializations in trade apply best to sectors or countries where traditional inputs with restrictions on access to resources and/or unskilled labour

predominate.

But once such bargain competitive advantages run out, their replacements in the form of infant import-substituting (IS) and export industries have to be created. And historically, both the private

sector and the state have been involved in this process.

The argument for trade liberalization in the static framework is on the basis that trade distortions imposed on an otherwise competitive allocation create welfare losses.

But decreasing costs or increasing returns to scale are ubiquitous in manufacturing and present in other sectors, thus invalidating this welfare economics theorem. And increasing returns and cross-firm externalities can lead to cumulative growth processes and different patterns of specialisations across economies. And, at the industry and enterprise levels, changing ‘advantage’ is likely to be the rule, and policy (as in East Asia) can guide such changes.

Unlike the trade liberalization theories, traditional development economics has recognized that there can be room for substantial benefits from establishing industries with scale economies, especially when transport costs and other factors drive wedges between border prices of imports and exports.

And income transfers associated with liberalization or imposition of regulation (as between overall welfare gains and losses of import-competing producers and owners of quota-rights) can be large,

and such distributional effects of liberalization programmes have become major topic of debate.

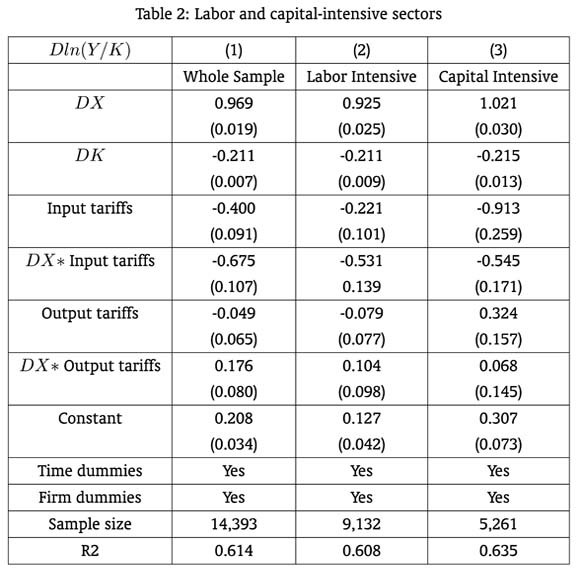

According to the Stolper-Samuelson trade theory, trade liberalization in advanced economies should benefit input intensive (or skilled labour) in production of their exports, while in developing countries it should benefit unskilled labour. Some 10-20 percent of the OECD region’s increasing wage inequality is attributed to trade effects and the rest to a ‘skill-twist’ to low paid workers induced by computerisation and changing social perceptions of ‘fair pay’ and lagging aggregate demand. In developing economies, a distributional shift in favour of the low paid remains to be observed.

In terms of the Samuelson factor price equalization theory, the assumption of the Hecksher-Ohlin hypothesis that all countries have access to the same technologies is not even remotely correct.

Even more damaging to the standard factor price equalization arguments is the fact that recent moves towards (not just) liberalization in developing countries have been associated with striking divergences in patterns of productivity growth overall.

In terms of trade liberalization theories, and in the absence of perfect competition,

Standard rent-seeking models suppose that tariffs or quotas always generate higher prices. But in fact, firms may take advantage of protection to build up a stable clientele by adjusting prices to bid up sales in customer markets. If resources are not fully utilized or there is a binding external constraint, the additional income flows associated with a larger volume of sales do not generate welfare losses. And rents in the right hands may speed capital accumulation. The Chilean experience since the mid-1980s is often cited as proof that far reaching liberalization may break down barriers and permit an economy to jump start to a much faster pace of economic growth.

While this has an element of truth, observe Ocampo and Taylor, it completely ignores the complicated history of the Chilean transition and the inconvenient fact that exchange rate devaluation was much more important than import liberalization in driving Chile’s export success.

With pay-offs contingent on performance, state interventions can also induce entrepreneurship. For this, the contingency criteria has to be defined. As the East Asian experience suggests, export performance can serve this purpose, along with other indicators such as output growth, technology upgrading etc.

Also, the state has to have leverage over firms — e.g. via control of allocated credit, so that non-performing recipients of publicly created rents can be chastised.

However, add Ocampo and Taylor, neither interventionist nor liberalization packages can be evaluated outside history, contrary to the main thrust of mainstream economic theory.

But to assess the effects of trade liberalization, macro-economic considerations have to be taken into account. The standard trade models are based on Say’s law or full employment of all resources and balanced trade, subject to existing restrictions on imports.

If not all commodities are traded, the local currency/foreign currency exchange rate serve as a relative price between traded and non-traded goods, and enters as a key variable to show that liberalizing imports will promote export growth. If import protection is reduced leading to an incipient trade deficit, the exchange rate adjusts to clear current account imbalance. That is a higher exchange rate will stimulate production of exportables and import substitutes with resources

transferred from non-traded sectors. That is liberalization pays off in the form of faster export growth. The underlying assumption is that local resources can be deployed to produce something and balanced trade assures it will find an external market.

But if resources are not automatically fully employed or if the country in question can borrow abroad, then income as well as substitution effects of both trade liberalization and exchange rate changes matter. They can be easily associated with output losses and a wider trade deficit.

These are two of the cases, of structural unemployment and rising foreign debt, in which Adam Smith observed that protection can generate welfare gains. The other two are of industries with acquired rather than natural advantages and with high cost production thresholds.

Thus arguments in support of trade liberalization, comment Ocampo and Taylor, have to overcome objections familiar from ‘The Wealth of Nations’. They have not succeeded fully to date.

In many cases in the past decades, both the trade and capital accounts of the balance of payments have been deregulated simultaneously. The exchange rate is allowed to float, responding to developments in the financial markets rather than imbalances in the current account.

In countries where this package has been applied — more in Latin America and Asia than in sub-Saharan Africa — almost uniformly a combination of high local interest rates and a strong exchange rate have emerged, diluting whatever benefits concomitant trade liberalization was supposed to bring and often leading to a balance-of-payments crisis in the medium term.

When capital markets are liberalized, deregulation induces a shift in desired foreign portfolios towards the home market and either asset prices should rise or interest rates fall. In other words home currency should be begin to appreciate. While this last has happened, in the wake of market liberalization have also come high interest rates.

Why is this so? Economic actors at home may pull back from the local market in a dynamic process. Authorities might well tighten monetary policy in an attempt to keep the current account deficit under control. In the Latin American context, inflation stabilization has been a complementary objective.

But the uncomfortable high interest rate and strong currency combinations, compatible with the present model, does not provide a solid basis for improved trade performance or investment to support economic growth.

What is worse, continuing trade deficit can lead ultimately to a dynamically unstable situation — characterized by an under-estimation of risk in a classic model. At some point, the under-estimation

reverses, leading to a massive capital outflow, devaluation and stagflation. Mexico in 1994 and East Asia in 1997 are the most striking recent examples of this.

The adverse effects of capital market liberalization can easily overwhelm whatever small benefits trade deregulation may bring.

Historically, when neo-classical economists turned their attention to the problems of development in the late 1960s, they were led by trade specialists, and the analysis of trade interventions has been central to the debate ever since, overwhelming the discussion of the production-related factors.

Not long after that, the World Bank began to invest heavily in economic research under the leadership of Hollis Chenery, and the methodologies used relied on cross-country regression analysis and computable general equilibrium (CGE) models.

Very little effort was devoted to historical or institutional studies of specific countries, undertaken by people with enough local knowledge to know what they were talking about. CGE models with causal structures predetermined to favour liberalization and meaningless regressions do not shed a lot of light on how trade policy really operates.

By now, the two authors of the article note, there are scores if not hundreds of econometric studies of the impacts of exports on economic growth, the relationship between ‘openness’ (defined in terms of trade shares or prevalence of protection) and growth and, in CGE models, the growth and output effects of specific changes.

But the regression equations, typically leave a substantial part of total variance unexplained, so that even if they point to a ‘modest’ positive effects of liberalization or openness on growth, such

conclusions cannot possibly hold for all the countries included in the sample.

Other survey such as those of Sebastian Edwards (1993), Dani Rodrick (1995) and Gerry Helleiner (1995) broadly conclude that trade policy changes do not matter very much. Helleiner in particular argues that a stable, and preferably weak, exchange rate is the best single explanation of successful trade performance in the medium term. He also observes, on the basis of country studies he organized, that an overly complex set of incentives can frustrate even the most entrepreneurial of potential traders.

Analysis by scholars like Alice Amsden, Robert Wade and Helleiner not only share this agnosticism, but also single out the historic importance of certain trade, industrial and macro policy manoeuvres in specific institutional contexts. They emphasize the role of interventions contingent on performance and the fact that in an environment unregulated by Say’s law (full employment of all

resources), there is ample room for protection of both infant import-substituting and export activities by the same firm or industry.

As for the overall directions of distributional changes under liberalization, UNCTAD in its 1997 Trade and Development Report has demonstrated that globalization has been associated with increasing income inequality in several countries, both developed and developing.

Other studies, such as by Albert Barry, Susan Horton and Dipak Mazumdar have concluded that in the wake of (not just trade) liberalization, that countries with abundant labour, sufficiently educated (and with other conditions present) to take advantage of international markets to expand labour-intensive manufactured exports, showed some tendency for improving income distribution. But middle-income countries with comparative advantage in some skill-intensive products, and upper

income countries, with comparative advantage in capital and skill-intensive areas, showed a definite tendency for worsening income distribution. And African economies, whose comparative advantage lay in peasant production, were expected to show an improvement, they have experienced a worsening in income distribution.

As for sectoral shifts and productivity growth, based on data through early 1980s, Japan, Israel, Spain and the East Asian NICs have been characterized by high TFP (total factor productivity) growth and factor accumulation. In the wake of the period of liberalization all around the world, since mid-1980s, only five Asian countries (Indonesia, Korea, Malaysia, Singapore and Thailand) maintained growth rates of better than 3% a year in both overall employment and labour productivity, with productivity expansion, balanced across sectors and with the rate in agriculture remaining high. India experienced rapid productivity growth, but less robust job expansion.

Off this Asian high road, the typical Latin American pattern was of rapid employment but slow productivity growth, while in Africa both rates were under three percent.

These suggest that manufacturing has always been the main focus of protection and productivity growth in this sector drives changes in the rest of the economy. Insofar as this argument is correct, the deindustrialization observed in much of the developing world due to liberalization, exchange rate appreciate and high interest rates and other symptoms of austere policy could have far-reaching adverse consequences.

Also, the good productivity performance in the Asian economies has been associated with outward-oriented, but distinctly not liberal trade regimes. their histories show that trade and other interventions are not always harmful; indeed, at least in terms of economic performance, they can promote substantial good.