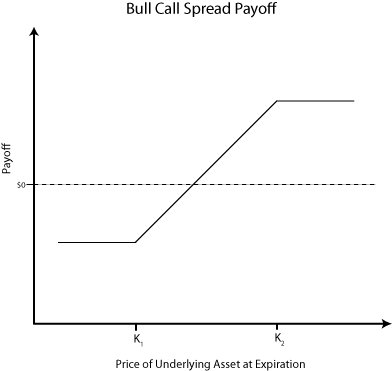

Bull Call Spread Profit Loss Graph

Post on: 16 Март, 2015 No Comment

Break-even

The breakeven point for the bull call spread is given next:

- Breakeven Stock Price = Purchased Call Option Strike Price + Net Premium Paid (Premium Paid — Premium Sold).

To illustrate, the trader purchased the $52.50 strike price call option for $0.60, but also sold the $55.00 strike price for $0.18, for a net premium paid of $0.42. The strike price paid was the $52.50. Therefore, $52.50 + $0.42 = $52.92. The trader will breakeven, excluding commissions/slippage, if the stock reaches $52.92 by expiration.

Max Profit

The max profit for a bull call spread is as follows:

- Bull Call Spread Max Profit = Difference between call option strike price sold and call option strike price purchased — Premium Paid for bull call spread.

To illustrate, the call option strike price sold is $55.00 and the call option strike price purchased is $52.50; therefore, the difference is $250 [($55.00 — $52.50) x 100 shares/contract]. The net premium paid for the bull call spread is $42. Consequently, the max profit is $208 ($250 — $42). As a sidenote, this max profit occurs when the stock price is at $55.00 (the upper call strike price) or higher at expiration.

Partial Profit

Partial profit is calculated via the following, assuming the stock price is greater than the breakeven price:

- Bull Call Spread Partial Profit = Stock price — Breakeven price

For instance, the stock closed at $54.00 at expiration. Hence, the stock price at expiration ($54.00) minus the breakeven stock price ($52.92) would mean the trader profited $108 [($54 — $52.92) x 100 shares/contract]

Partial Loss

A partial loss occurs between the lower purchased call strike price and the breakeven stock price. The calculation is given next:

- Bull Call Spread Partial Loss = Breakeven price — Stock price

For example, a closing stock price at expiration of $52.75 is between the lower strike price of $52.00 and the breakeven of $52.92 and is therefore going to be a partial loss. When calculated, the loss is $17 [($52.92 — $52.75) x 100 shares/contract]

Complete Loss

A complete loss occurs anywhere below the lower purchased call strike price ($52.50) which amounts to the entire premium paid of $42.