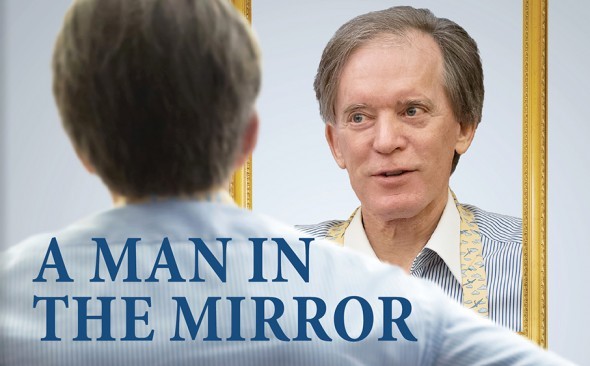

Bill Gross Doesn t Forecast a Bear Market in Bonds

Post on: 31 Июль, 2015 No Comment

Bill Gross says the Federal Reserve will most likely begin raising U.S. interest rates in the middle of 2015 but fixed-income securities will not be hurt as much as people anticipate.

I dont forecast a bear market in bonds, Gross said on the Forbes & RIA Database Advisor Playbook iConference webcast.

Gross, told Reuters that when the Fed begins moving the federal-funds rate, it must proceed with caution and probably needs to stop between 2 percent and 3 percent.

My expectation would be 2 percent fed funds is the final destination, Gross said, adding that bond markets are still attractive if his scenario plays out.

Gross went on to say that the U.S. is still highly leveraged and that there are structural demographic headwinds, including the effects of technology displacement, which lower real growth.

Todays Other Top Stories

Learn Bonds

Learn Bonds: – When will short term interest rates rise? – The basic headlines indicate that there is great concern within the Federal Reserve about when short term interest rates are going to rise and how they will rise. In addition, we read in recent days about how officials within the Fed are working on the wording relating to “forward guidance” about when short-term interest rates are going to rise.

Municipal Bonds

WSJ: – Detroit exits municipal bankruptcy case. – (Subscription) Detroit emerges from bankruptcy 15 months after filing for Chapter 9 protection.

MSN: – Tis the season to buy muni bonds says RidgeWorth fund manager. – The best time of the year to buy municipal bonds is right now due to all the supply hitting the market, said Ron Schwartz, portfolio manager for the RidgeWorth Investment Grade Tax-Exempt Bond Fund.

The Street: – Why muni-bond investors are wondering what Illinois is going to do. – Municipal debt investors are watching the appeals process that will decide whether or not Illinois pension reform bill ends up in the wastebasket, a decision that would send the Land of Lincoln back to square one in its attempts to battle its pension funding crisis.

Reuters: – U.S. municipal bond market shrinks to $3.63 trln in 3rd quarter. – The U.S. municipal bond market contracted to $3.63 trillion in the third quarter, the smallest amount of outstanding debt in about five years, Federal Reserve data released on Thursday showed.

Treasury Bonds

Market Realist: – What caused U.S. Treasuries to move last week? – In the secondary market, yields rose across the curve last week with the two-year to 10-year segments seeing a rise of more than 10 basis points each. Whats happening?

Bloomberg: – Treasury 30-year bonds may yield 2.863% at auction, survey says. – The Treasury’s $13 billion sale of 30-year bonds may draw a yield of 2.863 percent, according to the average forecast in a Bloomberg News survey of seven of the Federal Reserve’s 22 primary dealers.

Investment Grade Bonds

ADFN: – Bond investors look to cull the herd. – After years of strong gains and buying record amounts of debt, corporate-bond investors are facing a new challenge: what to sell.

High Yield Bonds

Bloomberg: – Oil-driven junk-bond selloff spreads as risk gauge climbs. – The rout in junk bonds driven by tumbling oil prices is getting worse as one of the high-yield market’s largest sector weighs on other industries.

ValueWalk: – Junk bonds, debt spreads: There will be blood!! – A quick look at the history of fracking and why energy bonds have been so badly hit by the falling oil price.

Wall St Daily: – Junk bond carnage. – The junk bond selloff means that the average energy junk bond now yields more than 8.5%! That is the highest yield seen since July 2010, up from an average 5.67% yield in June 2014. Investors seem to be asking no questions, just selling these bonds. I think a closer look at the situation is warranted.

MarketWatch: – Junk-bond contagion fears rise as oil extends drop. – Plunging oil prices are playing havoc with high-yield corporate bonds. Now, some observers are beginning to wonder whether trouble in the energy portion of the junk-bond market could pose broader risks.

Bloomberg: – Fed bubble bursts in $550 billion of energy debt. – The danger of stimulus-induced bubbles is starting to play out in the market for energy-company debt.

S&P Capital IQ: – 2015 high yield bond outlook: Investors see opportunities despite wildcards. – Consensus is fairly bullish on the high-yield market for 2015 despite recent volatility. In fact, many market players believe that the volatility has limited frothiness in what they see as attractive valuations to enter the New Year. They say that the end of historically loose monetary policy has already been priced into the market and that the market is underpinned by steady economic growth, sound corporate performance, and ongoing investor demand for yield.

Emerging Markets

CNBC: – Why a stronger dollar may not bite EM bonds. – Emerging markets may be buffeted by a stronger U.S. dollar and lower commodity prices, but the segments bonds still look like a good bet, analysts said.

Investment Strategy

Citywire: – Fixed income star reveals top 2015 themes and plays. – (Registration) Citywire AAA-rated Andrew Wells identifies three main drivers of the bond market in 2015 and unveils his best investment ideas.

MarketWatch: – Busting myths about bonds vs. bond funds. – Reasonable minds can differ on investment advice, and rarely do I read in respected financial publications duly considered viewpoints that cry out for refutation. But boy, did I find one in a recent issue of Forbes magazine.

Bond Funds

ETF Trends: – Issues to consider with mREIT ETFs in 2015. – Buoyed by tumbling 10-year Treasury yields, mortgage REIT exchange trade funds have been solid though not spectacular performers this year.

ETF Trends: – A high-yield bond ETF that skirts energy sector risk. – A prominent theme in the high-yield bond market has recently been the vulnerability of exchange traded funds and the junk market itself to falling oil prices. This funds skirts around that problem.

Scott Arterburn: – Analysis of some of Vanguards bond funds. – Seven years ago Vanguard only had four U.S. non-derivative (simple) bond funds to choose from. Two years later Vanguard more than doubled that amount to include more specific bond funds that gave investors more options to choose from. Does ten Vanguard bond ETFs provide comprehensive variety for bond investors? That is what this article will answer.

Yields on junk-rated energy bonds climbed to a more-than-five-year high of 9.5 percent this week from 5.7 percent in June

— David Schawel (@DavidSchawel) December 11, 2014

November retail sales maintains the pace of consumer spending witnessed during Q3 and still points to steady 3%-ish economic growth.

— AnthonyValeri (@Anthony_Valeri) December 11, 2014

Junk bonds raised by Energy XXI Ltd. have dropped from 106.3 cents in September to 64 cents today. Current yield is 27%.

— Eddy Elfenbein (@EddyElfenbein) December 11, 2014